Although it’s widely known that family offices typically have less access to operational and talent resources than larger investment management firms, family offices are making an impact in the capital markets industry, proving to be viable competitors in both capital investments and value creation.

In an INSEAD report from 2020, the number of family offices grew by 38% between 2017 and 2019. The same report estimated that assets under family office management stood at $5.9 trillion — a sizable amount compared to $3.6 trillion in the global hedge fund industry.

Family offices are becoming a powerful force in the private capital markets, and that growth can be linked back to investments made in strategy, origination, and execution. In an effort to think more like their competition, many family offices are searching for poachable talent. By hiring directly from the ranks of their competition, family offices are now beginning to staff their teams and behave more like private equity firms.

Given the uncertain tax and regulatory outlook — and the increasingly competitive deal environment —it’s no wonder family offices have their heads more deeply in the game than ever before. Talent aside, how else can family offices find ways to successfully compete with larger firms to win deals and succeed in the marketplace?

Creating Efficiencies with Pipeline Management Solutions for Family Offices

When small family offices begin behaving like large private equity firms, they begin to see the same outcomes as their competitors. Although Microsoft Excel spreadsheets and manual data entry and management may be low cost, most family offices have learned that the human error and wasted time of old-school pipeline management methods isn’t worth the money saved. By recognizing the importance of a custom-built solution serving as a single source of truth for investors, family offices can begin to manage their data, pipeline, and relationships like high-resource firms already do.

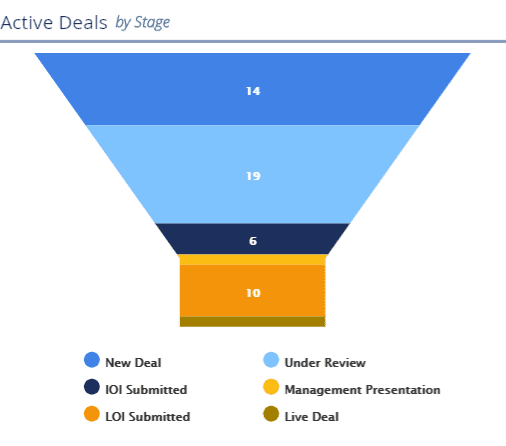

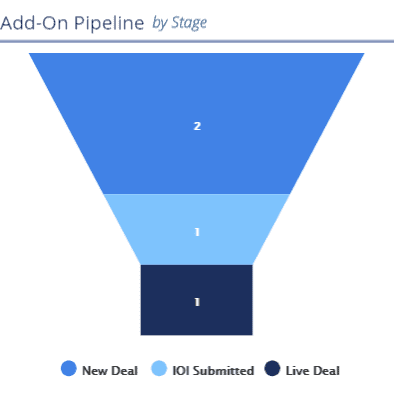

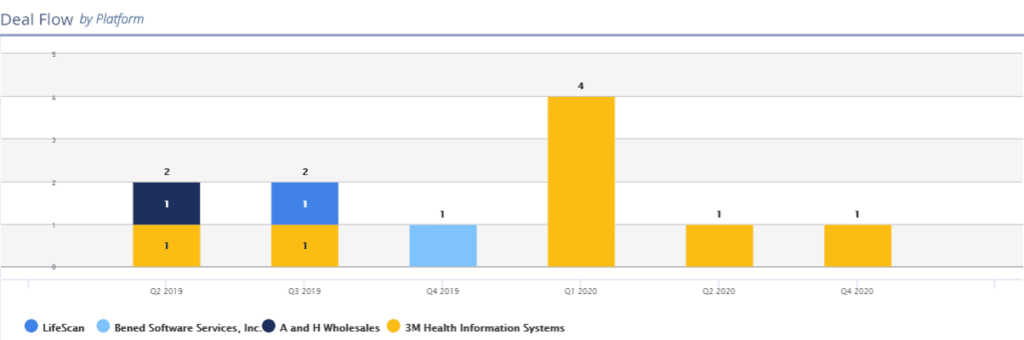

Deal management technology makes it easy for family offices to manage their overall deal pipelines, origination strategies, and add-on opportunities. By centralizing this data, family offices are better equipped to compete against more traditional private equity firms with bigger resource pools.

DealCloud — the pipeline management technology used by traditional private equity firms such as FSN Capital Partners and Atlantic Street Capital — is well suited to the needs of Evolem, a family office based in Lyon, France, recently implemented DealCloud for this very reason. Evolem recognized the need for a flexible, easy-to-use platform to improve its deal pipeline processes and relationship management workflows. When the Evolem team saw that DealCloud worked for PE firms and could be custom-built to serve their family office’s needs, they added DealCloud to its technology stack.

Supporting the Family Office Operating Model with Easy-to-Use, Configurable Solutions

When examining the many ways a pipeline technology solution can benefit a family office, firms often ask about the software’s user experience. Family office investors wear many hats and serve in many functional roles within their firms, and the various responsibilities can be better managed through a deal, relationship, and pipeline management platform. Solutions— like DealCloud — built for these specific purposes can sync to your Microsoft Outlook inbox and integrate with third-party data providers. This creates a single source of truth that automatically updates to reflect the most current information available to a team of family office investors. Sourcing, origination, fundraising, pipeline management, and deal execution information can live on dedicated dashboards, creating greater clarity and confidence when making investment decisions. This technology also gives family offices access to more sophisticated information security, data storage, and reporting.

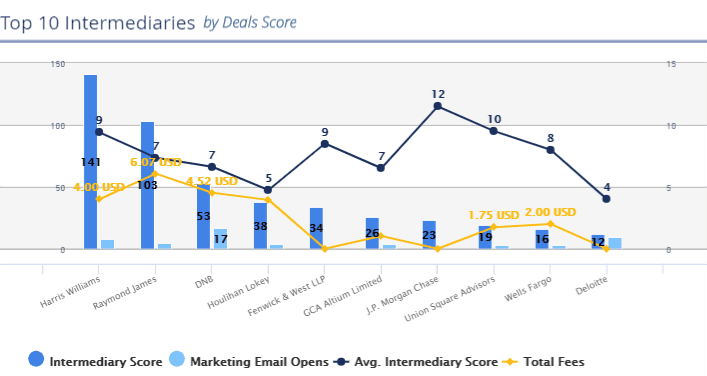

When your portfolios are properly managed, your client relationships become stronger. Within the DealCloud platform, investors can categorize, tag, organize, and report on their relationship data in whichever format best serves their needs. This technology helps family office business development and investment management professionals run robust banker coverage programs, just like their large-firm competitors.

By leveraging pipeline management technology, family offices can centralize their deal sourcing data. This technology helps them better understand where quality deals are coming from and where intermediary firms and brokers fees are going to over time.

Seeing Purpose-Built Family Office Investment Management Technology in Action

Simply put, family offices need the ability to consolidate, organize, and customize their pipeline management dashboards to compete for assets and create value in today’s complex deal-making environment. When your firm is united internally, they win more externally.

If you’re interested in learning first-hand how DealCloud can improve operations, schedule a demo today.