Technology is rapidly transforming the commercial real estate (CRE) industry, primarily due to growth in available data across markets and assets. However, a data increase alone doesn’t lead to better, faster decision-making, nor does it deliver on the wide range of benefits promised through digital transformation.

To meet and exceed the specific demands of investors and CRE operators in a time of increasingly dynamic markets and greater competition for quality deals, firms need to use available data in a purpose-driven way. Data only becomes useful, actionable information — with the power to transform execution— when it gains context and can be seamlessly integrated with mission-critical people and processes.

Accessing the benefits of digital transformation requires a holistic approach. Connected people and processes are essential components to ensuring that data can truly enable a digitally powered connected firm with improved decision-making and elevated execution.

Read on to learn how Intapp DealCloud data management features can help optimize decision-making and execution for CRE firms.

Mobile app and Microsoft Outlook integration

DealCloud’s mobile app lets real estate dealmakers work whenever and wherever they like. Users can easily run reports, log notes, enter data, and update information while on the go. Dealmakers can also receive automatic notifications about ongoing deals and tasks, informing them of any important updates in real time or at their preferred cadence.

The DealCloud platform also offers a Microsoft Outlook add-in that automates data collection, increases buy-in and utility, and delivers critical reporting and insights — all from a single source. With DealCloud, deal professionals can leverage real-time data to make decisions and manage their pipelines from wherever they’re working.

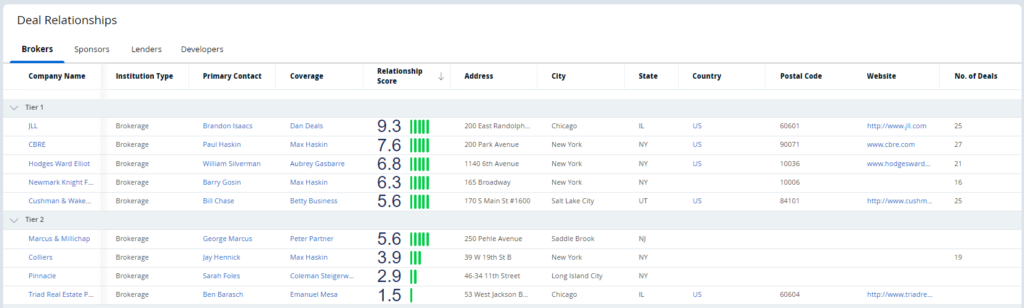

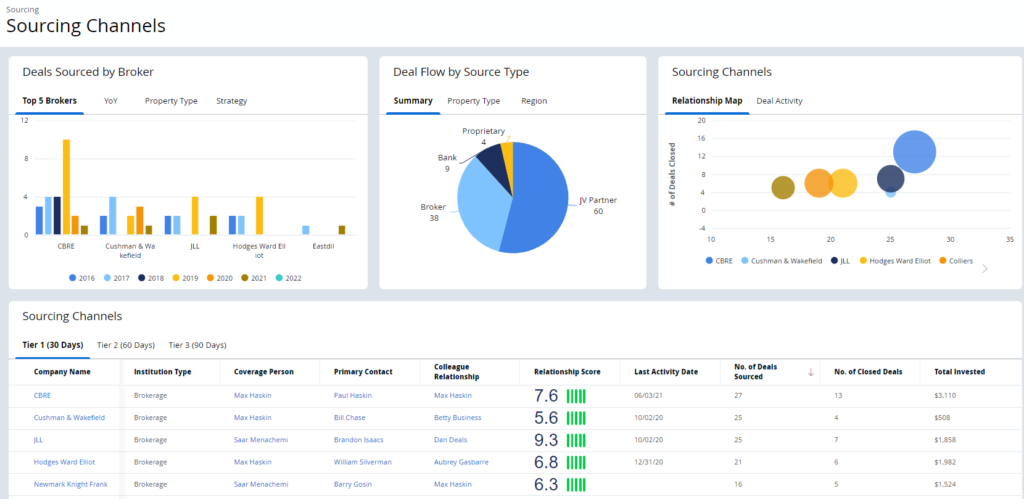

Network management supported by relationship intelligence

DealCloud’s relationship intelligence uses predictive insights to organize and track multidimensional relationships across sourcing, co-investing, servicing, and asset and portfolio management. This technology not only eliminates tedious manual entry, but also organizes the complex matrix of key players involved in the real estate market. By identifying a firm’s strongest and most productive relationships, DealCloud creates data-based insights and automated notifications that help users maintain and develop key relationships.

Task-based workflow configuration

Built with real estate professionals in mind, DealCloud streamlines workflow by consolidating information on property, transactions, and relationships to save team members significant time they’d otherwise spend switching between various databases and sources. DealCloud digitizes best practices by automating task-based workflows, which are uniquely configurable to each firm’s needs, to optimize execution and exceed institutional investor demands.

Additionally, DealCloud’s CRE investor software mitigates risk by unifying conflicts and relationship management, all in one place. This helps firms streamline workflows, improve compliance and auditability, and make better-informed decisions.

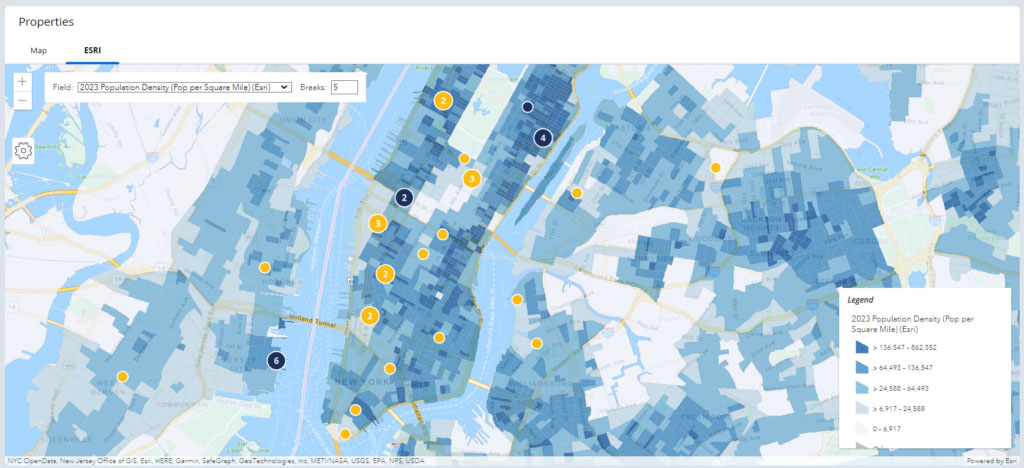

Property and location intelligence

DealCloud partners with industry-leading third-party data platforms — including Esri and Cherre — to provide users with holistic insights and analytics when making investment decisions. With the support of these integrations, users can compare asset management, building information, zoning, tax, mapping, and mortgage data within the DealCloud platform.

By analyzing proprietary data alongside broader market intelligence, deal makers gain the context needed to better evaluate prospective investments.

Card-based widget view

To improve due diligence and achieve more detailed and complete reporting, DealCloud’s card-based format helps users visualize and organize properties and deals in the pipeline by stage or status. This “bird’s eye view” helps investors connect the dots that can help further and complete any deal.

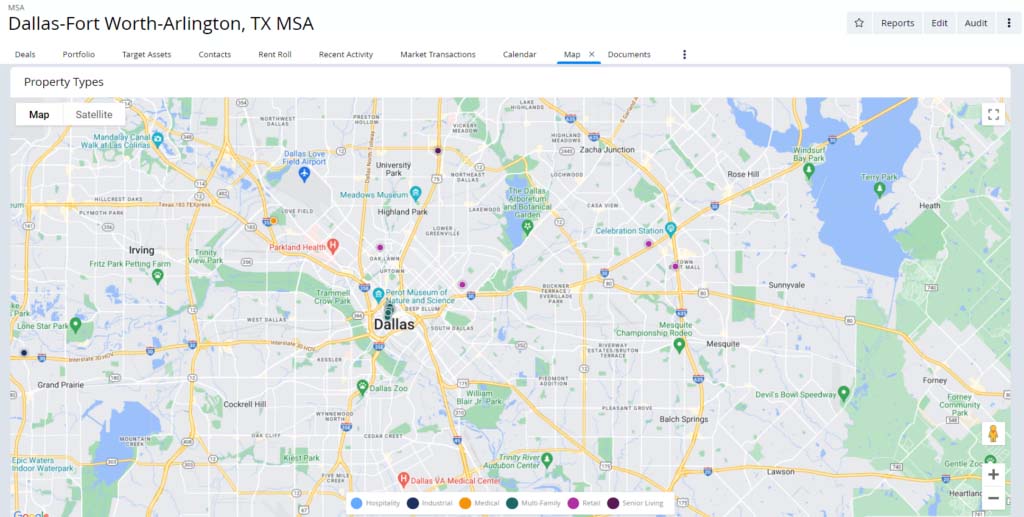

Map-based discovery

To further support real estate professionals, DealCloud lets investors centralize and track multiple deal processes and multidimensional relationships all on one easy-to-use platform.

DealCloud’s map-based discovery lets users analyze prospects, properties, portfolios, comparables, and points of interest (POIs) right from the map view, without having to access separate detail pages. Users can also filter based on characteristics, and drop pins to access summary information and images, providing a context-based, pre-deal exploration that leads to comprehensive decision-making.

Real estate private equity intelligence in action

Balfour Pacific, a Vancouver-based real estate private equity firm, initially lacked a dedicated data-and-contact management system. Balfour needed to deploy and institutionalize purpose-built technology to ensure the firm could grow and expand successfully. In about 3 months, the firm configured and implemented the DealCloud configurable platform to deploy a solution that achieved better structure and a more efficient tracking process customized to Balfour’s unique needs.

Balfour’s implementation of DealCloud led the firm to create an organized and centralized method for tracking relationships and deal activity. The result of Balfour’s partnership with DealCloud included significant improvements in the following areas:

- Relationship management — The DealCloud platform encourages better communication among team members through real-time notifications and prompts.

- Investor relations — DealCloud’s Microsoft Outlook add-in syncs emails and tracks conversations all in one place, giving team members a comprehensive overview of the process and progress of each project.

- Deal management — Balfour professionals can now track each deal from beginning to end. Team members stay up to speed by reviewing deal metrics, property photos, and Google Maps data, and by uploading documents on the spot.

- Property tracking — DealCloud provides a 360-degree view of deals and their underlying assets, and lets Balfour users quickly review and reference each deal and benchmark against new opportunities.

- Road trip planning — When traveling to industry conferences and site inspections, Balfour team members can find out who’s in the area, and review their information before scheduling a meeting.

- Data integration — DealCloud offers third-party data management that provides access to proprietary and third-party intelligence, giving Balfour dealmakers the most up-to-date, accurate information to power informed decision-making.

- Dealmaking capabilities — Balfour professionals can access contact, account, and real-time dealmaking information while on the road. The DealCloud mobile app offers syndication dashboards that display deal status, important action items, and correspondence, keeping team members in the know.

Real estate firms need a central command center and a flexible, seamless way to connect their people, processes, and data. By implementing purpose-built real estate data management technology, CRE firms can remain competitive, make better-informed decisions more quickly, and, ultimately, win more deals.

Learn more about how DealCloud can help your firm connect people, processes, and data.

Download our video case study to learn how DealCloud helped Balfour Pacific improve its structure and deal-tracking process.