DealCloud is excited to announce the spring 2020 product release is now available to clients globally!

The spring 2020 product release provides solutions which improve key workflows and processes central to maintaining a data powered platform delivering vertical specific solutions for our 800+ clients. DealCloud is pleased to deliver enhancements including improved reporting functionality, data manipulation capabilities, and a new product solution: Automations.

What’s new?

Automations: We have released Automations, a new product suite streamlining repetitive data entry and improving workflow functionality. This decreases manual data entry for users, taking predetermined criteria to trigger automatic data entry for downstream identified fields. This also improves data quality through the automation of creating new entries, updating existing entries, and initiating instant alerts. Automations are accessible to permissioned users from Tools > Automations.

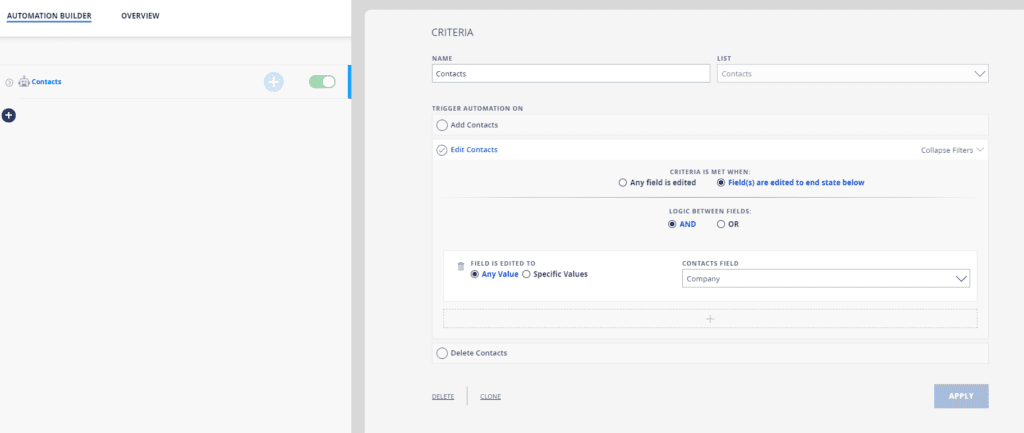

Figure 1: Automations Builder [Automations Criteria]

The automations view builder depicted above displays the point-and-click functionality used to build Automations Criteria that triggers an automation. In this example, the defined event is any time the “company” field is edited on the contact list. This is a primary use case for automations, it will remove the need for duplicative data entry for clients looking to quickly capture previous employment company affiliations.

The second step is to Define Automation Actions. In the company affiliations example, the action required is to “Create Entry” because the goal of the automation is to create automatic entries on the company affiliation list, any time a company is edited on the contact list. This achieves the underlying goal of tracking a contact’s previous company without the manual requirement of updating these data points on the company affiliations list.

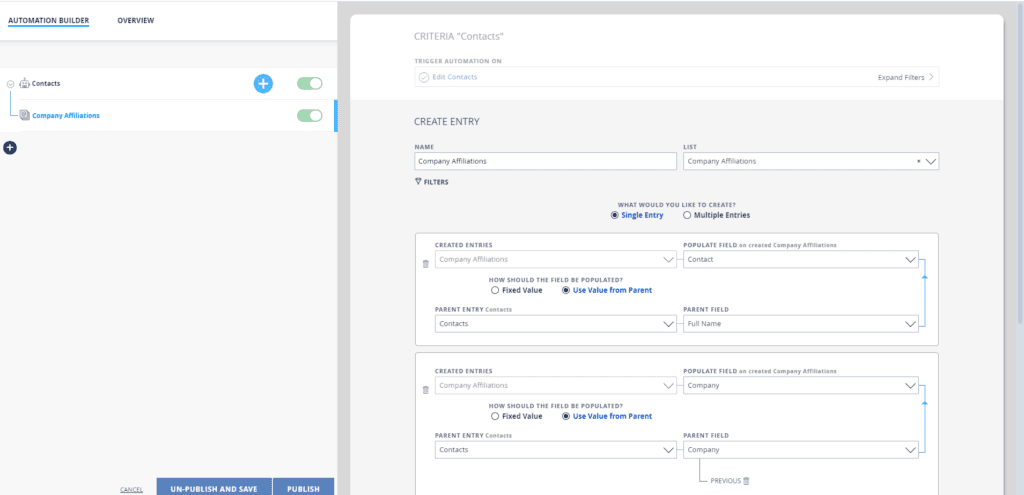

Figure 2: Automations Builder [Define Automations Actions]

The automations view builder depicted above displays the constructed automations actions; identifying the company affiliations list and building the logic to instruct the system to create automated entries for the contact and previous company associated.

Automations use cases: We are thrilled for our existing and future clients to begin leveraging the powerful Automations suite. A highly requested feature, Automations is a primary example of how client feedback informs the DealCloud product roadmap. See below for a few use cases for capital markets professionals:

- Example use case #1: Automation of creating a fee entry data point when a prospective engagement becomes a won mandate

- Example use case #2: Automation of contact details (company, owners, office, business email) when a contact moves from live to inactive status

- Example use case #3: Automation of creating investment committee vote entries when the stage of a deal reaches “Needs Approval from IC”

- Example use case #4: For our real estate clients, Automation of asset creation when a deal is added to the system

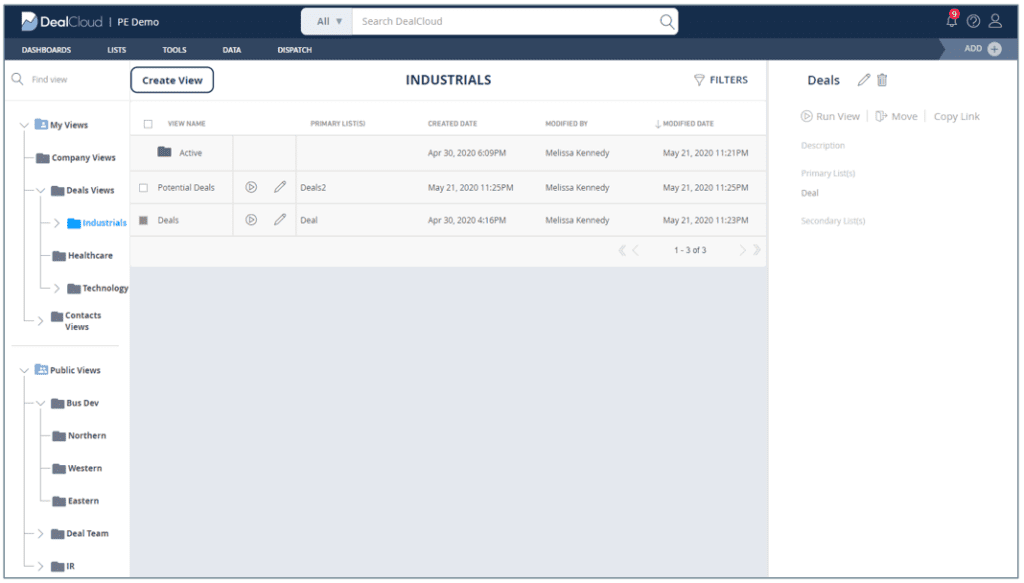

Folder for views: Users are now able to organize views within folders! This feature makes views easier to locate and leverage. Platform Administrators can sort existing Public Views into sub-folders, improving organization and ability to search. An example folder structure is sorting Views by sector or location, improving visibility of the Public Views that specific team members leverage on a daily/weekly basis.

Figure 3: Folder configuration for Views

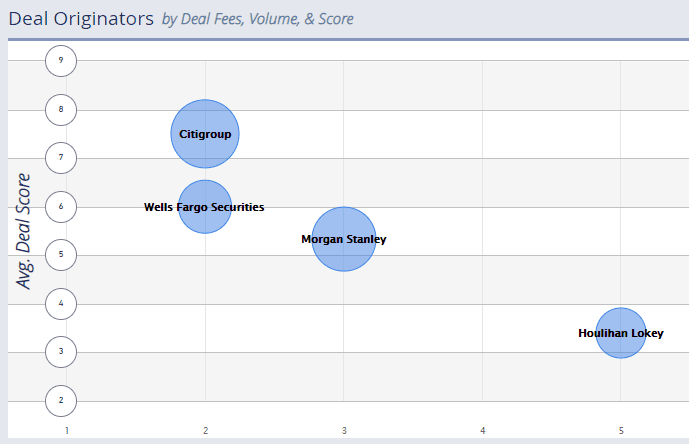

New Chart Type: DealCloud would be remiss if we did not include an exciting reporting development for our clients to leverage: Bubble Graphs. The new chart type gives users an additional method for data consumption. Users are now able to analyze three variables in one chart (X-Axis, Y-Axis, and Bubble Size). This is useful in many cases, on example being analysis of Deal Originator Source as shown in the figure below.

Figure 4: Bubble Chart

See below for a few use cases and ways capital markets professionals can use bubble charts:

- Staffing application: Bubble charts can be helpful applied to staffing metrics by allowing firms to evaluate the Analyst Name vs. Number of Deals/Pitches Staffed on vs. Staffing Intensity Rating/# of Hours Worked

- IC voting application: Bubble charts allow management teams to evaluate voting analytics by plotting IC Voter vs. # of “Yes” votes vs. Sector of Deal

- Broker fees: For our real estate clients, bubble charts can be applied to identify broker fee analytics associated to specific individuals and companies

Chart drilldown feature: This Pie with Drilldown feature provides another exciting reporting development for users viewing pleasure. The feature allows for users to click on a pie chart and see a more in-depth breakdown of data within each slice of the pie. An example of this, is if there is a pie chart that displays deals by stage, clicking into “active stage” will derive a second pie chart that displays the active deals parsed by industry.

DealCloud is thrilled to continue to provide solutions that drive value for our 800+ clients.

For current clients…

We hope that the enhancements showcased above have reinvigorated your excitement about DealCloud! If you would like more detailed information regarding the spring 2020 product release, please visit DealCloud University where you can find Detailed Release Documentation.

For future clients…

Welcome to DealCloud! We hope that the spring 2020 product release has piqued your interest in DealCloud. If you are impressed by the above features, it is just the tip of the iceberg – just wait until you see what else the platform has to offer!

If you are interested in our best-in-class deal, relationship, and firm management platform, please schedule a demo.