Sutton Place Strategies’ Deal Origination Benchmark Report shows how careless deal sourcing and origination in private equity leads to slower, more disorganized deal management and, ultimately, fewer and lower-margin deals. By improving deal origination processes, private equity transaction professionals can greatly improve deal results in terms of both volume and returns. However, before firms can improve their processes, they must first adopt a better deal flow management system.

Set your firm up for success for 2022 and beyond. Check out these best practices for kick-starting deal origination and sourcing efforts and discover how systems such as Intapp DealCloud can improve your firm’s processes.

1. Set up a CRM

To constantly generate the most relevant and lucrative deals, it’s imperative to stay top-of-mind with your contacts amid their high volume of touchpoints. Without a robust CRM system, firms may lose key details about calls, emails, conferences, and meetings.

Previously, CRM systems focused solely on managing customer relationships, and excluded other key relationships such as general partners (GPs), limited partners (LPs), business owners, intermediaries, co-investors, distribution agencies, advisory service providers, and lawyers. Acquisitive leaders need a system that collects and reflects the various ways all these players interact.

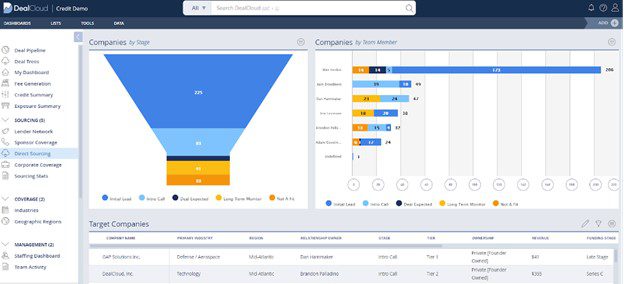

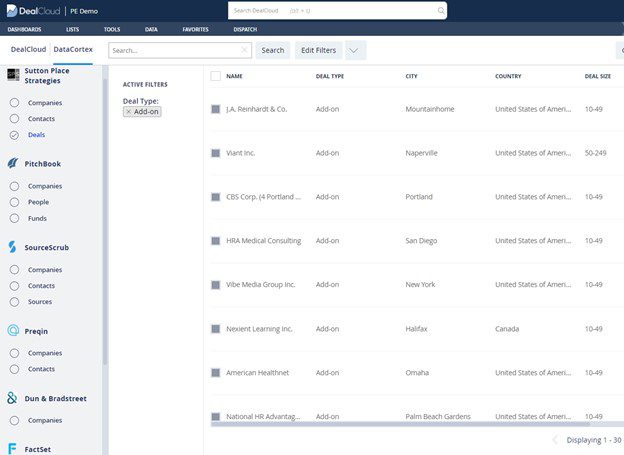

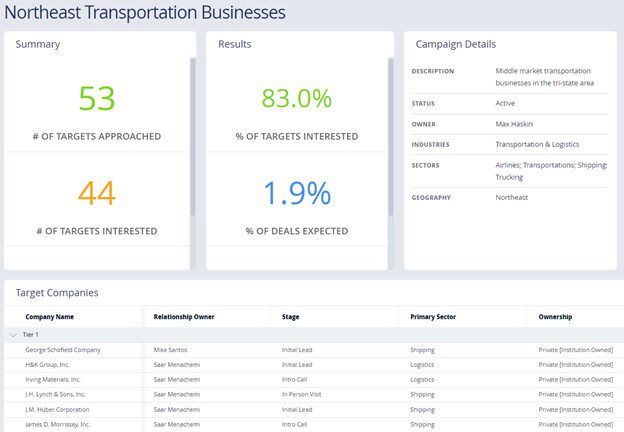

DealCloud lets GPs simplify relationship and pipeline management from origination to close and beyond, and helps firms meet both short- and long-term needs. You won’t need to license separate tools or point products to manage deal flow, scheduling, secure file sharing, and financial and activity data analytics. Instead, you can easily use DealCloud’s end-to-end pipeline and deal management features to streamline sourcing workflows and improve deal quality.

DealCloud’s Direct Sourcing Dashboard offers users a daily peek into the current stages of deals. This visibility informs decisions such as where business development (BD) team members should spend time each week to keep the firm’s target pipeline full and moving.

2. Establish efficient operational processes

There’s nothing worse than wasting valuable energy chasing unqualified leads. Better standard processes can prevent the most lucrative opportunities from slipping through your fingers and landing in the hands of competing investors.

To build tighter, more powerful processes, begin by customizing your CRM. For example, Rob Kaufman, Vice President of Investor Relations at FTV Capital, leverages DealCloud’s application programming interface (API) to securely track investor information as well as environmental, social, and

corporate governance (ESG) data. FTV Capital also integrated DealCloud with its portfolio monitoring and accounting software — Cobalt and Investran, respectively — letting the organization’s data ecosystem live within a single source of truth. Once firms leverage CRM systems to upgrade their processes, buying teams can spend more time finding higher volumes of more promising deals.

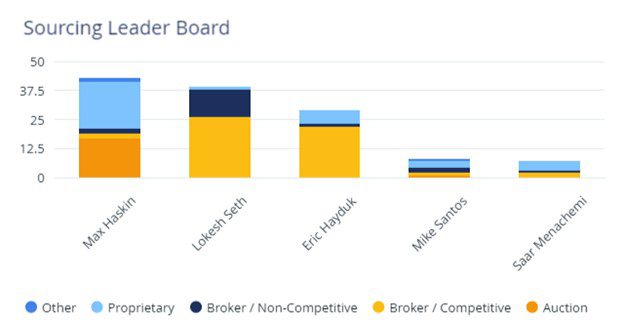

After you’ve customized your tools, you’ll need to collect deal sourcing activity data to inform process-improving decisions — including when to cut or change low-yield activities, and whether to invest more time and energy into high-yield activities.

You’ll also need to decide how to maintain your new processes. Some firms integrate processes into their analysts’ and directors’ goals, while others discuss their firm’s new and improved deal sourcing processes in weekly meetings. Once your processes are clear and efficient, you’ll have more time and energy to source better deals.

3. Enrich current relationships for repeat deals, investors, and referrals

Maintaining your existing financial connections benefits your firm. Consultant and Harvard Business Review contributor Scott Edinger says that current business relationships yield faster transaction processes, easier negotiations, better margins, and more loyalty than new partnerships.

Adding more value to your existing connections can also improve future origination conversations. As your connections transfer to different firms or even different industries, they can refer you to their new connections, thereby introducing you to new opportunities and expanding your professional network.

To improve your current relationships, pay more attention during your interactions. Listen for mentions of non-business interests — such as hobbies or music genres — and bring up these topics in future conversations. You can also better connect with your network by directly asking them for personal recommendations. One fund manager, for example, reaches out to local contacts when he’s in their area on business to ask for restaurant recommendations.

Another way to build relationships is to support your contacts’ brand-building efforts. If a fellow capital manager posts something on social media, share and comment on the post, or offer supporting points to bolster the firm’s unique theses.

Strong relationships have always been — and always will be — the most fertile ground for new, profitable deals. Prioritize both current and new relationships to improve your bottom line.

4. Differentiate your strategy and cultivate new relationships

Find and connect with previously unknown players to uncover latent or hard-to-find deals that match your firm’s unique investment strategy. Sell-side leaders — advisors, brokerages, investment bankers, and investors — are looking for unique partners, and want to know how you work differently from other buyout firms. Plus, new relationships bring fresh perspectives to both sides, often resulting in rare, off-market proprietary deals.

Before you meet with these sell-side leaders, figure out your “secret sauce” — what differentiates you and your team from others. Start by analyzing prior marketing activities and identifying those that have worked before. For example, one capital manager may swear by networking in-person at conferences, while another finds that blogging about their industry sparks the most profitable conversations. Once you have a clear understanding of your philosophy and messaging, you can begin making new connections.

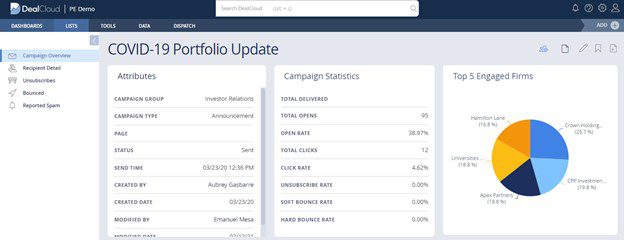

Email newsletters are another viable way to connect with your network. Dispatch allows you to launch email promos without manually importing, exporting, or segmenting targeted leads. Best of all, DealCloud integrates all your recipients’ data, so you can track which email recipients go on to generate deals for the firm.

5. Automate workflows for deal sourcing in private equity

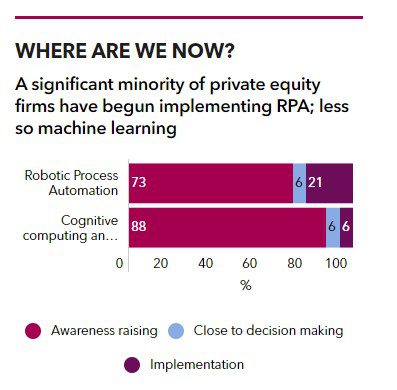

Sutton Place Strategies’ 2021 Deal Origination Benchmark Report shows that the majority of private equity firms have at least one person dedicated to deal sourcing. But very few firms are using automated technology to free that person from tedious tasks such as data entry and information management. A recent KPMG study revealed that just 21% of private equity firms have implemented automated processes.

Implementing process automation saves your team valuable time and effort, and it doesn’t require a major change management program. Simply choose software solutions that can automatically perform important tasks:

- Compile research — Crawl industry lists for keywords that include your target’s geography; growth rate; earnings before interest, taxes, depreciation, and amortization (EBITDA); sector; and recent media coverage

- Match investors with deals — Match LPs with components such as inflation concerns, and automatically route them to funds-backing portfolio companies in sectors with material assets

- Track deal progress — Notify relevant parties of milestones such as LOIs, IOIs, NDAs, due diligence, and initial closing events

- Collect deal sourcing data — Automatically generate a simple report that shows which deal origination sources and strategies produced revenue, how much revenue they produced, what other costs were involved, and overall profit margins

- Capture and view dealmaker activity — Determine how different team members are using emails, calls, video conferences, or in-person meetings to connect with targets in specific industries, and use these insights to improve future deal origination efforts

A recent survey conducted by Intertrust Group revealed that 56% of private equity leaders believe digital innovation is the biggest determinant in their teams’ efficiency. By automating your business development team’s tasks, your team members can get more mileage out of every activity. The more efficient your office becomes, the more time you can devote to finding and securing more profitable transactions.

Source: DealCloud

6. Uncover fruitful sources with market and deal data

For the first time in history, dealmakers have access to abundant, real-time data to strategize higher-margin deals from the outset. Although some investors still bemoan the lack of public information in private investing, the sector as a whole has seen an influx of information services. Savvy dealmakers are taking full advantage of this trend by leveraging verified data from Pitchbook, Preqin, Sutton Place Strategies, SourceScrub, Dun & Bradstreet, FactSet, S&P Global Market Intelligence, PrivCo, Esri, and other data providers.

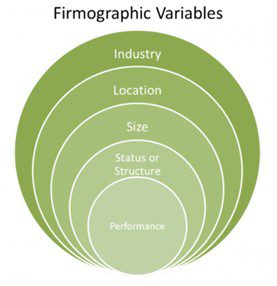

With DealCloud, firms can capture target firmographics such as a business’s industry, location, entity type or structure, business model, performance, and size in term of sales, employees, funding to date, assets, or valuation to start.

To improve your deal sourcing insights and provide decision-makers with a big picture view, consider combining market trends with historical deal data. Decision-makers will be able to make powerful, clear, and better-informed judgments to help steer your firm in the right direction.

Firms should also note that the revenue model is maturing. Consider the subscription-based direct-to-consumer (DTC) retail segment, which experienced intense short-term growth and stabilized as more subscription companies joined the market. Acquiring teams can combine DTC firmographic data and previous placement information to predict future investment opportunities.

7. Clarify your deal thesis and investment mandate for intermediaries

In pooled asset and private equity scenarios, you’ll create more viable future deal sources by producing repeatable deal-origination processes, higher margins, and stronger relationships. To do so, you must first establish clear and mutual understanding around your firm’s identity.

Investment banks and placement agencies need to understand your firm’s values, investment mandates, and risk profile — all of which make up your “strike zone” or investment thesis. With this knowledge, intermediaries can bring you clearer, more developed ideas and more compelling pitch books that don’t waste their time or yours.

A strong investment thesis focuses on both you and your firm’s ideal end-to-end transaction. When writing your thesis, consider including key information:

- Founding partner’s name

- Geography, number of offices, or number of team members

- Assets under management (AUM)

- Purpose or vision

Your investment thesis serves as a powerful introduction and summation of who you are as acquirers. Here are some examples of high-level synopses that work as the first step toward creating a solid investment thesis:

“We are an independent financial services firm with the freedom to focus on what matters most: building value for our clients. We are committed to establishing and maintaining long-term relationships based on integrity and trust and delivering long-term results based on deep research and independent thinking.”

“We have always been a different kind of financial services firm, embracing long-term planning, valuing methodical decision-making, and remaining focused on what matters most: you.”

“NGP ETP, NEGP’s energy transition strategy, provides growth equity to compelling companies focused on today’s energy transition. We partner with world-class teams, using our global network and extensive investment and industry experience to help scale growth and create substantial value.”

“Cassel Salpeter & Co. is an independent investment banking firm that provides advice to midmarket and emerging growth companies across a wide range of industries in the U.S. and worldwide.”

You should also include more granular details in your thesis:

- Sector — Describe the products and services that make up your area of specialization

- Metrics — Include sales within the sector, past growth, and the number of private companies currently occupying the space

- Industry outlook — Describe trends, predictions, and factors driving or stalling demand

- Economics within the space — Include capital intensity, operating leverage, revenue continuity (or lack thereof), margin profile, and current disruptions

- Regulatory hurdles or opportunities — Determine which, if any, legislation hinders or supports growth, and which political trends may affect future compliance efforts

- Past and current M&A activity within the sector — Identify your largest, most recent, and most relevant acquisitions, and specify what made these deals notable to acquiring executives with a similar investment thesis

- Potential targets — List and describe businesses that fit your values and explain what makes them attractive as an acquisitor

- Preferred exit options — Communicate whether — and why — a secondary sale or private placement sounds better to you than an IPO or buyback

Adding details like these to your thesis can help your firm stand out against competitors. Ramsey Goodrich, an investment banker at the Connecticut-based firm Carter Morse & Goodrich, says buyout firms rarely provide specific investment theses. “I get at least 20 emails every day from private equity funds asking me to show them every deal,” he tells Axial. “Most say they are industry agnostic but are looking for a well-run company in a defensible market with strong margins, good growth, and a management team that wants to stay. There is not much in that pitch that makes them stand out from the crowd.”

If you’re getting one lackluster offering memo after another, get on the phone with your investment banker, clarify your firm’s deal investment thesis, and explain whether and why it’s changed. Paint the picture of your firm as the most qualified partner.

8. Use deal sourcing tools and marketplaces

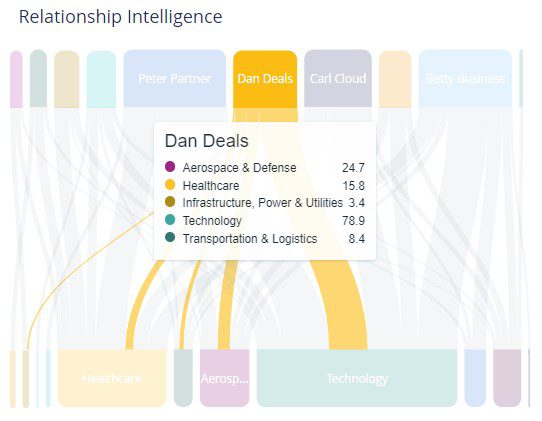

Your pipeline can become more dynamic than ever with the help of online deal sourcing products and outsourced services. Explore M&A marketplaces, deal sourcing platforms, and communities that you may have previously overlooked, dismissed, or forgotten. Start with Relationship Intelligence, which automatically shows people with whom you’ve lost contact and from whom you have or haven’t sourced deals.

Next, tap into deal origination marketplaces, some of which may include DealCentre (formerly Intralinks DealNexus), Axial, and Dealsuite. These sites allow sell-side players to divulge only the information they wish to share, so buy-side firms and advisors are as informed as private companies want them to be.

Another option for firms is to engage more intermediaries. You can grow your current team by hiring more investment bankers, custodians, advisors, transfer agents, and distributors, or you can tap a disruptive, emerging service like CAPTARGET to outsource your deal origination.

Deal sourcing and origination can be challenging, so don’t attempt to approach it alone or expect your deal sourcing team to operate without assistance. Leverage proper services and tools to get more mileage out of every step of your research and origination processes.

9. Swap yesterday’s best practices for forward thinking

Alternative asset management is a notoriously slow-to-change industry. Private equity has dragged its feet on ethnic and gender diversity, environmental sustainability, data integrity, and many other key issues. To lead the way to positive change and innovation, dealmakers must question conventional methods.

Start by curating your reading: Instead of just skimming industry headlines, seek out a daily dose of benchmarks, trends, and prediction-rich content from authoritative voices. Subscribe to publications from firms conducting primary research. Participate in conferences, webinars, talks, or forums like WallStreetOasis to learn from up-and-coming partners and dealmakers in your sector.

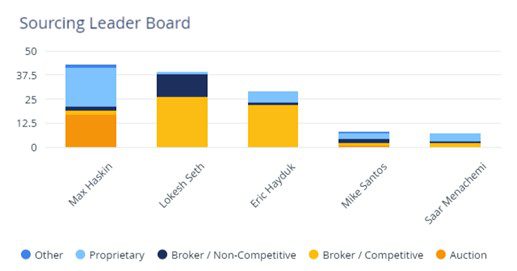

Private equity firm leaders must also learn to think more like business leaders. This means creating more value for your portfolio companies and then applying your learnings to your own firm to generate alpha. Aim to create healthy competition between business development professionals in the same way as a traditional sales organization.

“To create real value, high-performing firms must essentially become more entrepreneurial,” writes McKinsey’s private equity analyst team. “That is, they need to take initiative, shape strategy, be willing to assume risks with the promise of bigger rewards, and take the long view on creating value.”

Prepare for a deal-sourcing year like no other

Your firm’s future success directly depends on today’s pipeline. The less time you spend on each lead, the more time you have to devote to new opportunities. By implementing these best practices, you’ll ensure more qualified leads make it through your process to close, boosting both deal margins and deal.

Ready to explore a pipeline management solution that streamlines all the deal sourcing best practices outlined in this article? Schedule a demo to learn more about how Intapp DealCloud can help.