With cyberattacks on the rise, investing in the right M&A technology is more important than ever. A 2021 IBM report found that more than one in three executives surveyed have experienced data breaches during the M&A process, making this an all too familiar threat for leaders in the field.

Given the high value of their deals, M&A teams can’t afford breaches. However, dealmakers are rarely sufficiently technically skilled — or inclined — to explore their solutions’ security options. Thankfully, acquisitive teams can adopt technology with built-in security features specifically designed to protect dealmakers in the capital restructuring sector.

Check out the top five security features for M&A technology, and learn how you can help reduce your risk of cyberattacks.

1. Cloud-based operating and storage technology

Once your firm decides to upgrade away from locally hosted file processing and storage technology, make sure to avoid web-based applications and instead adopt cloud-based technology. Unlike web-based apps, cloud-based architecture allows multiple instances (users) to process tasks without a browser or an internet connection, and it can sync any updates once the user is online again.

Cloud-based M&A technology solutions are also more secure, as they allow your compliance officers to institute a single security policy to blanket all data and files. This isn’t possible if team members are using their own point products across multiple devices and in between internet connections. With cloud-based products, leaders can customize permissions and access, eliminating the need to email files and juggle login credentials for multiple spot solutions.

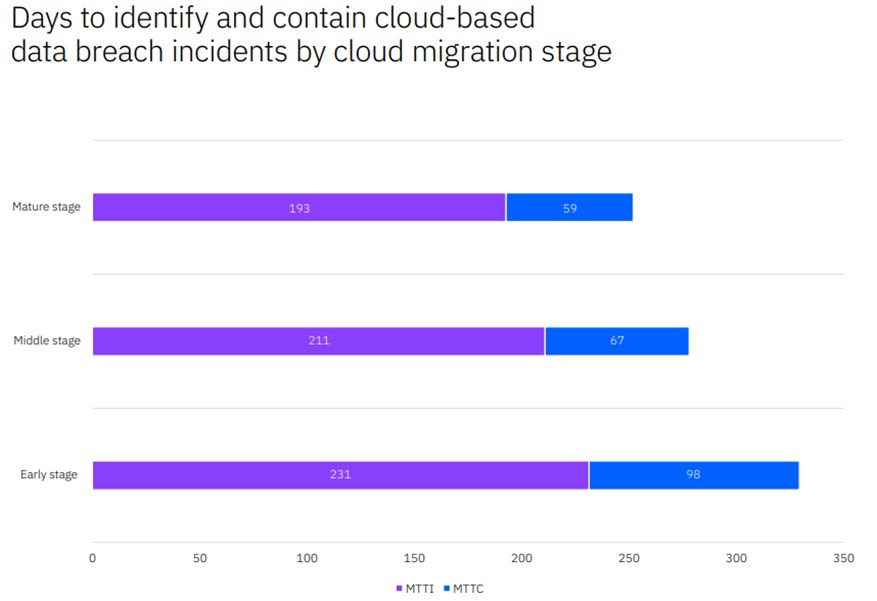

Finally, cloud-enabled teams fare better when faced with a breach. Researchers at IBM found that organizations who adopt cloud technologies contain breaches an average of 77 days faster than their lagging counterparts.

Median time to identify (MTTI) and median time to contain a breach (MTTC).

Source: IBM’s 2021 Cost of a Data Breach Report

2. Industry certifications

Professional credentials lend credibility to otherwise confusing or lofty cybersecurity concepts. Adopt M&A technology that has been accredited by industry experts and gone through necessary safety measures.

Industry certifications are essential to credibly support a software company’s security claims. Without them, firms and dealmakers who adopt new software risk exposing themselves, their investors, and their service providers to unnecessary risk and potentially massive profit loss.

Although M&A firms are often small in terms of personnel, they still handle large, enterprise-level financial transactions. Unfortunately, most security software tools are either too complex for small teams, or unable to sufficiently secure sensitive, high-value data. Security certifications solve this conundrum by granting your smaller team the highly secure tools you need.

3. Comprehensiveness

It’s more secure to use a single solution than to run multiple tools for handling transactions, deal stages, relationships, and tasks. Comprehensive systems — or well-integrated systems customized via API — seal purpose gaps without redundancies. These gaps and redundancies often pop up when individuals use their own unsanctioned tools to do similar jobs in different ways.

Imagine, for example, that your business development representative keeps a locally hosted spreadsheet as an acquisition target longlist. Your analysts wouldn’t know when or where to start their preliminary valuation work, and emailing that file back and forth would expose your firm to vulnerabilities from multiple angles. A comprehensive M&A system, on the other hand, welds these gaps so that team members can log into the same system to collaborate on the same transaction, either simultaneously or asynchronously.

The more technology systems your team uses, the more risks you invite. McKinsey analysts say that dealmakers “are layering more systems into their IT networks to support remote work, enhance the customer experience, and generate value, all of which creates potential new vulnerabilities.” The company’s research reveals that well-integrated and fully digital M&A firms are 30% less likely to encounter digital transformation challenges like data decay or loss.

DealCloud is the only relationship, deal, and task management system purpose-built for acquisitive firms and their intermediaries. Teams that adopt DealCloud eliminate functional gaps and redundancies — both of which expose firms to unnecessary risk.

4. Custom data access and contingency backups

You want the right people to access the right data at the right time — and you want reliable recovery if a disturbance occurs. Investing in an advanced cloud-based system can give your firm these critical capabilities.

Imagine you’re part of an M&A advisory team with a well-organized process for approving transactions. As an intermediary, you don’t want your investment banker to change a deal’s status. However, you do want the investment banker to know the deal status in real time as your compliance officers move the deal through the pipeline.

In this scenario, you’d need a solution that can keep your team on the same page while preventing data-handling mishaps. DealCloud allows for user grouping and authorization — and provides multi-factor authentication (MFA or 2FA) and single sign-on (SSO) access — to increase security and provide the right people with the information they need.

Unfortunately, even with custom access permissions and secure authentication measures, disturbances may still occur within your firm. The ability to recover after a disturbance can be the difference between long-term success and failure. If the unexpected happens, you’ll want a system that comes with built-in audit trails, contingency, and recovery capabilities.

Choose a solution that backs up data frequently and stores it for a length of time that suits your needs. Make sure your backed-up data is protected with as much diligence as your primary information. Ask your service provider to present a mock restoration demo so you’re familiar and comfortable with the process.

Very few M&A teams or advisory firms have a dedicated tech team or advocate. If this is the case with your firm, choose a solutions provider that deeply cares about the implementation process. The provider should help you set up user groups and customized permissions, and teach you exactly how to recover if an incident occurs.

5. Ongoing customer support

Today’s competitive CRM market has raised the bar, and ongoing support for M&A teams is more important than ever. The rise of remote and hybrid work alone has increased the number of ways teams can inadvertently expose information. According to Proofpoint’s 2022 State of the Phish report, nearly 75% of remote workers say they use personal devices for work, and 77% use work devices to access personal accounts.

Human error was also found to be the third-most common cause of data breaches in 2021. Look for an M&A technology system that trains your team to protect user credentials and files. Then, ask how that support will evolve once your firm’s tools are up and running.

Ask your provider questions such as:

- Will our firm have a dedicated agent to answer questions or give updates as we develop?

- Is there a self-help portal with answers to security best practices?

- Does the support team monitor user behavior to identify unsafe practices early?

- Will the support team help our firm navigate our audit trail, and determine which users edited records or when and why they made those changes?

- Does the software’s publisher host regular webinars to share recent cybersecurity news and trends?

These criteria will immediately narrow down your choices. Select a publisher that meets these needs and provides best-in-class cybersecurity support.

You don’t need to be an enterprise-size tech firm to mitigate cyber risk

Cybercriminals target organizations with smaller headcounts more frequently than enterprise-level companies. Many M&A teams fit that description — but, unlike other small businesses, they often handle massive transactions, increasing their vulnerability. Take, for example, the painful story of a pending merger that lost 5% of its purchase price to a preventable ransomware attack.

Don’t let something like that happen to your team. Resist the temptation to believe that your firm doesn’t need enterprise-level security just because you have a small-business headcount. Get your professionals the security they deserve so you can focus less on potential losses and more on potential profits and enterprise-level revenue.

Schedule a demo of DealCloud, and contact a DealCloud team member today to learn more about the private capital restructuring industry’s only purpose-built data management system.