With the increased competition in the market, it’s more challenging than ever for leaders at private equity firms to think about how the market is shifting on a day-to-day basis. The fact of the matter, however, is that these micro- and macroeconomic trends have a serious impact on the firm’s ability to achieve long-term success.

So the question remains: how can private equity leadership maintain visibility on the ever changing private equity market trends, and on their team, while executing on their mandates?

In this article, we explore a few ways in which technology – supported by a combination of industry-leading and proprietary data – can power business development efforts behind the scenes so investors can stay focused on closing deals.

Historical Comparisons

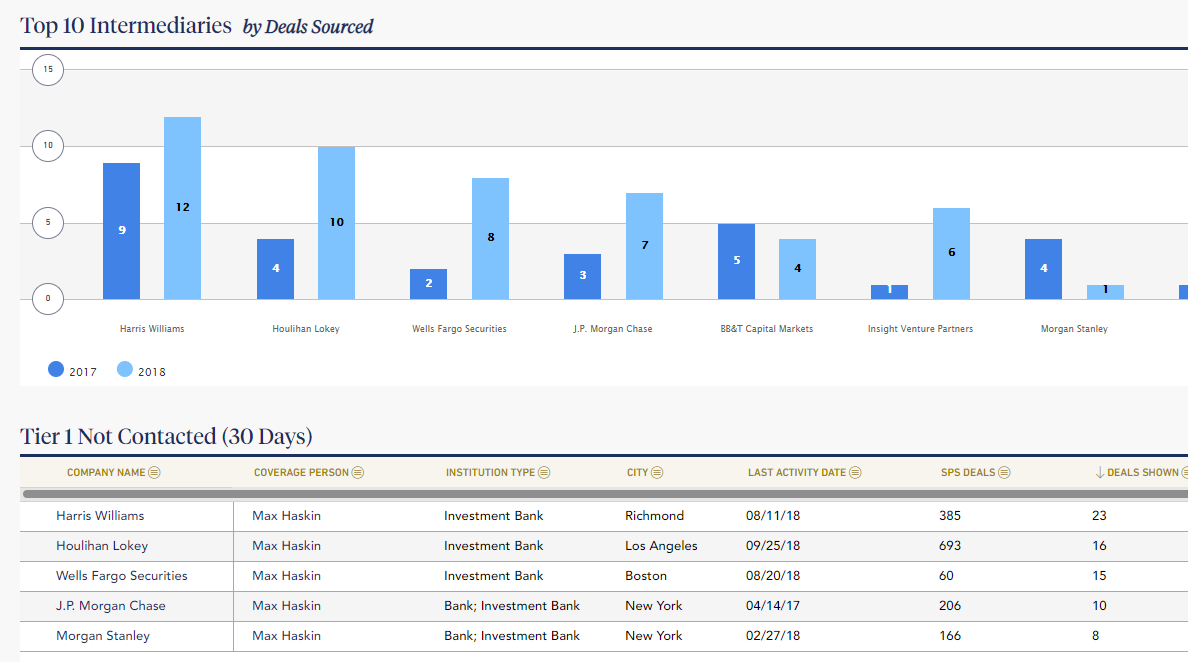

It’s easy to simply close the books at year-end and never look back, especially after a tough year marked by poor performance and unattained goals. Looking at past deal and business development metrics, however, is one easy way to keep firm leadership in tune with long-term goals. When every communication and activity firm-wide is logged in one place, it’s even easier to leverage that data.

For example: if the total count of business development activities (such as phone calls, emails and meetings) in the healthcare sector was 1,000 at this time last year, and the firm is currently at 800, firm leadership should take that cue and dedicate more resources to that coverage in order to surpass last year’s performance. Similarly, if your top tier of intermediaries are not sharing as many deals with you as years prior, that should signal deal professionals to pick up the phone.

We encourage firms to set up these types of dashboards so that users can easily visualize activity and performance over time. While identifying past mistakes and shortcomings can be scary (and even embarrassing), historical data serves as an effective tool for benchmarking, resource planning and setting realistic expectations for what can be achieved.

Leverage Third-Party Sources

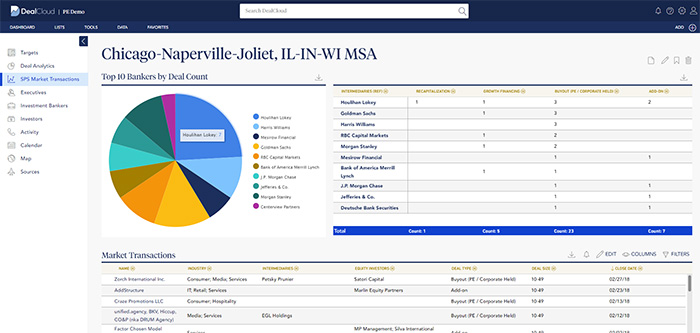

Within the investment community, it’s been no secret that historically, reliable data on private and public companies, investors, funds, limited partners and service providers has been hard to find. Thanks to many technological advances in the industry such as web crawlers, machine learning technology, artificial intelligence as well as specialized and expertly-trained data teams, firms of all sizes are now able to validate their proprietary data with the support of third parties to more closely align with shifting private equity trends.

Relying solely on your own data no longer provides full coverage of the market, so infusing your technology systems with this type of third-party data helps force you to not have tunnel vision. Instead, you can more accurately assess the total universe of companies and deals, and how much of that universe your team has been able to access.

Ultimately, leveraging a host of verified data helps private equity professionals make more actionable decisions, more confidently.

Unique Categorization

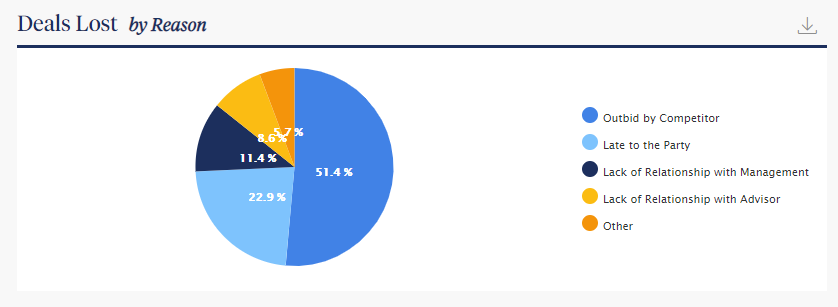

While it’s a best practice to keep data standardized, most firms will admit that what seems on the surface like a one-time, fluke event, can actually turn into a trend. That’s why there’s a case to be made for tracking very specific market factors within your technology platforms such as losing out to a competitor, or experiencing major swings in activity in a given industry.

For example, even when your team loses a deal, a detailed reason for the failure should be accounted for within your information systems. That data is extremely valuable because it can be leveraged to inform future strategies and guide the way the team spends time and resources.

Whether that information leads you to halt certain business development activities for a period of time, or double-down on the existing strategy, having the visibility (backed by data) helps to better steer the ship.

Your technology systems should allow you to re-categorize activities based on what really happens throughout the deal lifecycle, positive or negative. Once those categorizations are put into place, firm leadership can more easily check statuses and better navigate the complexities with their teams.