When strategizing your group’s venture capital (VC) spend, it can be tricky to plot the best route to get to your desired goal — especially as trends in the market keep shifting.

For investors, staying up on VC trends is as important as checking the weather before planning a journey. Knowing the weather forecast can help you determine the best vehicle to use, when to leave or make stops, and what routes to take. Similarly, understanding VC trends and the overall VC environment can help you predict the best ways to move forward with your investments.

Check out the top VC trends of 2023 to create a better strategy and outperform your rivals.

1. The bid-ask spread is reversing

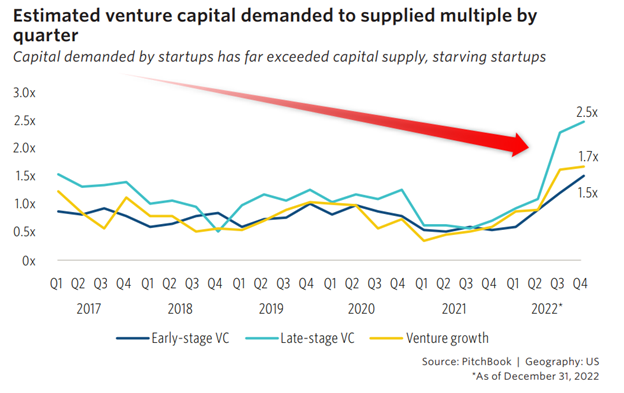

For the past 3 years, VCs and their limited partners (LPs) have wanted one thing: to deploy their surplus of dry powder. Now, in 2023, founders have caught on and caught up. In fact, the total ask for venture funding has already surpassed the undeployed but committed capital that VCs have available — a trend first identified and covered by PitchBook analysts.

Image intended for educational purposes only.

“There’s a hiccup in the private markets that almost no one is talking about,” reads the PitchBook report. “[There’s a] disconnect between the capital startups are seeking and the money VC firms are actually investing.”

The reason founders think their ventures are unicorns worthy of VC attention, support, and money is because, until recently, they were right. In 2021, more capital was invested in venture capital than ever before. That capital also produced incredible returns, leading to a record-breaking number of startups earning the “unicorn” title.

2021 also saw more mega VC deals than ever before. After realizing the value of these deals, founders began hustling for more of the funding. Once they worked out their supply chains, talent management strategies, growth plans, and profitable revenue operations, these founders were finally ready to pitch VCs.

However, many of these founders are now finding they’re late to the game. Funding to Silicon Valley startups fell 40% from 2021 through 2022, and the downtrend isn’t slowing.

“It is, frankly, a bad time to be raising,” states a TechCrunch article covering recent VC spend.

The silver lining is that VCs are now in a prime position to help founders, while also investing in their own futures. How? By thinking beyond check-writing and instead investing in founders in other ways.

Research shows that repeat founders are more successful than first-timers. That means some of today’s failing startups — the ones that flunk 2023 fundraising — will produce entrepreneurs who want to try again. And when they do, they’ll look to the early-stage investors who encouraged and advised them in 2023.

Carve out a few hours each week to coach founders. You can coach them one-on-one or in a group forum like an online discussion board, or invite them as guest speakers on entrepreneurship podcasts or events.

Although it’s not the same as writing checks, spending time with founders is still an impactful investment. By supporting and advising promising startup owners, they will be more likely to rise from the founder-harsh conditions of 2023. The returns will appear when those founders remember your help and give you first dibs when the markets are more founder-friendly again.

2. Valuations are facing downward pressure

Founders feel their treasured startups are being undervalued, while LPs feel that early stage private businesses are overvalued. VCs find themselves in an unexpected role: interceding for both.

As early stage and startup fund managers, VCs know that many LPs are nervous about crashing tech stocks in the public markets, and are wondering why fledgling private companies still expect bigger checks. Silicon Valley–based VC Ryan Gilbert, who founded Launchpad Capital, recently told the San Francisco Business Times that entrepreneurs in his circles are “shell-shocked” over falling valuations.

VCs know that the reason behind this decrease in valuation is because retail stocks are constantly repriced, while startups are only written (valued) down when they announce a new round or their VCs publish their AICPA-required quarterly estimations.

Even in favorable conditions, 60% of the typical VC fund’s portfolio companies (portcos) will fail. Matthew Le Merle, Blockchain Co-investors’ Managing Partner and CEO, explained that this gets accelerated in downturns, where early-stage startup valuations start falling.

Despite these obstacles, you should expect to see an uptick in M&A and private equity (PE) deals throughout 2023 as strategic and financial acquirers go bargain-hunting and VCs remain especially choosy. Pivot your attention to current portcos and LPs whose leaders may feel the squeeze and need your reassurance.

In 2023, many VCs will look more like PE shops in their treatment of their own assets. You’ll need to hire operational and management consultants and audit current procedures to tighten efficiencies, double down on profitable markets, and cut costs.

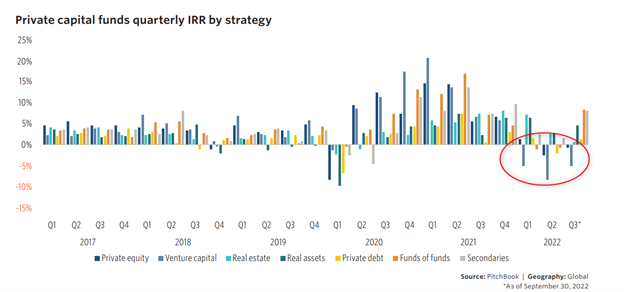

3. VC funds are temporarily experiencing more negative returns

Halfway through 2022, analysts were surprised when VC funds reported multiple negative returns for the first time in more than 5 years. For the first time in decades, those losses were much deeper than those of other private capital markets asset classes.

Experienced VCs aren’t the least bit surprised by this trend. In fact, many thought it would come sooner. Carey Smith, a VC and former startup founder, says the whole VC space is built on bubbles that are made to pop.

“At our office, we tell founders things they’re not used to hearing,” Smith writes in an article for CrunchBase. “That high valuations can be the kiss of death — they inevitably lead to down rounds and less founder equity; that a strong business plan from the get-go is essential; and that if everybody’s doing it, you probably shouldn’t.”

Those who know macroeconomics will recognize that this trend is likely a natural correction, or perhaps even representative of bad collective investment strategies. More seasoned startup investors will consider the losses within the big picture of the industry’s 30-year history. They remember years of retracted IPO filings, falling valuations, and dire warnings from fellow VCs.

However, to inexperienced dealmakers and those new to the VC markets, this trend — which will continue into 2023 — can seem unique and scary. They’ll need to let go of their fear and trust their partners’ learned processes.

If your group members are among those who are still unfamiliar with the VC market, consider focusing on building your investor relations (IR) muscles. Successfully navigate your portcos through an uncertain market in 2023 by learning to dig into both internal and external data; clearly communicating what the data shows; and using the data to build a case that will convince LPs to book again

For your own benefit, consider promoting an additional “lessons learned” drive where your partners can add observations from this deflating bubble to a shared knowledge bank or training manual for future new hires and young guns.

4. VC due diligence is finally getting its due

Experts at KPMG say that the previous two trends — unmatched demand for venture funds and decreasing valuations — will result in more thorough due diligence as VCs scrutinize targets more closely than before.

Contrast this scrutiny with the half-hearted financial, legal, and operational research processes we often witness during times of frantic VC activity.

According to a TechCrunch article about the 2017 spending spree, “Cutthroat competition between VCs over the more attractive deals drives valuations through the roof and causes VCs to run a much looser due diligence process in order to quickly win deals.”

History repeats itself: Today’s VCs, emerging from the feeding frenzy of 2021, know that comparable deals have driven up valuations more sharply than they did sound financial or legal analysis.

During bubble-like expansions, deployment seems more important than discernment, and hastiness appears to work in the short run. Many VCs “beat” other speculators to the punch, deploying capital allocators’ commitments, a move that — somehow — becomes the goal.

But now, leading VCs are returning to their original goal: to buy low, improve, and exit high. To identify what “low” means, they need to conduct proper due diligence — not take shortcuts.

The practical answer will materialize in 2023 as more patient, sage-like VCs emerge and apply more time-consuming, circumspect due diligence methods. Although these VCs may not make splashy headlines when acquiring, their investments will be more reliable, data-driven, and profitable. They’ll find overlooked startups that promise true future value based on traditional, fundamental, and time-tested benchmarks like discounted cash flow (DCF). They’ll resist the urge to value targets based on “comps” or other unreliable market fads.

Forbes’ Under 30 VC lister Alexis Alston attributes her success to deep, deliberate, detailed due diligence when selecting founders to fund. “Everything has to be right — all of the i’s have to be dotted and the t’s have to be crossed,” she says. Alston explains that she often wins deals because she spends 2 to 3 months on due diligence, while her rivals simply show up to an introduction meeting with a term sheet.

To improve your own due diligence, we recommend giving your business development and deal sourcing teams a “due diligence mindset.” Investigate new opportunities more heavily against your investment thesis and basic due diligence checklists before submitting them to the investment committee for consideration.

If your deal sourcing team consists of investment bankers or business brokers, have a hard, honest talk with them to see what can be done about finding more aligned prospects so that mismatches consume less of your valuable time. Then, revamp your current due diligence checklist. Read insights on failed startup postmortems and note the warning signs that those early stage investors could have identified — before writing their checks — to avoid eventual catastrophe. Keep a secure knowledge bank of these learnings and review them against target acquisitions.

5. VCs are adopting technology to work more effectively and outperform rivals

One of the biggest moves you can make to increase your odds of finding and landing the most fruitful VC deals — without all the inefficiencies that create the above dismal statistics — is to adopt technology to streamline your work.

Consider what your work involves. For example, the average successful VC deal requires 118 hours of due diligence just for winning deals. For every check written, 250 opportunities are dismissed — but not before VCs have spent a significant amount of time and effort reviewing these deals that never materialize. To make matters worse, fewer than one-third of your winning VC deals generate a portco that produces financial returns at all.

Although VCs clearly need automation and information management technology to help reduce their busy workloads, they often claim that they’re too busy to research and implement such solutions. Now, as deal activity slows and valuations stall, VCs are recognizing that delayed technology adoption is a direct cause of their current inability to properly compete for the most profitable deals.

VCs determined to outperform their rivals moving forward are tooling up with DealCloud and training their deal-sourcing and due diligence teams to leverage the system for faster, smarter decision-making.

DealCloud is the only VC workflow management tool made specifically for the needs of early-stage investors and their support staff. Through the skyrocketing valuations, deal volume, and transaction sizes of 2021 and 2022, we at DealCloud saw an increased demand for purpose-built technology that would enable the unique needs of VCs and their LPs, intermediaries, and legal service providers.

From deal sourcing to transaction execution and investor relations, DealCloud enables dealmakers to automate the menial, manual parts of their work so they can focus on more nuanced tasks like evaluating founders and the quality of their ideas. Users also gain unmatched visibility into market data, recent comparable deals, dealmaker activities, internal and external relationships insights, and transaction status intelligence.

Navigating 2023 is easier knowing venture capital trends

The Office of Financial Research recently published its annual report to Congress, which showed that the combination of “slow economic growth, increased interest rates, inflation, Ukraine’s war, financial market volatility, and corporate credit risk” will put a great amount of strain on the financial system throughout 2023.

You need to ensure that your team is ready to face uncertain conditions like these as they grow and change over time. Thriving in 2023 and the years ahead will require more knowledge of VC trends and statistics than dealmakers previously needed. By staying abreast of this crucial information, you’ll be more prepared to journey through stormy markets — full of both tailwinds and headwinds — on your way to 2024.