In today’s competitive investment landscape, managing your pipeline efficiently is more important than ever. Unfortunately, many dealmakers still rely on disparate spreadsheets to manage large amounts of data — a time-intensive and inefficient method that increases the risk of inaccuracy. With the large volume of deals coming through, it’s critical to monitor the progress of every deal and maintain pipeline transparency in a single source of truth. By leveraging deal pipeline software, dealmakers provide their entire firm with a centralized, authoritative location to store and manage their pipeline data.

Deal pipeline management tools also help firms move deals from stage to stage faster and with more precision. Integrating a deal pipeline software ecosystem is one of the best ways to access real-time data and create accurate, up-to-date, and robust summaries of every deal as it moves through the pipeline. As a result, firms can achieve faster due diligence, increase cross-team transparency, create fully customizable workflows, and avoid unexpected deal failures.

Benefits of Deal Pipeline Software:

1. Increase Data Due Diligence

Because every deal is unique, it’s important that firms document, centralize, and manage their deal processes using deal pipeline software. By leveraging a centralized platform for their transactions, firms can easily organize their data and move deals through the due diligence process while remaining compliant. With DealCloud, firms can successfully utilize data, streamline due diligence, and enhance the dealmaking process.

2. Expand Cross-Team Transparency

Historically, capital markets firm professionals have used spreadsheets, emails, notes, memos, and their own memory to capture data. Subsequently, dealmakers waste a significant amount of time asking colleagues for their latest pipeline update or tracking down information in their own email inboxes and documents. Leveraging data pipeline tools enables dealmakers to easily access data and share information with one another within a single platform, allowing them to close deals faster. With DealCloud, different teams can access pipeline data that’s updated in real-time, enabling decision-makers to stay fully informed and up to date.

3. Configure Workflows Built for Complex Pipeline Management

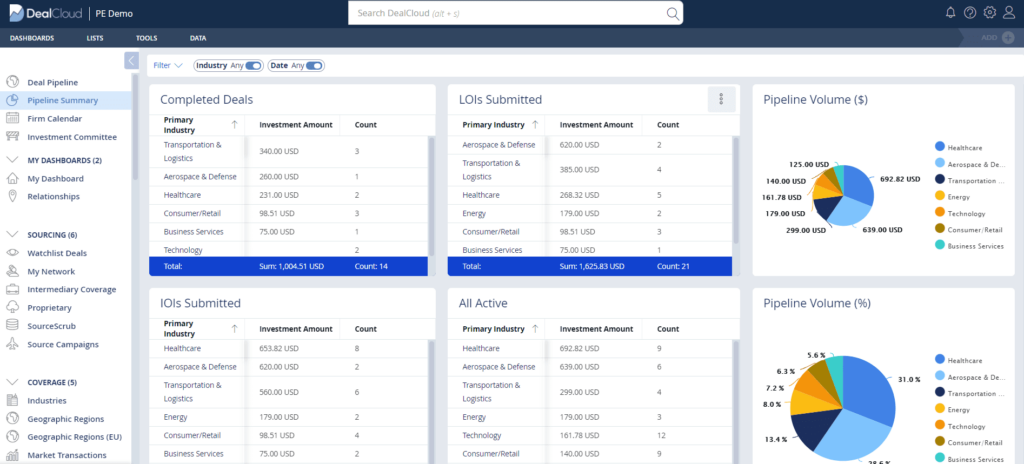

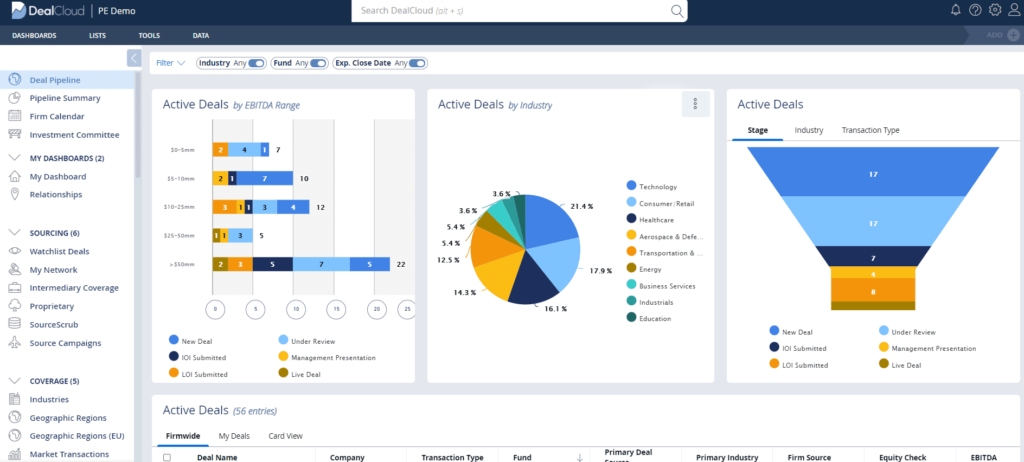

Users of traditional CRMs know all too well that the technology is only capable of accommodating one-off tasks. Users must go into specific accounts to manually create dozens of individual tasks — a cumbersome and painful process for a firm with a standard pipeline management workflow. Manual processes like these also increase the risk of human error, and make it difficult to identify and locate mistakes. Using DealCloud’s deal pipeline software, dealmakers can categorize their pipeline by industry, stage, owner, and other categorizations to better organize and track their complex data. Dealmakers can also use advanced visualizations to show their deal pipeline data and increase transparency within the firm.

Schedule a demo today to learn how your firm can better manage its pipeline using DealCloud technology.