The COVID-19 pandemic has caused a drop in total volume of legal services demanded. Firms are seeking to manage their immediate exposure, and to successfully emerge from the downturn in the coming months.

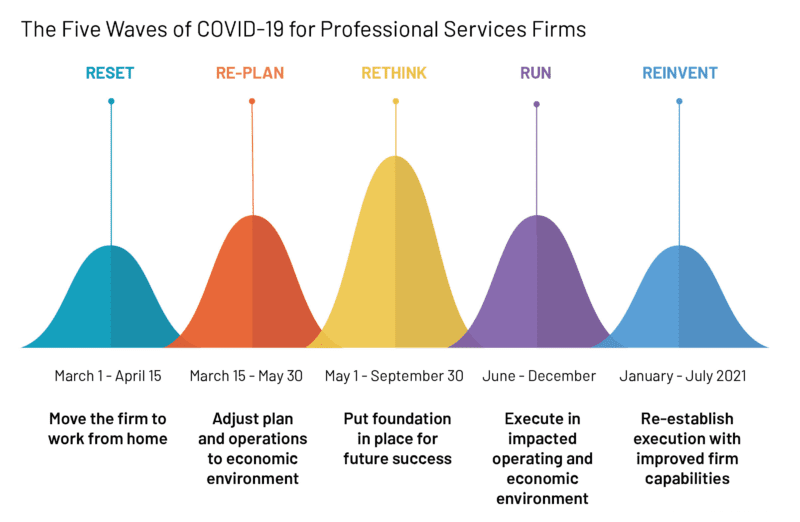

Intapp anticipates that law firms will manage through five waves of COVID-19 adjustments:

- Reset — Moving the firm to work-from-home

- Re-plan — Adjusting the plan and operations to the economic environment

- Rethink — Putting a foundation in place for future success

- Run — Executing in a constrained operating and economic atmosphere

- Reinvent — Re-establishing execution with improved firm capabilities

To date, many firms have completed the reset and re-plan transition phases, and instated new financial plans for the firm that include a modified model for legal services delivery. Some key examples include withholding partner distributions, introducing of stringent cash management measures, and ramping up resources in counter-cyclical practice areas (e.g., restructuring and insolvency).

Intapp Strategic Consulting has leveraged statistical analysis of past public health and financial crises in order to help law firms make data-driven decisions as they move into the rethink wave of adjustment.

Legal sector industry outlook

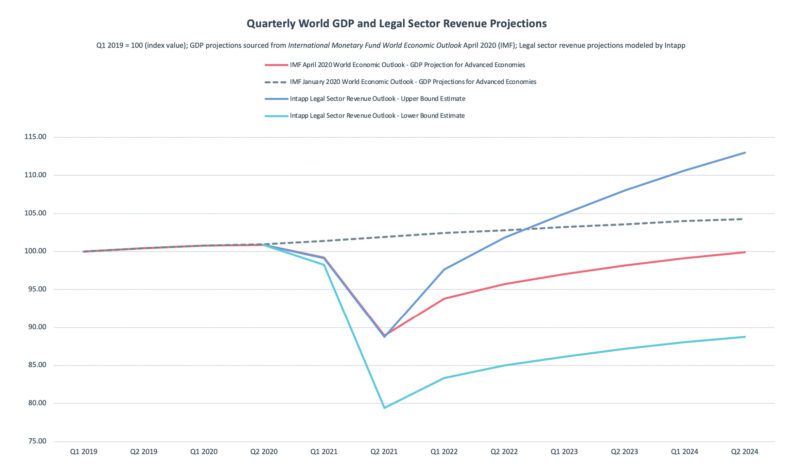

The impacts of COVID-19 on global GDP are estimated to be significant, with advanced economies — like the U.S. — seeing an anticipated GDP hit of 5.9% in 2020 before rebounding in 20211.

Many law firms are now trying to quantify the associated impact of the current recession on their businesses in order to support planning for their practices and operations during the coming year. Although like-for-like comparisons are challenging, given the global scope of this public health crisis, our analysis on past data seeks to understand the correlation between GDP and the prosperity of the legal sector.

Our findings indicate that the correlation between GDP and legal sector outlooks is positive and significant at the 95% confidence level. Further, the analysis indicates that between 36% and 47% of the change in the value of legal sector revenues is historically explained by changes in the economy.

Based on International Monetary Fund (IMF) April 2020 GDP projections for advanced economies, the most likely impact of COVID-19 on total legal sector revenue is estimated between -6.2% and -11.1%. Our analysis has also identified outlier data that suggest far more positive and negative potential scenarios; however these outcomes are unlikely.

Glimmers of hope

Lessons from the last financial crisis indicate that there will be both winners and losers. Analysis of strategies used by leading law firms that benefited during the last recession offer particular insights. Supporting AM Law data suggests that, for example:

- Fee concessions were seen all round, as evidenced by the erosion of revenues per lawyer and profit margins. Smarter firms used these concessions strategically to bolster client relationships. Across the industry, per-lawyer revenue erosion was also partly attributed to bad debts derived from improper client intake and increased competition from lower-cost providers.

- Larger firms were better able to weather the storm as a result of portfolio effects driven by diversified industries, practices, and geographies. Near-term demand in counter-cyclical practices also buoyed service volumes.

- More esteemed firms leveraged their prestige to sustain fee volumes, and were relatively buffered from the economic recession compared to the rest of the industry.

That said, today’s recession offers many differences that firms should bear in mind.

- The pandemic effects today are relatively more widespread; economic repercussions were better contained within certain industries in 2008–2009.

- There’s also more competition today: Many corporate legal departments are far larger and more sophisticated than in 2008–2009, and a greater number of alternate providers (e.g., Big Four accounting firms) continue to provide increased competition to traditional law firms. The last recession provided the opportunity for many alternate providers to enter the market and take market share, resulting in the demand growth for traditional law firm services never fully rebounding to pre-crisis levels.

- Finally, firms have established services diversification. Many firms utilize flexible lawyers and low-cost delivery hubs, which may provide immediate capacity to clients. Today’s environment also has seen the growth in boutique firms — which are more agile and typically lower cost — empowered with newer technology (and far less constrained by legacy systems), and providing attractive offerings to increasingly selective buyers.

Future market opportunities

It’s not all doom and gloom, and firms that focus on certain industries and practice areas will do well. In alignment with this understanding, Intapp has projected demand impacts across industries and practices for the next 6 months (as illustrated in the Intapp Demand Impact Model).

Many firms have yet to quantify these changes in market opportunities. Quantitative analysis and other supporting research will help illuminate the likely magnitude of the impact to law-firm business volumes, and will inform the next critical steps toward supporting business planning and investment decisions across firms’ practices.

For example, our analysis has determined that during the 2008–2009 financial crisis, patent applications in the U.S. fell from 485,312 in 2008 to 482,871 in 2009 (a change of -0.5%)4. Research has shown that IP filings are correlated with business cycles and are pro-cyclical5. Research firms are thus predicting that filing activities could fall 2% to 4% in 2020 and 20216.

Recommendation: Invest now for the future

Beyond the Intapp Strategic Consulting quantitative analysis, we have also corresponded with senior law firm leaders to qualitatively understand their short- and medium-term considerations. Some of these include:

- Reentry in the post COVID-19 world

Leadership is focused on future-proofing operating models to ensure organizations, people, processes, and technology will deliver success in the post COVID-19 world. - Leadership — not management — is key

Anxiety is understandably high, and only confident and clear leadership will enable people to be able to do their jobs. Leaders must establish and maintain an honest dialogue with their people. - Partners must shoulder their share

Everyone agreed that partners should bear the brunt of the financial impact, and that no other group within the firm should be financially affected at a similar level. - Lack of recession experience in firms

Firms engage many people — including partners — who weren’t around in 2008, and haven’t worked through a recession before. The onus is on leadership to guide and mentor these younger team members, helping to ensure no one panics.

Finally, those firms that make the right investments and apply data-driven thinking to decision-making, will be best placed to win in the future.

For more information on helping your firm weather upcoming uncertainties, visithttps://intapp.wpenginepowered.com/pages/strategic-consulting-covid-19-business-impact/

Appendix and end notes:

Discussion and limitations/caveats

- A simple regression analysis and Pearson’s correlation coefficient were used to investigate the relationship between the change in legal services GVA and GDP growth across the U.S., U.K., and Hong Kong. The results indicate a positive and significant correlation between GDP and legal services GVA, ( i.e., when GDP falls, there tends to be an associated fall in value added by legal services).

- Multiple tests were performed to measure the normality of distribution and the constant residual variance. Table 1 provides the normality of distribution using the Shapiro Wilk and the tests for skewness and kurtosis. Table 2 summarizes the regression analysis and shows the adjusted R-squared range from 0.37 for the Hong Kong data to 0.46 for the U.S. data. The statistical p-values of the t-test range from 0.0044 for the Hong Kong data to 0.0000065 for the U.S. data, which are significant and within the 95% confidence level. This suggests that the legal services GVA may add significant information to help assess the business outlook for the legal industry.

- For 2003, the impact on the Hong Kong legal sector from the SARS-related economic recession was positively correlated and amplified, (i.e., for a 3.1% GDP hit, the legal sector dropped 12.1%). For the 2008–2009 financial crisis, given the severity of GDP shocks, the data indicates that legal services GVA shows an amplified magnitude of impact.

- In the U.K. and U.S., for GDP hits of 4.2%, and 2.2% respectively, there was between 6.4% and 10.6% legal sector hits. A point of note is that the Hong Kong data showed the legal sector actually growing when the economy was shrinking, (e.g., in 2009, for a 2.8% GDP hit, the legal sector grew 5%). However, this reflects a two-year downward trend from double-digit growth in 2007.

- We have attempted to extrapolate our study of the 2003 SARS crisis and 2008-2009 recession impacts on the legal sector to 2020, using quarterly GDP outlook estimates obtained from the IMF. It has been observed that — in 2020, for a projected world GDP change of -3% — the projected legal services GVA change is between -5.1% and -3%. For advanced economies, we expect to see a change between -6.2% to -11.1% in legal services GVA.

- From our analysis, we believe that the legal industry as a whole will experience a contraction between 3% and 5.1% in 2020, as a consequence of the recession precipitated by the pandemic. However, once the pandemic is contained, and as the world economy begins to recover, legal industry revenues will grow by 5.9% to 11.8% in 2021.

Limitations/caveats

- While our research may indicate the presence of a linear, significant, and causal relationship between GDP growth and legal services GVA, it cannot be concluded — even if there is statistical significance — that one variable causes the other.

- Measuring the strength of a relationship using regression analysis provides confidence that a dependent relationship exists. Correlations could indicate possible causal relationships. A correlation between variables where the data is normally distributed increases the confidence level in measuring the linear relationship. However, we cannot assume the relationship between the quarterly change in the GVA and the quarterly change in real GDP will be linear in nature over time.

- Additionally, due to limited data availability, we have had to apply annualized correlation estimates to quarterly world GDP data to extract legal sector outlook forecasts.

Appendix:

| Table 1. Tests of Normality | ||

| Assumption/Test | ||

| Residuals follow normal distribution | Test Value | Prob Value |

| United States | ||

| Shapiro Wilk | 0.94274 | 0.07443 |

| Skewness | -0.5519174 | – |

| Kurtosis | 1.355055 | – |

| United Kingdom | ||

| Shapiro Wilk | 0.95426 | 0.3577 |

| Skewness | -0.5714448 | – |

| Kurtosis | -0.4590729 | – |

| Hong Kong | ||

| Shapiro Wilk | 0.91045 | 0.08763 |

| Skewness | -0.8165996 | – |

| Kurtosis | 1.505715 | – |

| Table 2: Regression Statistics | |

| United Kingdom | |

| Multiple R | 0.692580406 |

| R Square | 0.479667619 |

| Adjusted R Square | 0.454889887 |

| P-value | 0.000249748 |

| Standard Error | 1.227231969 |

| Hong Kong | |

| Multiple R | 0.636749287 |

| R Square | 0.405449654 |

| Adjusted R Square | 0.368290258 |

| P-value | 0.004488991 |

| Standard Error | 0.050320337 |

| United States | |

| Multiple R | 0.697288104 |

| R Square | 0.4862107 |

| Adjusted R Square | 0.469636852 |

| P-value | 0.00000650911 |

| Standard Error | 0.020108537 |

1 IMF World Economic Outlook, April 2020: https://www.imf.org/en/Publications/WEO

2 As per the OECD, Gross Value Added (GVA) is an economic productivity metric that measures the contribution to the economy of each individual producer, industry or sector. It is an important metric because it is used to adjust GDP.

3Legal and Accounting Services definition: This division includes legal representation of one party’s interest against another party, whether or not before courts or other judicial bodies by, or under supervision of, persons who are members of the bar, such as advice and representation in civil cases, advice and representation in criminal actions, advice and representation in connection with labour disputes. It also includes preparation of legal documents such as articles of incorporation, partnership agreements or similar documents in connection with company formation, patents and copyrights, preparation of deeds, wills, trusts, etc. as well as other activities of notaries public, civil law notaries, bailiffs, arbitrators, examiners and referees. It also includes accounting and bookkeeping services such as auditing of accounting records, preparing financial statements and bookkeeping.

4 U.S. Patent Statistics, U.S. Patent and Trademark Office, https://www.uspto.gov/web/offices/ac/ido/oeip/taf/us_stat.html

5Evidence from European Patent Office Filings, ‘Do Business Cycles Affect Patenting?’ http://fs2.american.edu/wgp/www/EPO_BusCycle.pdf. Forecasting Patent Filings at the European Patent Office (EPO) with a Dynamic Log Linear Regression Model: Applications and Extensions http://fs2.american.edu/wgp/www/ACEB%20Singapore.pdf

6 Bloomberg article ’Patent Filings, Litigation May Shift in Economic Crisis’, https://news.bloomberglaw.com/ip-law/patent-filings-litigation-may-shift-in-economic-crisis