In addition to the COVID-19 pandemic and consequential economic disruption, the changing and increasing queries of limited partners (LPs) have put a great deal of pressure on general partners (GPs). LPs are now asking GPs to supplement traditional accounting and performance reports with customized, hyper-relevant analytics to help them make winning investment decisions. Discover how DealCloud can help you improve your firm’s investor reporting.

Understand and exceed investor reporting expectations

Determine what information LPs expect to know and how quickly they expect to receive it. Traditionally, conventional investor reporting has involved accounting reports, performance reports, and multiples reports. Learn how you can improve all three types of reporting.

Provide regular accounting reports

LPs expect basic quarterly accounting reports that encompass a full suite of robust, granular metrics. Include key information such as your firm’s income statement, balance sheet, cash flow statement, financial forecast, and budget scenarios.

Although the expenses and profit-sharing agreements of GP firms are traditionally provided to more sophisticated LP operations, it’s becoming more common for LPs to request this information up front. The Institutional Limited Partner Association (ILPA) recommends LPs cover this specific investor reporting during negotiations to provide added transparency.

Provide regular portco performance reports

Another investor reporting standard that LPs expect from GPs is regular performance updates. Providing investors with the right portfolio company (portco) report at the right time helps them keep tabs on various criteria:

- Notable changes in company valuations

- Potential risks across geographies and sectors

- Value created across both individual funds and the portfolio

- Contractual side-letter compliance

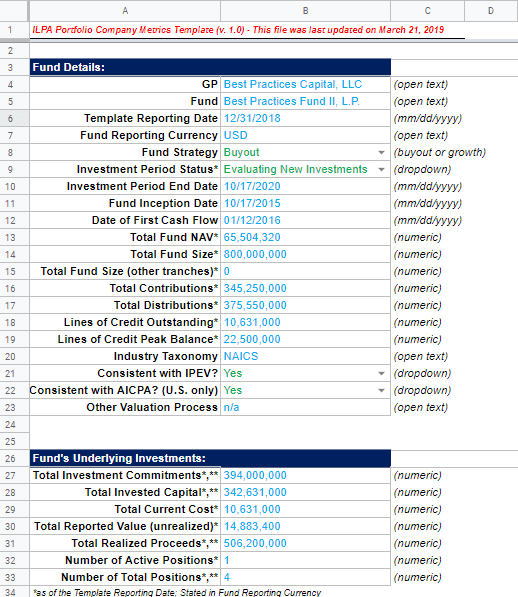

GPs can download ILPA’s portfolio company metrics template to keep LPs informed of portco performance.

Source: ILPA

Provide industry standard multiples reports

Occasionally, investors will want to understand how accounting and performance work together. You can achieve this by calculating multiples and showing LPs how you arrived at each ratio. Check out Breaking Down Finance’s walkthrough to learn how to compute these industry standard investment multiples for alternative assets.

Accounting and performance reports have become a common expectation for traditional investors. These reports, which were previously executed on a quarterly basis, can now be generated more quickly and consistently than ever before. With the right technology and agile processes, GPs can answer investor questions during any part of the accounting cycle.

Identify what matters most to your LP

When you know what piques an investor’s interest, you can build and customize your reporting capabilities to successfully meet expectations. LPs may differ in terms of the material or content they desire as well as the medium or way in which they want to receive it. The solution is to offer LPs a variety of both content types and delivery cadence.

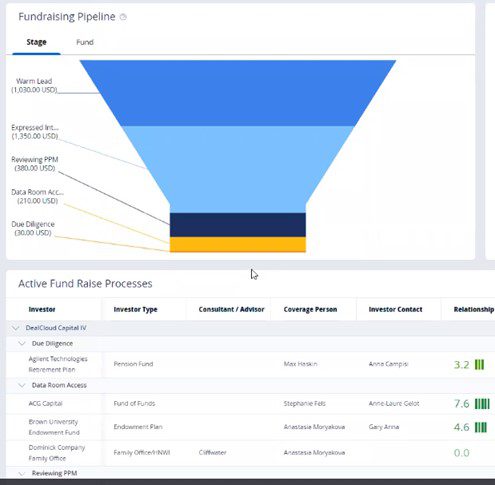

Offer a fundraising pipeline report

Start by offering to share your own fundraising pipeline report and help LPs visualize the progress of the fund to which they’ve committed. Delivering real-time metrics on a consistent basis will help you continue building relationships with your clients while providing assurance about the progress of the fundraising and fund allocation process. With DealCloud, you can show your pipeline by fund or by stage.

Source: DealCloud

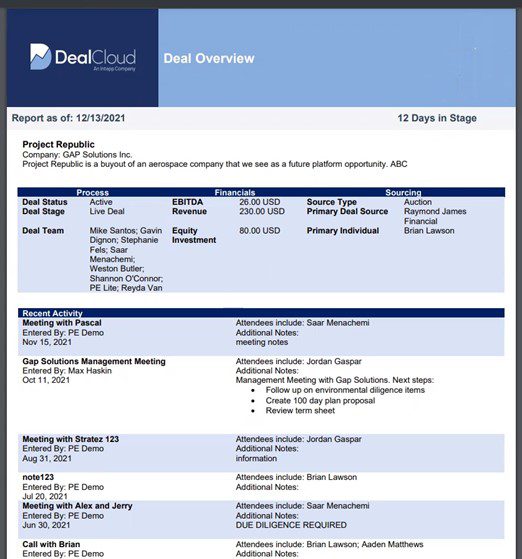

Offer deal summary reports

You should also consider offering deal summary reports — rather than traditional investment papers or investment memos — to accredited or institutional investors during the early stages of deals. DealCloud lets you view the number of days a deal has stayed in its current stage along with its status, financials summary, origination information, recent activity, and key parties. This overview serves as an ideal briefing for LPs and investment committees.

Source: DealCloud

Offer compensation and incentive allocation reports

Although dealmaker transparency is becoming increasingly important to investors, many GPs continue to obscure their compensation structures. Differentiate your firm from others by providing compensation data regularly. Offer reports to investors that provide a breakdown of how your team works and makes profits.

“The incentive allocation — which is often buried in unrealized gains and distributions for the purpose of investor reporting and disclosed in the financial statements at the fund level — is arguably the most difficult amount to verify and track,” writes Shay Caufield, Executive Vice President of PEF Services. Transparency is a counterintuitive way for firms to compete as well as build trust and long-term relationships with investors.

Download this standard reporting template from the ILPA Transparency Initiative to help your GPs improve transparency.

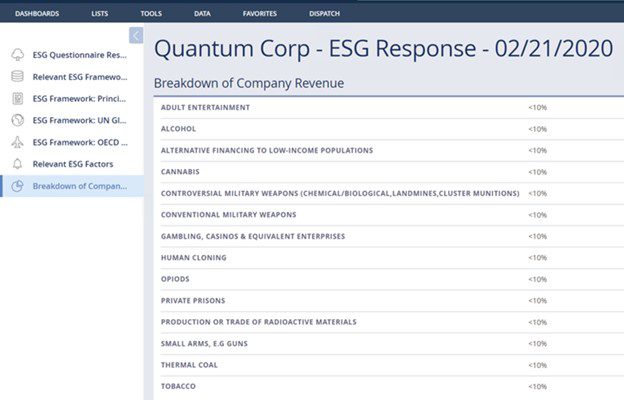

Offer ESG impact reports

Investors are becoming increasingly concerned with sustainability in a variety of areas. Analysts at EY report that environmental, social, and governance (ESG) funds have outperformed their non-ESG rivals throughout the pandemic, proving that these initiatives are both impactful and profitable.

Before you begin reporting on ESG initiatives, read through the Hong Kong Exchanges and Clearing Market (HKEX) step-by-step ESG report generation guide, and review best practices published by experts at the Harvard Law School Forum on Corporate Governance. For sector-specific ESG report generation help, consider the Global Sustainability Standards Board’s (GSSB) sector standards.

Source: DealCloud

Offer portco value creation reporting

Some investors may want to know how your management team creates value for portcos. Before you share these insights up front, review and edit your internal operational improvements memos. Your storytelling should come from an objective angle and avoid overpromising outcomes. Explain how your team tackles challenges such as:

- Launching new sales or marketing initiatives

- Adopting technology to improve workflow and productivity

- Cutting costs by renegotiating contracts with vendors

- Reducing customer churn

- Penetrating new geographic markets

- Creating and training new departments or people

- Developing new service or product offerings

- Rethinking the business model altogether

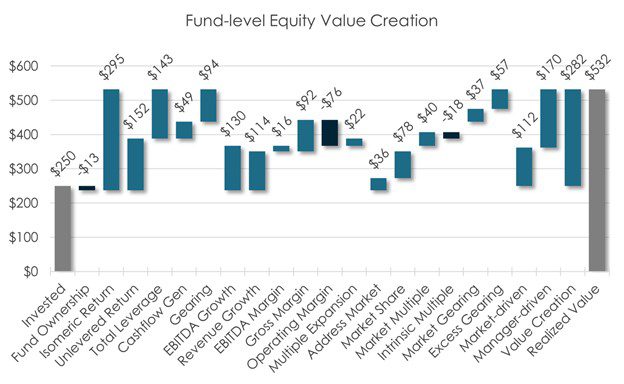

In his recent handbook, Private equity Value Creation Analysis, consultant Michael David Reinard describes an included report as a “robust and comprehensive deconstruction of GP value-add.” The report includes more than 20 value drivers to show investors exactly how GPs are working to generate alpha.

Source: Michael David Reinard via LinkedIn

When you create your value creation analysis, include a summary with details such as whether an external operating partner has been deployed or if you’ll create value remotely. List how — and how often — you plan to measure the results of your operational improvements.

Upgrade your investor reporting tools

Traditionally, firms have managed reporting challenges via outdated, unsecured spreadsheets and emails. During a recent panel discussion hosted by Mercatus, prominent private equity leaders asserted that firms must abandon this inefficient process and invest in data management tools to remain competitive.

Upgrading to an information management system helps you better harness and manage data and lets you quickly and confidently report to your partners whenever they have an inquiry. Invest in a system that democratizes usage, offers template reports, and provides a variety of formats to choose from when publishing or sharing information.

Democratize GP usage

As an end-to-end system, DealCloud lets everyone on your team access all appropriate data based on their access and permission levels. With direct access to the information they need, users no longer have to rely on others to provide the data for them, which can greatly decrease firm efficiency.

Imagine, for example, a nontechnical member of your investor relations (IR) team wants to view company data in a variety of ways. Normally, that person would ask your firm’s database administrator (DBA) to write a custom query, which would consequentially slow down the rest of the IR team. With DealCloud, all users can access and manipulate the data they need to answer and report on questions that arise.

Create report templates

Automating tedious tasks such as reporting is another way DealCloud empowers firms and their IR teams. After creating the perfect query, users can enhance the report with firm-specific branding, colors, fonts, formatting, and graphics. Users can also automate the generation and distribution of the new report, letting it run and publish regularly.

Automated reports can help teams stay better informed and perform more efficiently. Imagine, for example, that each group within a firm automatically receives a relevant PDF — which details the team’s activity summary and industry pipeline — an hour before their Monday morning team meetings. All team members can now attend their meetings ready to discuss the week’s key issues without spending time going over the information in the report. Better yet, users can automatically distribute drafts of these reports to associates and analysts to review, edit, and approve on Friday so that reports are more accurate before the briefing on Monday.

Provide a variety of investor reporting formats

LPs have varied preferences when it comes to how they receive their information. Dealmakers who use DealCloud can easily accommodate all preferences:

- Tear sheet one-pagers formatted as PDFs, Microsoft Word documents, or Microsoft Excel spreadsheets

- Presentations for in-person communications or web meetings

- Interactive webpages that serve as real-time data dashboards

Producing these reports may sound like a lot of effort, but the right tool can automate most tedious tasks and democratize usage, ensuring the data is always up to date.

Report information in real time

Your private equity firm can take two routes: Sourcing and growing investments, or delivering valuable, real-time investor reports to ensure LPs will continually trust your fund managers. Leaders who outperform other alternative asset managers combine both tactics for an extraordinarily profitable advantage.

Ready to improve your investor and limited partner reporting? Schedule a demo of DealCloud.