Business development work can be difficult to scale, as every interaction with clients and prospects requires a significant amount of time and attention. Previously, private equity firms would often assign business development work to vice presidents, principals, or even the whole team, adding to their already-full plates. Because these professional couldn’t dedicate their full attention and effort towards this work, their firms would miss out on numerous opportunities and fail to drive momentous growth.

Now, general partners (GPs) are prioritizing private equity business development like never before, with many leading firms appointing dedicated business development professionals to help them outperform competitors. According to journalists at M&A Magazine, “[F]irms with strong leadership in business development roles definitely had an advantage [throughout 2021] while others toiled.”

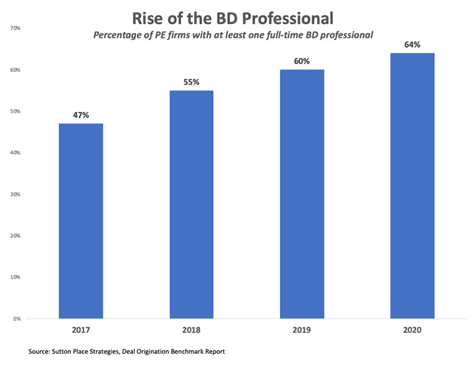

The Deal Origination Benchmark Report from Sutton Place Strategies revealed that in 2017, 47% of private equity firms had at least one in-house professional dedicated to business development. By 2020, that number had jumped to 64%.

When firms employ more business development professionals to help generate new business and fill the pipeline with new relationships and deals, other dealmakers have more time to analyze and valuate deals, manage investors, conduct due diligence, and meet with management. Check out three competitive advantages of prioritizing business development at your private equity firm.

1. Gain a competitive edge

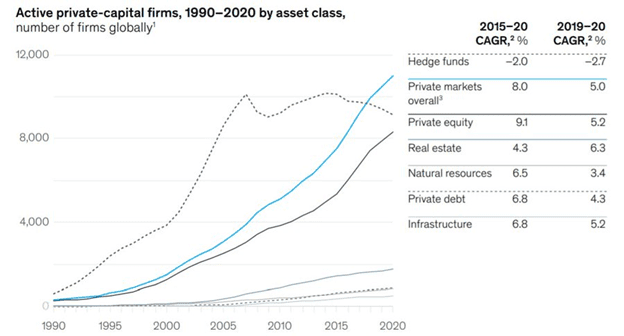

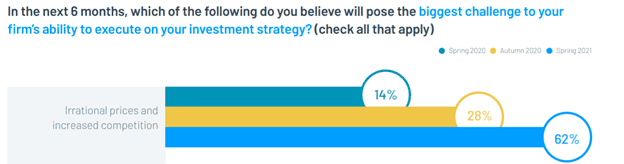

Currently, there’s a record amount of dry powder, or committed capital that investors haven’t yet invested or allocated. GPs are finding an unsettling uptick in competition, with new firms trying to unseat incumbents. Bids have become so aggressive that many acquisition targets are now unprofitable. And, for the first time in history, private capital firms outnumber hedge funds management groups.

The combination of increasing investor demand and growing competition has made for a more aggressive deal-generation market. According to the 2021 Dealmaker Pulse Survey, standing out and competing in today’s market is currently the top challenge for acquiring firms.

Dealmakers need to know they’re working with a winning acquirer, and prioritizing your firm’s business development helps convey that image to stakeholders. Take the following steps to help set a clear course for success and gain a competitive edge in the industry.

- Show intermediaries that the acquiring partners will seriously consider every deal sent their way. Investment bankers often share opportunities that GPs fail to spend time vetting; consequentially, deals may fizzle mid-execution or be dismissed or forgotten. Intermediaries know that diligent, astute business development professionals can help prevent tragedies like these by applying the partners’ unique investment thesis to every opportunity.

- Show investors that buyout firms are willing to get creative to find unique, undervalued, and off-market opportunities. Limited partners (LPs) know that if you’re willing to do business development work upfront to find an ideal investment fit, you’re more likely to execute deals that deliver reliable returns within the expected timeline. By prioritizing diligence, dedicated business development professionals show that your firm is willing to conduct a proper opportunity search, and LPs will be more inclined to commit capital.

- Show targets that their ventures are more likely to thrive in the hands of the buyer. Entrepreneurs and family business owners know that problems arise when portfolio companies (portcos) aren’t well-cared for. If members of an acquisitive team can’t develop their own business, they’re less likely to do the same for targets. Having business development professionals can help your GPs source smarter deals, create more turnaround stories, and generate dramatic growth within your firm. When founders see this outcome, they’ll know their own venture is more likely thrive in the hands of your team.

Focusing on private equity business development and deal sourcing is more important than ever, as Erin Carroll, a partner and business development recruiter at BraddockMatthews, told Sutton Place Strategies. “Unless you’re highly differentiated, you’re probably behind the curve if you don’t have some kind of accountability around deal sourcing,” she explained. By dedicating a person or team to private equity business development, your firm can streamline deal sourcing and show investors, intermediaries, and private companies that it prioritizes the most lucrative opportunities.

2. Generate new and ongoing relationships

Many people believe business development solely consists of deal sourcing or deal origination; however, the best private equity business development work goes beyond deal sourcing to produce and nurture ongoing relationships. To successfully meet your firm’s day-to-day business development needs, you need to invest in a platform like Intapp DealCloud that offers streamlined workflow for deal or relationship management.

“Before working with DealCloud, much of our data was kept and maintained in spreadsheets,” said Grant Marcks, Head of Business Development at Atlantic Street Capital. “Our manual processes and workflows took hours out of our week that we could have spent elsewhere. DealCloud has allowed us to better collaborate as an organization, streamline mission-critical workflows, and use data and metrics to track and optimize our efforts.”

Experts at the American Express Working Capital Solutions agree that relationships are the number-one benefit of business development work, stating: “Connecting with clients, colleagues, and other members of one’s network can be fundamental when identifying new business opportunities, generating leads, and making critical hires. Strengthening existing relationships will help deliver repeat customers, or provide an opportunity to hone and enhance talent from within.”

Although dealmaking is the ultimate goal of a business development professional, that goal can’t be reached without first focusing on relationship sourcing and building.

3. Surface reporting insights

At private equity firms, the business development function can produce actionable data and eye-opening insights about the relationships they’re building as well as the private capital markets.

Imagine that a buy-side business development professional at your firm is looking to build a relationship with a placement firm in midmarket health care, but instead meets with a new boutique banker in industrials and collects that banker’s information. Previously, contact information typically consisted of a person’s phone number or email address; today, it includes details such as the intermediary’s preferred communication method, time zone, sector, deal history, connections, relationship insights, and the quality and outcomes of the deals the person has sent.

The key to housing and organizing all this data is adopting a sector-specific data management system like DealCloud. Rather than spend hours manually entering data for individual contacts, business development professionals can use DealCloud to access proprietary and third-party data within the platform, and unlock additional details about their network of connections in a readily available and fundamentally reliable manner. Users can use these insights and real-time data to better answer questions such as:

- How many relationships do we have in the sector?

- What is the quality of each source, and how strong are our relationships with those sources?

- What’s the average timelapse for our communications with clients?

By assigning one or two dedicated professionals to business development, GPs can capture data from their activities and use those insights to cut bottlenecks, save time, and focus on more profitable work.

Differentiate, build relationships, and harvest data

When buy-side teams prioritize business development and create dedicated business development roles, their firms are in a stronger position to build profitable relationships and pull insights from their own activities. Help your firm stand out from the competition and prove to your prospects that you can meet all their business development needs.

Ready to try a custom-built pipeline management system that unlocks new insights for business development professionals at private equity firms? Schedule a demo of Intapp DealCloud today.