Competition for M&A remains strong in the post-pandemic market. However, as M&A teams learned from the feeding frenzy of 2021, seizing as many M&A deals as quickly as possible is not always the best strategy, as it can lead to corporate hangover.

On the other hand, moving too slowly presents its own set of problems. The longer a deal team spends on a transaction’s lifecycle, the higher the risk of rival bidders, strategics, and private equity buyers stealing the deal. Additionally, disputes, waning enthusiasm, implementation problems, and unrealized synergies all threaten a slow-moving deal team.

As an acquirer, you need to find a balance between acting quickly and acting carefully. You must be thorough and deliberate when sorting through opportunities, while also prioritizing time-to-close and ensuring rivals don’t beat you to the best deals.

The good news is that faster acquisitions can be achieved without sacrificing security, accuracy, or, most importantly, synergy realization. By equipping each member of your M&A function with the right technology, your team will be able to find more quality deals faster than ever before.

Executives: Empower your deal team to manage the deal’s middle phases

Executives such as board members, executive sponsors, and steering committee members all set a corporation’s M&A strategy. It can therefore be tempting for executives to get in the weeds when it comes to a transaction’s details. However, directors, platform heads, departmental executives, and even the deal’s executive sponsor must all learn to let managers manage, and to focus only on the parts of the deal pipeline where they can add most value.

Top-tier M&A leaders often engage intensely during the first phase (inorganic growth vision casting, investment thesis, and synergy planning) of M&A deals, as well as when it’s time to negotiate, approve, and close the deal. Acquirers need their executives and platform heads to be involved in these early stages for maximum overall productivity. Once the deal moves forward (for example, to the diligence stage) and there’s nothing more that the high-level leaders can do to steer the deal, they must move on to supporting the next acquisition candidates.

Many executives already know they should step back after the initial stages of an M&A deal, yet they fear that the deal may disintegrate unless they remain involved. Executives often use the following excuses for interfering with a deal:

- “I’m better than your M&A managers at sourcing, project management, risk avoidance, diligence, and relationship building.” Many executives (especially those who’ve risen through the ranks) have a corporate development background, and therefore feel more qualified to work on M&A deals. They forget that you and your team members likewise have strong M&A experience and knowledge — which is why you were hired for your roles in the first place and why you nominated these skilled executives for the steering committee. It’s time for executives to trust those who filled their seats to excel in their own roles.

- “This deal is too important not to have my attention.” Deal fever is nearly impossible to detect in oneself. Executives may get involved in a transaction because some deals or markets are just too exciting and interesting not to dissect — but they end up sabotaging themselves and the acquirer’s whole investment strategy. Check yourself in the mirror regularly to preempt this pitfall.

- “Negotiations require a certain personality type and/or skill set.” Leadership has long been a trending topic because so many top-level executives lack the characteristics needed for high-stakes talks. These characteristics can be learned, but it takes time and intentionality.

- “Post-merger integration (PMI) is illimitably complex.” Due diligence can become a subconscious safe space for leaders who dread the nearly impossible task of delivering on promises made on Announcement Day. Making excuses and postponing the inevitable undermines your productivity.

In addition to stepping back and letting their teams manage the middle stages of a deal, executives must equip their deal teams with the right tools so they can better develop and administer processes. By empowering your teams, the urge to interfere gives way to a different kind of excitement: the optimism of knowing you have a capable crew to carry out tasks while you steer the ship.

Start by compiling a list of lessons that you and other board members have learned about executing M&A strategies. If needed, hire a professional writer to make the material interesting and readable. Arrange the points chronologically or in order of importance to help your project managers (PMs) and analysts avoid missteps and work in the most effective way possible.

Next, foster open communication, including regular and honest feedback via routine surveys of deal team members. What do they need to work more efficiently? What do they believe will set them up for success in future deals? Whose M&A leadership do they admire most and why?

Finally, provide the support your deal team has asked for, whether it’s more flexibility, faster responses from you and other executives, new tools, or clearer direction. When your team is empowered, it frees you up to be more productive as an acquisitive leader.

Integration managers: Adopt a data management system to improve visibility

The integration management office (IMO) typically shoulders the responsibility for a deal. Whenever a deal slows down or goes off-track, the workstreams teams, PMs, and executive steering committee often blame these decision-makers. To support your IMO’s productivity, your IMO will require top-notch information management.

On-demand access to reliable, relevant, and real-time firm and market data gives integration managers (IMs) clear visibility across the pipeline to confidently orchestrate and monitor all deals. The result is a smooth, productive process in a blame-free zone. IMs are free to make decisions knowing that the data on which they base those decisions is available to anyone who questions the logic.

Traditionally, the hindrances thwarting IMs’ productivity have been:

- Lack of accountability — Rob Heaton, Co-Host of the M&A Stories podcast, says IMOs falter when no one runs point on synergy delivery. “It’s about achieving the deal thesis that you originally laid out and promised to the board,” Heaton said. “Somebody has got to take day-to-day responsibility for that. And that somebody must be accountable to the CEO and the board.”

- Misalignment — Acquisition candidates that don’t match the deal thesis or inorganic growth strategy come in all shapes and sizes, but their incongruence always creates IM slowdowns and snarls.

- Scarce, unreliable, or outdated information — If your firm lacks reliable, real-time data, your IM won’t be able to work productively or effectively drive a strategy-aligned deal.

With the right visibility, IMs can identify and deal with accountability issues, deal mismatches, and unusable or outdated data. Advanced data management technology can provide the transparency your IMO needs to promote more confident leadership.

DealCloud is a data management platform purpose-built for M&A deal teams and their relationships, pipelines, and workstreams. It centralizes, parses, and organizes both internal data — including details surrounding previous candidates, team member outreach activity, and workloads — and external data — including information around the people and businesses involved in all the deals being conducted in the marketplace at any given time.

Additionally, instead of having analysts run reports, IMs can check custom, tailor-made dashboards to access relevant real-time data the moment they need it. DealCloud stores all your information in one place, allowing you to choose between a wide, market-level view and a granular view that’s fixed on a single data point. They can then explore how the deals’ administrators transact their initiatives.

Project managers: Persuade and motivate your teams

Project managers are only as productive as the people who are responsible for moving deals forward. Learning how to find and use persuasive data to make a case will give you the ability to articulate the reasoning behind tasks and motivate people to produce the documentation, actions, and leadership that the deal needs.

Without the right data, PM productivity slowdowns are likely to occur, and you may experience the following issues:

- A lack of cooperation from sellers, service providers, and workstreams teams — Sometimes people lack the motivation or resources to keep a transaction moving toward the next milestone. Data can support your directives in these situations.

- A lack of response from the executives and board of directors whenever a deal needs another round of internal approvals — Although this speed bump is rarely the PMs’ fault, it’s almost always their responsibility to correct and prevent. Supporting data can drive your point home and encourage executives to respond.

- Switchbacks to correct or complete inadequate work — Do-overs are a classic sign of a PM’s productivity issues. They can be largely eliminated by equipping analysts with relevant, real-time information.

Frustrations like these can cause PMs to feel discouraged and disillusioned with their role, the firm’s strategy, the acquirer, and even the asset class. It’s therefore crucial that PMs track and leverage more powerful statistics, as they’ll be able to urge analysts and service providers to do better work, and they can build a case to draw out more aligned, confident decisions from higher-ups.

DealCloud gives PMs unique, granular analytics that supercharge their ability to convince people to move forward with a decision. For example, you can tie time-to-close metrics to the performance bonuses of your due diligence teams, or you can tie relationship scores to deal sourcing folks.

By relying on DealCloud to automatically organize, centralize, and democratize access to the information your firm generates daily, you can choose what you measure. For maximum PM productivity, we recommend measuring both individuals and teams using our deal velocity formula.

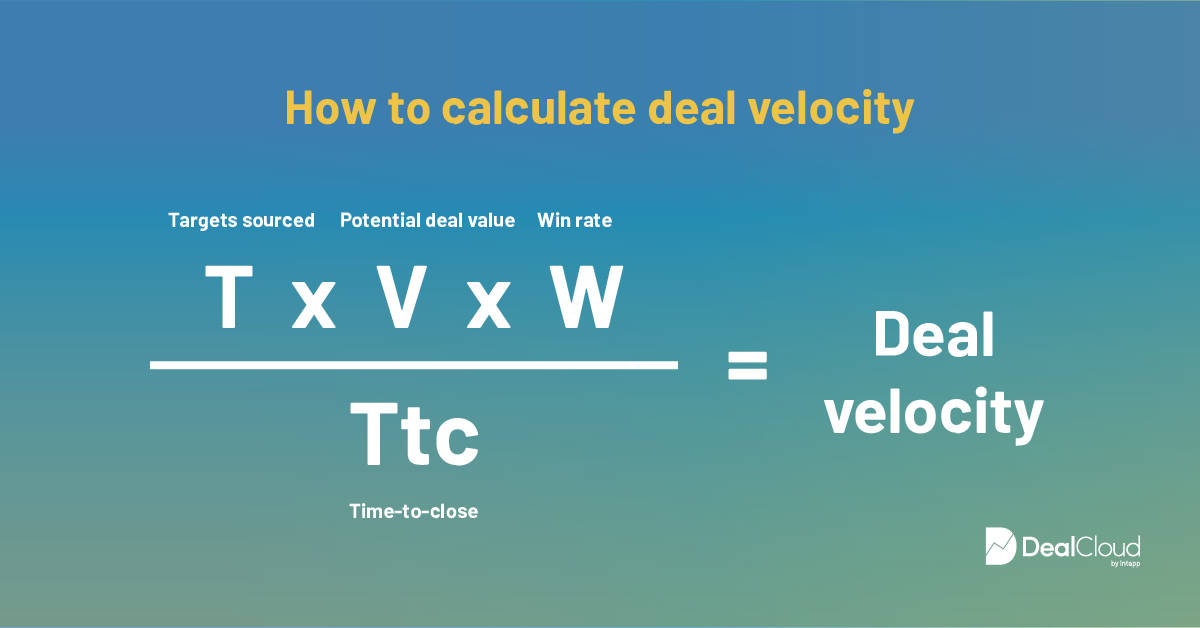

The deal velocity formula multiplies the number of incoming qualified candidates by their value, and then multiplies that by the percentage of the deals that close. The product is then divided by the average time it takes to make all this happen.

Source: DealCloud

“I’m a big believer in measurement,” said Toby Tester, Co-Host of M&A Stories. “I expect M&A teams to have someone who’s actually … keeping proper track [and] making sure data is being reported clearly, correctly, and from only one source of truth.”

In addition to measuring more relevant data, you should also work on the skill of persuasion. With subordinates, data alone might be enough to support compensation decisions and motivate staff. But with executive sponsors and board members, you’ll need to combine measurements like deal velocity with strong persuasion skills and an increasing ability to inspire.

“[Although] good presentation skills will get you by, the ability to use those skills to persuade (versus simply informing) is highly desirable,” explained one PM in an anonymous M&A discussion forum. “I put together a great presentation with lots of valuable information, and management [made] the opposite decision that I would have hoped for. In retrospect, I should have driven the point home, made it clear what my position was, and then been relentless in supporting my position. Sometimes you need to be able to pound the table (literally and figuratively) to really get your position across to management.”

Functional and specialized workstream teams: Customize automations to better collaborate

Most tasks conducted during transactions are performed by deal team members who collaborate with or hold functional roles in departments like legal, finance, IT, operations, and HR. To transform productivity at this level, you should automate as many of your processes as possible.

Teams often put up with manual or outdated processes because individually, the tangles seem small. Collectively, though, these inefficiencies quickly sabotage a whole M&A group’s productive capacity:

- Time-consuming administrative work — Menial tasks like data entry and report generation consume far too much time from people who are qualified to perform higher-level work like valuation, diligence, and financial modeling and forecasting.

- Conditional level I decision-making — People in these ranks often have the information they need to make deal-progressing decisions, but they don’t have the authority. Occasionally the opposite is true: They’re authorized to make decisions but are ill-informed and struggle to find the right data they need to settle questions and move forward.

- Missed communications and miscommunications — When sending a message, you may miss sending it to some of the people who need it, causing confusion and slowing down your process. You may also forget to provide context in your communication, prompting others to follow up and clarify.

- Competing internal goals — Sometimes executives inadvertently pit one group against another by creating conflicting performance objectives. Imagine the IT group refusing to give the deal team information for fear of compromising their data security goals.

DealCloud’s automation tools can help prevent these slowdowns and promote team collaboration. You can automatically enter contact information, meeting notes, changes in deal status, and personnel updates into your teamwide database based on the actions you take in your day-to-day. For example, DealCloud’s activity capture feature automatically synchronizes email and event details alongside associated relationships in DealCloud.

Level I decisions can also be automation-assisted. For instance, when setting up team clearances, you can receive automatic alerts of potential conflicts rather than having to track them down manually. Investigating, documenting, and ruling on each possible problem will go much faster, allowing you to move on to the next project.

You can avoid the clunky back-and-forth of internal approvals by emailing forms to your superiors to fill out. With the right automation, their answers can automatically populate a deal page. Never again will you need to transfer information from emailed paragraphs to a database.

By leveraging automations, you can spend less time on menial tasks and more time on valuable work that requires your knowledge, experience, and creative thinking.

Move deals forward quickly and thoroughly

Investment banker Nate Nead notes that M&A deals that drag on past the 60-day mark tend to implode. In fact, anything that takes longer than 90 days “further increases the probability of a deal completely falling apart,” he writes. It’s imperative that your team keeps deals moving. To do that, use the productivity skills and tools offered above.

With a technology system like DealCloud, actionizing these tips and improving M&A efficiency is simple. To learn how you can support your deal team to work more effectively, schedule a demo today.