According to Refinitiv, 2021 marked the highest value for M&A activity ever recorded in a first quarter since official documentation started in 1980. Although deal volume only rose 6% year over year, the total value of pending and completed deals rose 93% to $1.3 trillion, establishing the second-largest quarter on record.

Competition for high-quality deals continues to be more intense than ever, forcing many buyers to think outside the box for ways to source and close deals. Read on to review some notable statistics from the first quarter of deal-making this year, and learn how purpose-built technology enabled transaction professionals to adapt to the ever-changing trends.

Turning to Add-Ons

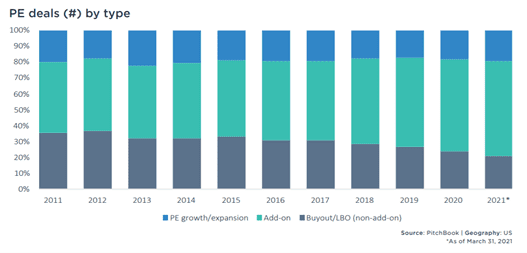

In an effort to accelerate portfolio company growth, lower-middle and middle market firms continued to focus on add-on acquisitions in the first quarter. At the current pace, private equity is on track for a record ratio of add-on acquisitions to buyouts and growth deals in 2021, per PitchBook’s Q1 report.

With this competition for smaller deals, firms need to act quickly and benefit from a centralized source like DealCloud to know where relationships stand, what the next steps are, and which team members are the running points for all correspondence with private companies and their deal advisors.

Increasing Specialization

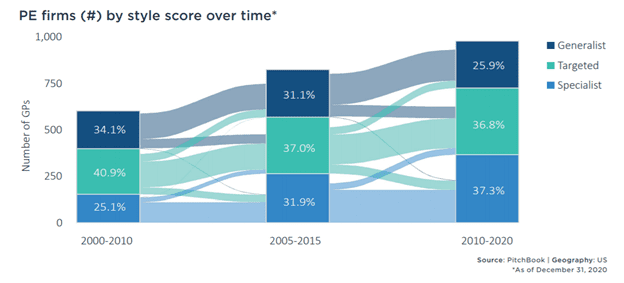

We’ve seen the rise of thematic exchange traded funds (ETFs) in public markets; now we’re witnessing a similar shift in private markets, with more specialist firms in the market than ever before. From 2010 to 2020, the proportion of generalist firms in the private equity ecosystem decreased to 25.9% compared to 34.1% during the span of 2000 to 2010.

Generalists: Firms without a sector that comprises approximately 50% or more of their deal activity

Targeted: Firms with between roughly half and two-thirds of their deals in one sector

Specialists: Firms with more than approximately two-thirds of their deals in one sector

These statistics raise an important question: As firms significantly narrow their universe of deal possibilities, how can they continue to source opportunities?

The answer to this is simple: communication. If a firm is focused on energy investing, for example, the firm must keep in regular contact with a smaller subset of investment banks and counterparties focusing on the space. With DealCloud Dispatch, it’s easy to maintain communication with key stakeholders via templated materials like industry analysis, newsletters, holiday cards, and many other communications.

Driving Co-Investments

Appetite for co-investments is picking up, following lower usage in 2020, according to Private equity International’s LP Perspectives 2021 Study. The study found that 71% of LPs intend to deploy capital in deals alongside managers during the year. In addition, firms like Neuberger Berman and Lexington Partners also raised co-investment funds above initial targets during the quarter.

It’s important for these firms to use purpose-built technology so they can have the right LP data at their fingertips. Information revolving around LPs — such as what types of deals particularly interest an LP, what sectors an LP prefers or dislikes, deal size preferences, and softer data such as speed of decision-making — is all critical.

Evaluating SPACs

Lastly, it almost goes without saying the number one trend in deal-making this quarter continued to revolve around special purpose acquisition companies (SPACs). There were almost as many combinations between a SPAC and a privately held company announced in the first quarter as there were in all of 2020, according to The Deal.

It’s hard to say whether this volume of SPAC formation is sustainable, but more exposure to public markets is going to open deal-makers to a new level of relationships they will need to manage using leading technology solutions to do so.

To better take advantage of the Q1 deal-making trends outlined above, contact us at sales@dealcloud.com, or schedule a demo.