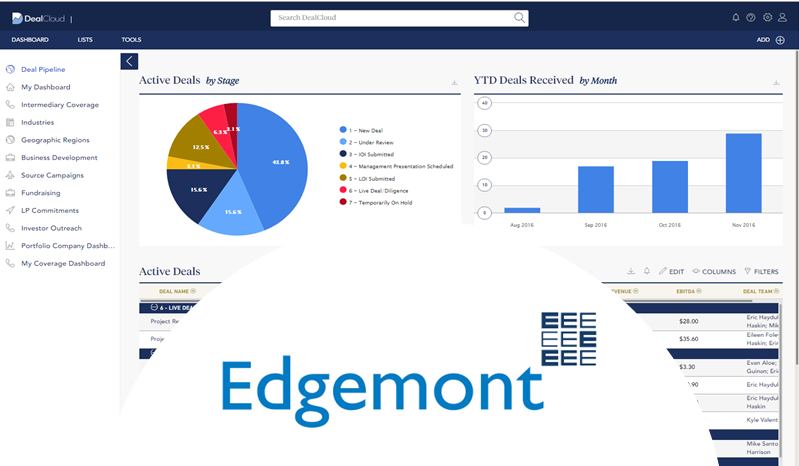

Edgemont Capital Partners, a leading healthcare investment banking firm providing mergers and acquisition advisory services to healthcare services, life sciences services and healthcare (HCIT) information technology companies in the middle market is leveraging DealCloud. Edgemont ranks among the largest independent healthcare investment banking firms with 22 professionals serving founders, owners and entrepreneurs, along with their investors and management teams. “Our deep healthcare industry and extensive M&A expertise supports our proven ability to maximize value and achieve optimal transaction results for a broad range of healthcare services and technology companies. We have closed over 125 transactions representing more than $35 billion in combined value. Given our firm’s rapid growth we wanted a platform that is multidimensional allowing us to monitor transactions while simultaneously continuing our business development efforts, which is possible with DealCloud’s features, including its geography tool and multi relationship tagging,” explains David Blume, Edgemont’s co-founder and Managing Director.

For more information about Edgemont Capital Partners, visit: http://www.edgemontcapital.com/