Firmwide software adoption initiatives fail more often than they succeed, often because professionals either struggle to learn their new technology or use it in siloed, disjointed, or conflicting ways. As a result, many firms give up on their change management plans and return to their old, inefficient systems and processes.

We’ve discovered the antidote to abandoned technology upgrades: Creating and executing a simple yet comprehensive change management plan that’s achievable for every user at the firm, from analysts and associates to managing directors.

John P. Kotter, the renowned change management thought leader and author of Leading Change, evangelizes eight clear steps to effecting organizational transformation in a team of any size. Learn how your investment banking division (IBD) can follow these steps to successfully adopt a cohesive, streamlined system.

Step 1: Create a sense of urgency among your system’s future users

Kotter calls urgency the most important ingredient for a successful software implementation, and stresses that it must be maintained throughout the entire initiative. “A majority of employees, perhaps 75% of management overall, and virtually all of the top executives need to believe that considerable change is absolutely essential,” he writes.

However, firms must beware of the number-one obstacle for successful software adoption: complacency. Complacency usually isn’t a result of laziness, incompetence, or ill-intent; rather, it’s born of genuine belief that current IB tools and processes are adequate.

“People will find a thousand ingenious ways to withhold cooperation from a process that they sincerely think is unnecessary or wrongheaded,” writes Kotter.

It’s easy to understand why some people would be hesitant to adopt a new system. Disrupting processes means slowing down the moving machine, and in today’s volatile and hypercompetitive market, no one in investment banking wants to slow down. However, just as making a pit stop can help you ultimately win a race, disrupting your process can help your team become more efficient and productive in the long run.

Here are some ways to convince your IB team to modernize its workflow:

- Hire a consultant to explore the benefits of pursuing new endeavors — such as an emerging market or an untapped sector or asset class — which your firm can only achieve with a technology upgrade.

- Calculate the time your team members spend on automatable tasks and explain how new software can help them reclaim that time.

- Research new competitors that are using intelligent tools to disrupt the status quo and are seizing opportunities before your firm has a chance.

- Learn about the solutions other IB teams are leveraging and document the ways these tools could increase your own team’s ability to build better, more profitable relationships.

- Emphasize the loss of experience and knowledge that your junior bankers suffer when a managing director retires.

Your top bankers may be most resistant to a proposed workflow change since they’re already performing well. If that’s the case, remind them that the goal of the adoption plan is to strengthen the team as a whole and support the entire team’s leadership in market share.

Step 2: Build a guiding coalition

A successful solutions deployment hinges on your ability to build a coalition that advocates for all users. That said, IBDs often involve too many people in the decision-making process, which can slow down the implementation process.

“In a less competitive and slower-moving world … committees can help organizations adapt at an acceptable rate,” Kotter writes. “A committee makes recommendations. Key line managers reject most of the ideas. The group offers additional suggestions. The line moves another inch. The committee tries again. Meanwhile … the company’s competitive position gets a little weaker and the industry leader gets a little farther ahead.”

Another mistake IBDs often make is assigning one leader all the decision-making power. Although a single leader may make decisions more quickly than a large committee, the lack of user representation will likely hurt your chances of a successful firmwide adoption process.

To create a healthy balance, enlist a few change-hungry leaders to join you in evangelizing the implementation. Choose people with the following characteristics:

- Positional influence — Your guiding coalition members should be powerful enough to lead and influence others within your organization.

- Expertise — Members must have relevant experience in a variety of the IBD’s roles, and should also be experts in their current roles.

- Outstanding reputation — The whole team must believe coalition members when they speak. Credibility is crucial.

- Leadership — A guiding coalition must consist of members who have successfully led organizational changes before.

The size of the leadership team will depend on the number of people in your group. For a firmwide system implementation, we suggest enlisting around 5% of your professionals to be part of the guiding coalition.

Step 3: Form a strategic vision and initiatives

Make no mistake: Plenty of pitfalls will present themselves mid-transformation, and they could potentially derail a successful change initiative.

For example, your analysts may discover a new workflow management point product that streamlines their valuation work but leaves the back office out of the loop. Or a director might begin using a note-taking app that keeps his activity and knowledge siloed from junior bankers, allowing embarrassingly redundant calls to institutional investors. Or a vice president might revert to using a file-sharing system that doesn’t provide the security that sponsor data deserves.

The two biggest pitfalls that afflict IBDs during the deployment stage are authoritarian messaging and micromanaging. Professionals often stay loyal to the tools they currently use and will ignore requests from firm leaders to adopt new software. Micromanaging is equally ineffective, as users lack internal motivation to change, resulting in an empty-shell implementation.

Establishing a clear, actionable, strategic vision will help your firm overcome these challenges and move forward with your change management plan. Write out your plan to implement a new workflow and customer relationship management system, making sure to include the following critical elements:

- The specific goal of the change — Clearly define what success looks like. Your end goal may be to reduce the time spent between task handoffs by 3 hours per week. You may also aim to eliminate tear sheet and report formatting for meetings and investor relations activities. Or your goal may be to equip your roadshow representatives with a mobile app that has all the functionalities of your in-office software.

- The reason behind the change — Explain how the change will benefit your firm. For example, describe how the new system will help you accelerate work, win new business, and allow you to compete with financial services teams who are leveraging newer and more efficient tools.

- The initiatives to conduct the change — Determine how you plan to achieve your goal, and communicate the plan in detail to the whole team. For example, choosing, installing, and using a tool that provides best-in-class implementation support throughout the implementation process will promote firmwide adoption.

Establishing a clear vision creates a shared sense of direction and allow your teams to better understand how to reach your goals.

Step 4: Communicate the plan

By generating a sense of urgency around your initiative, and by building a guiding coalition of leaders to eagerly communicate your company’s vision, your professionals will likely be curious about the new solution and more willing to listen. Unfortunately, Kotter warns, many change management initiatives stall out at this point, and teams soon become disinterested and unengaged.

Disseminate your strategy’s steps to everyone at your company while you still have their attention, and inform them of how the new system will benefit them individually to encourage firmwide adoption. “Accepting a vision of the future can be a challenging intellectual and emotional task,” Kotter explains. But by effectively communicating with your teams, you can help them understand and embrace the changes your firm plans to implement.

Be sure to keep your communications succinct. Craft a message that delivers the system’s adoption vision and includes next steps for every user type. You should also include a link to the entire implementation plan, along with timeframes, to help professionals plan accordingly and avoid any surprises.

For your change management plan to land, you must repeat it often and use a variety of vehicles to distribute the plan. Expect to transmit it in weekly meetings, memos, internal newsletters, posters or other analog visuals, and informal one-on-one deskside conversations. Still, remember that IBDs are bombarded with messages and information daily, so don’t overwhelm them with too many messages.

Finally, prove that your firm is committed to this change by practicing what you preach. If your guiding coalition members are secretly using apps or tools that undermine the use of the new system, other professionals will likely do the same.

Step 5: Enable action by removing barriers

You may be surprised at how difficult it is for intelligent, well-intentioned bankers to change their habits. The good news is that you can reduce or remove obstacles that hinder this change.

- Eliminate structural barriers. Do your users have the authority they need to use the new system to its full potential? Work with your software publisher to give permissions and access to the right users.

- Eliminate skills barriers. Provide adequate user training to your junior bankers as well as your vice presidents and directors.

- Eliminate systemic barriers. Performance reviews, compensation, promotions, and succession planning should all align with the new vision. Don’t dismiss the power of internal processes when pushing new software usage.

- Eliminate supervisory barriers. In an IBD, a single team lead who doesn’t believe in the vision can lead to a failed CRM implementation. Listen carefully for managerial complacency or resistance at this stage to ensure that juniors don’t have supervisory obstacles to their usage of the new system.

The private capital markets are unlike any other revenue-generating machine in the world, mainly due to the interdependence of relationships, transactions, and tools between players. However, the complexity of interdependence can block or hinder software user adoption. Purpose-built deal management tools for capital markets are often halfheartedly used at 30% or 40% capacity, so the majority of a firm’s professionals miss out on all the benefits of that software.

Support your users by learning what adoption impediments they face and removing them quickly.

Step 6: Celebrate short-term wins

In his book, Kotter tells the story of a major enterprise transformation that he thought would be a change management success. “I was wrong,” he recalls. “Employee morale collapsed. As I write this, the division is still a mess.”

So what happened? “The worst mistake was that insufficient attention was given to short-term results,” he writes. “People became so caught up in big dreams that they didn’t effectively manage the current reality.”

Acknowledging milestones and small victories is essential to keeping momentum going during a new solutions deployment. If you want your firm to continue supporting the project, you must ensure that your team members — especially those who may be skeptical about the transition — know that their hard work is paying off.

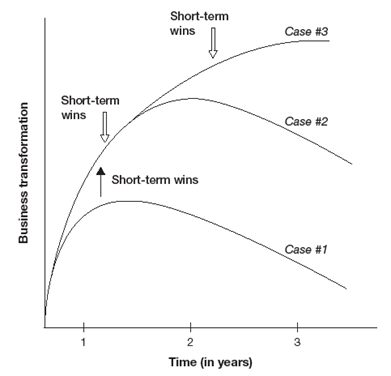

Kotter provides three examples of change management efforts to further illustrate this point. The first team’s guiding coalition neglected to generate or celebrate short-term wins, while the second team halfheartedly acknowledged the firm’s efforts. But the third team committed to commemorating incremental achievements regularly — and ultimately succeeded in transforming the business.

Enlist your managers to look for visible and unambiguous performance indicators — specifically, incremental movements towards goal-related numbers — that show progress towards your ultimate objective. For example, if your IB software adoption goals involve reducing the time spent on administrative work, have team leads measure time spent, and celebrate decreases as analysts’ tasks become further automated.

Step 7: Sustain acceleration

When celebrating small wins, beware the reappearance of complacency. It’s a common hazard IBDs encounter when approaching the completion of their software adoption.

New practices, habits, and processes are extremely fragile; once a regression begins, it can be difficult to rebuild momentum. Sustain acceleration by reviving the sense of urgency you began with. This, Kotter argues, will help you in terms of “consolidating gains and producing more change.”

You’ll likely need to take a different approach to creating a sense of urgency than you did the first time. During the first stage of change management, teams were complacent because they were devoted to their previous tools. This time, though, they may be complacent if other users — particularly bankers — are criticizing the new platform.

Remind users why your firm made the change to begin with, and review the ways the new system will address your prior challenges. As a change management leader, you must also provide answers to any criticisms of the system, and direct users to support resources. The best software publishers for investment bankers will be ready to answer complaints and support leaders at this phase with self-help resources, scheduled check-ins, and impromptu live assistance.

“Press harder after the first successes,” Kotter encourages. “Your increasing credibility can improve systems, structures, and policies.”

Step 8: Institute change

It can be tempting to declare your implementation process a success once everyone in the firm begins using the new system daily. However, success only truly comes when these processes become part of your IBD’s culture. Consider the following when building your culture:

- It’s one thing to use technology to connect with team members, but it’s another to build a connected firm. Leverage your system to the fullest by connecting all your people, processes, and data.

- In addition to supporting your internal IB needs, utilize your technology to support your clients, partners, and other external parties.

- Don’t simply pull reports from your system — instead, create your own customized, “living” dashboards and habitually use them to inform meetings with real-time data visualizations.

For investment bankers to successfully integrate new processes into the team’s culture, they must first value their user experience with the product, and they must all agree that they can’t do business as usual without the tool. When the new way becomes the normal way, you can consider the implementation a success and not in danger of regression.

Make sure to use the new tool as a creator, not just a consumer, and tinker with its various features as much as possible. Ask your software publisher if there are different ways to configure and project your team’s data into the future. If not, encourage and work with the tool’s engineers to potentially turn your new ideas into reality.

Don’t let your change management plan fail

Research shows that smaller teams gain a variety of benefits — including better client interactions, higher investor satisfaction, lower costs, more effective management, higher performance, and better problem-solving — when they upgrade their information systems. However, the same study also reveals that the smaller teams who would benefit most from this upgrade are the ones least likely to pursue a change management plan.

IBDs are often hesitant to undertake a firmwide system upgrade due to a lack of knowledge of the change management process, and because it’s difficult for directors to determine which system to choose. Ease your worries by selecting a system like Intapp DealCloud that’s specifically designed to meet the unique needs of IBDs.

Intapp DealCloud is the only investment banking CRM that also manages deal pipeline and transaction data and workflows. It also automates manual data entry, saving IBDs countless hours per week.

Once adopted, the DealCloud platform serves as a living repository where powerful, real-time insights can be pulled up at a moment’s notice to instantly answer the variety of deal-related questions that constantly arise. Using Intapp DealCloud builds overall institutional knowledge and firmwide transparency, allowing everyone — from junior bankers to managing directors — to have the information they need to thrive in their roles.

Request a demo to learn how Intapp DealCloud can help your IBD lead a change initiative within your firm.