According to a survey conducted by Private equity International, 52.6% of private equity (PE) limited partners (LPs) want to increase the number of fund manager relationships they currently have. Unfortunately, private equity networking isn’t easy: Institutional investors, intermediaries, brokerages, and lawyers may have dozens of people trying to meet or connect with them every day. If you truly want to form a strong relationship with fund managers, your introduction must stand out.

Creatively tailoring your introductions to new connections will help you set the trajectory for fruitful, long-term relationships. In this article, we’ll share a few ways to ensure that your introductions make a lasting impression and lead to better relationships with your contacts.

“I saw this and thought you’d appreciate it.”

Mentioning a common interest is a great way to begin a conversation with a new connection, as it expresses a dedicated investment in your contact. Be deliberate when choosing your topic of conversation: Get to know the sectors of private equity-log that your target contact is interested in, and keep an eye on relevant industry updates. To meet new LPs, read blog comments, discussion forums, and social channels to learn where they’re joining in the discussion, and what their interests are.

In this example, a dealmaker asks a thoughtful question on Twitter:

Source: Lindel Eakman via Twitter

Here, a smart way to introduce yourself would be to respond to the post by sharing your personal experience, or linking to a research report that lists the pros and cons of meeting less often.

“Do you remember so-and-so?”

An introduction from a mutual colleague may be the most effective way to meet someone in private equity. A shared contact lends a degree of credibility you don’t always have as a stranger.

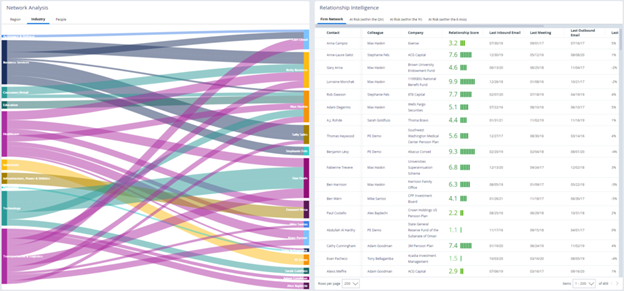

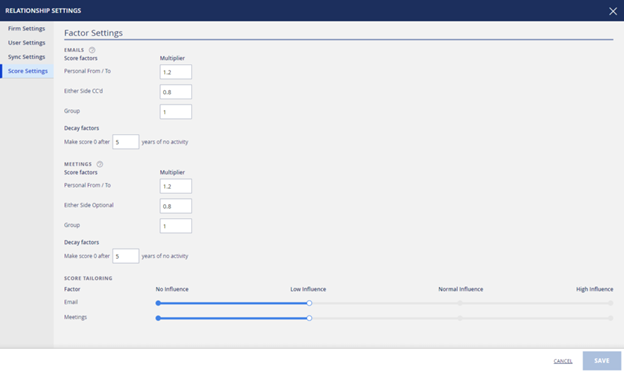

The challenge is learning who in your network knows whom. LinkedIn can only help so much, because relationships in private equity are notoriously complex. For teamwide visibility into who knows whom — and how — you’ll need a pipeline management system like DealCloud that’s designed specifically with this complexity in mind.

Not only does DealCloud reveal how people on your team know others, but it also shows how well they know one another. Additionally, DealCloud lets users view the potential value of each relationship and the opportunities and possibilities of new partnerships. This is made possible via a proprietary, customizable, visible relationship scoring feature that applies the most important factors to each individual and their connections.

If your team’s current CRM doesn’t offer this who-knows-whom intelligence or relationship strength data, take a tour of DealCloud and consider upgrading your system.

“I had lunch with your associate yesterday. You should join us next time.”

Even if you and a target dealmaker don’t have mutual contacts, you can still warm up your introduction by creating a go-between.

“Don’t straight cold call or email people,” advises a bulge bracket investment banking analyst on WallStreetOasis. “Instead, make connections and network your way in.” To successfully network, you should do the following:

- Identify your target contact (e.g., the managing director (MD) of an investment bank)

- Ask one of the MD’s associates to lunch or to a happy hour

- Let the associate know you’re interested in meeting others in their network — namely, your target MD

- Ask the associate to introduce you to the MD

- Invite the MD to lunch or coffee

- Let the MD know they came up during your chat with the associate

“Do this with a few different MDs, and if you hit it off with one or two, you are in,” says the analyst.

“Congrats on that tricky share buy-back.”

Dealmakers in the private markets appreciate being recognized for their achievements, especially if those accomplishments required creative or resourceful thinking. Bringing up a person’s recent professional wins — such as completing a potentially complicated liquidation event — can help make a good first impression, as it proves you’ve done your homework when researching that person.

Until recently, dealmakers would need to scour headlines each day to know who was involved in which deal and how. Today’s technology makes granular research much easier. Third-party data providers show buy-side PE firms which LPs have been involved in which deals, and how each fund performed over time. If those providers integrate with your CRM, you won’t even need to leave your current work environment to gather the intelligence. SourceScrub and PitchBook, for example, integrate directly into DealCloud workflows, so you can pinpoint top PE players and congratulate them on their wins.

“What would you do in this situation?”

Your team isn’t the only one navigating complex transactions, market changes, and personnel strategies. Leverage tools like SourceScrub or PitchBook to effectively surface dealmakers and experienced leaders who’ve navigated unique deals. Reaching out to these leaders indicates that you respect their input and view them as important figures in their fields.

Imagine, for instance, that you’re approaching an exit and want to retain your LPs for the next fund. After all, it costs 10 times more to attract new investors than their incumbent counterparts, as Covercy’s CEO Doron Cohen shared during the recent webinar “7 Ways to Make Sure Your LPs Reinvest in Your Next Deal.” Equipped with fund exit and re-creation data from third-party data sources, you can reach out to dealmakers at other funds to get their general tips. Although they probably won’t reveal their “secret sauce,” they may provide an overview of ways they’ve learned to handle nuanced scenarios.

Once you’ve reached out to dealmakers, set a reminder to circle back in a few months and let them know how their advice served you.

“It was great to meet you at DealCloud Connect.”

If you and a dealmaker don’t have someone in common, a great alternative is to have something in common — specifically, an industry event. Start by making a list of the events most relevant to you. You can use Savvy Investor’s annual compilation to see what networking events are coming up over the year, and which session descriptions and topics sound the most relevant and interesting to you.

When you attend an event, set a goal to meet a certain number of industry connections each day that you’re there, even if the event is online. When you follow up with your new contacts, ask for their opinions on the sessions, or ask questions related to the session’s topic.

For example, at the recent annual DealCloud Connect event, Tony Hill of Trivest Partners told attendees that business development (BD) professionals were key to the firm’s recent explosion of growth. The team tripled its number of dedicated BD professionals from two to eight, and went from 2,000 successful deals per year to more than 3,600. Hill then posed the question: Would a similar move work in commercial real estate? Hill advised the DealCloud Connect20 attendees to expand the conversation to help them meet new people in the private capital markets industry.

“I’ll be down in front after my talk. Come chat.”

If you’d like to meet new people in private equity, consider speaking at industry events. Speakers are considered both generous promoters of the industry and authorities in their field. Those who rent an event booth, on the other hand, easily blend in among all the other vendors.

Offer to share tips, tricks, and wisdom at upcoming conferences. Did your team switch to remote or hybrid work during the pandemic? Have you just completed particularly thorough due diligence or valuation work? Did you recently identify and invest in a unicorn that’s now one of your portfolio companies? Did you learn a new way to parse start-ups? Event planners typically book a year in advance, so until the big day, practice your presentation in smaller settings.

“Need a guest for your panel, podcast, blog, or webinar series?”

The financial services sector abounds with PE firms that need guests for their podcasts, webinars, and other media. When you offer to contribute, you establish relational equity that you can use to ask for an introduction to someone else in the content creator’s firm or PE network.

Consider a midmarket boutique investment banker who has a podcast and wants to encourage listeners to rethink the traditional loan structure for future buyouts. If you recently combined a term loan to finance the leveraged buyout (LBO) with a working capital line of credit to fuel operational changes, you may be able to speak about the challenges and rewards you experienced from that creativity.

Remember that marketing isn’t for client acquisition alone. Marketing can also help you build relationships with intermediaries, private company managers, fellow general partners (GPs), and vendors.

“Welcome to the industry.”

Encourage new players in the industry by receiving them into the space. Interns, fresh graduates, fledgling family offices, recent promotions, first-time founders, repeat entrepreneurs, and newly appointed hedge fund managers are all great candidates for private equity networking. These new appointments may not be able to reciprocate your generous outreach right away, but welcoming new dealmakers into the industry is a move that won’t be forgotten.

Avoid using LinkedIn’s canned text when messaging your new candidates on the platform. Instead, personalize your message to show your humanity and convince them you really do care about them and their interests.

For example, if you’re a woman in private equity, send a virtual fist-bump to fellow women who score scholarships or internships in the industry.

Source: Canadian Business Growth Fund via Twitter

This long-term play is a relational investment that may take a lot of time to produce returns, but the payoff is always worth it.

Keep track of and nurture your network with a CRM built for private equity

The stronger you grow your professional network, the healthier your fundraising, deal flow, and execution will be. Keep all your relationships organized with an industry-specific CRM that’s purpose-built for this exact type of networking.

Schedule a demo to see DealCloud in action today.