What is on the horizon for capital market dealmaking trends for 2021? DealCloud’s Fall 2020 Dealmaker Pulse Survey polled dealmakers to gain key insights into how capital markets firms are dealing with the effects of the global pandemic and thinking about opportunities for the fourth quarter, next year and beyond.

In our recent webinar, Dealmaker Pulse: Key Findings for Capital Markets Firms to Take into 2021, Saar Menachemi, VP of Marketing and Business Development at DealCloud, shared the results of the survey along with data driven takeaways and dealmaking trends specifically for private equity firms and fund managers. Below are some of the key takeaways from the survey.

New platforms are the focus

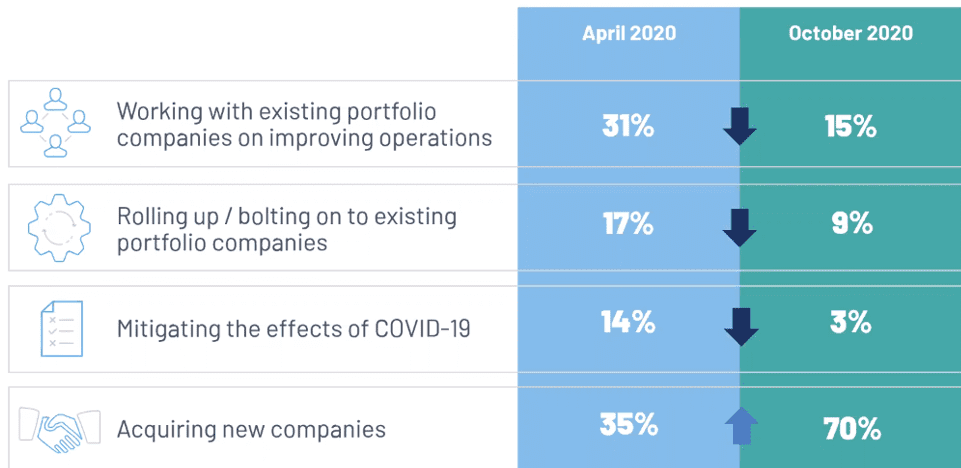

70% of investors said new platform investments are their primary focus over the next six months, compared to 35% six months ago.

Fewer investors expect valuations to decline further

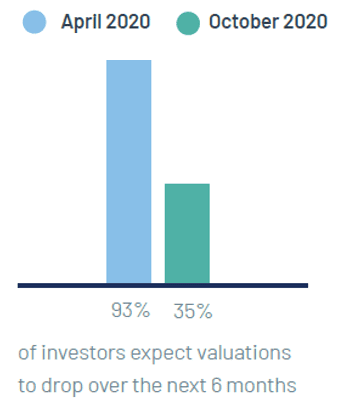

Only 35% of respondents said they expect valuations to decline, down from 93% in April.

The pandemic continues to impact the work environment

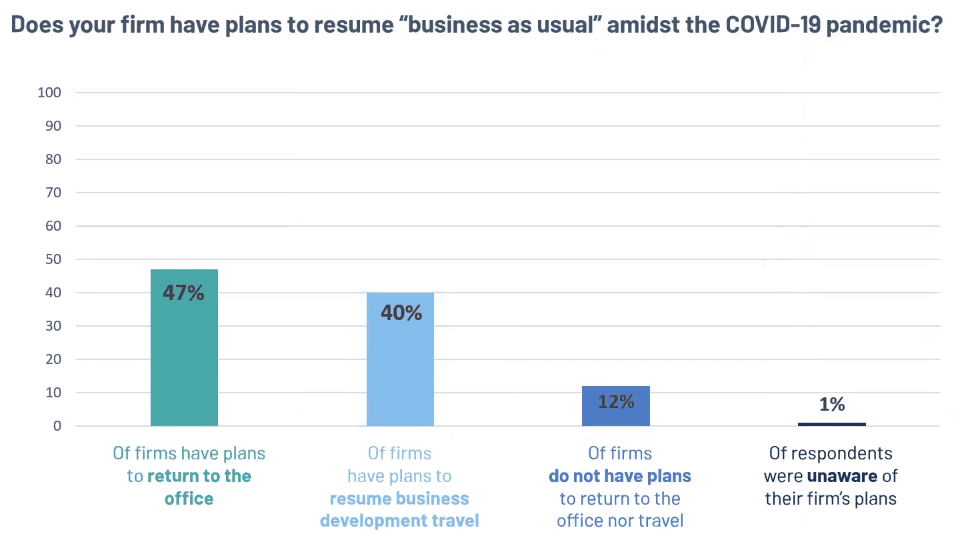

47% of private equity firms have plans to return to the office, and only 40% have plans to resume business development travel, as technology-driven operations are seen by many as a bare minimum to remain competitive and cultivate key relationships.

For some, dealmaking evaporated

30% of investors said their firm did not close a deal (platform or add-on) since March.

Click here to download a recording of the Dealmaker Pulse: Key Findings for Capital Markets Firms to Take into 2021 webinar.

To see the full results of the DealCloud Dealmaker Pulse Fall 2020 Survey, visit dealcloud.com/pulse.