To help the legal community better navigate through our current uncertain, Intapp is fielding a regular study to understand — in near real time — how law firms are responding, and then sharing best practices and findings with the broader professional services community. These findings represent the views of top law firm leaders in the largest global law firms.

In this installment of the Intapp Pulse survey data, we’re seeing yet another series of changes in law firm leaders’ reactions to the COVID-19 pandemic. These findings reflect the most recent survey period — April 1 to 3 — as well as key trendline changes from previous survey periods.

Current research indicates a shifting landscape:

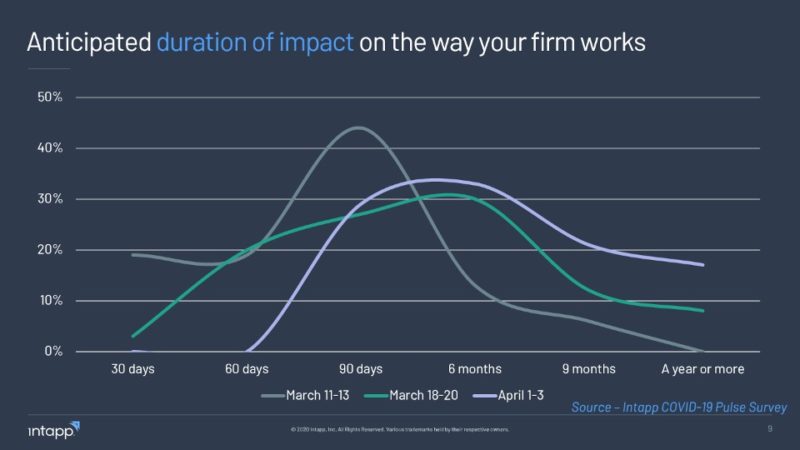

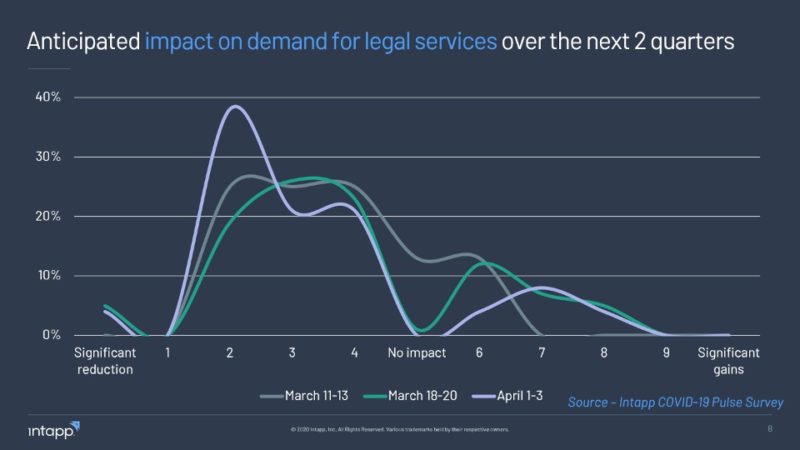

- A majority of firms now expect to feel moderately severe impacts to operations, including a moderate reduction in demand lasting anywhere from 90 days to 6 months — a time horizon that has slowly extended as the pandemic evolves.

- More than 8 in 10 law firms are now seeing shifts in demand for legal services. Increases in demand for recession-associated practice areas (labor, employment, estates, bankruptcy, etc.), and decreases in other practice areas (corporate litigation, M&A, real estate, finance, etc.).

- Nearly two-thirds of firms report lowered employee morale as one of the significant consequences of the pandemic. To date, respondents tell us that budgetary and spending changes are more prevalent than reduced partner distributions or shrinking headcount.

For those of you who want to explore the data further, here are more-detailed findings:

An increasing proportion of firms — 92% during this survey period — have experienced substantial impact on their business. This number has risen from one-third facing measurable business impacts a mere month ago.

As the pandemic continues, half of firms report reductions in billed hours and collections. More than 8 in 10 firms have experienced changing demand within certain practice areas. These shifts mirror the changes in practice areas typically associated with a recession, including decreased demand for M&A, corporate, transactions, and litigation practice areas, and increased demand for employment, bankruptcy, labor, and real estate practice areas.

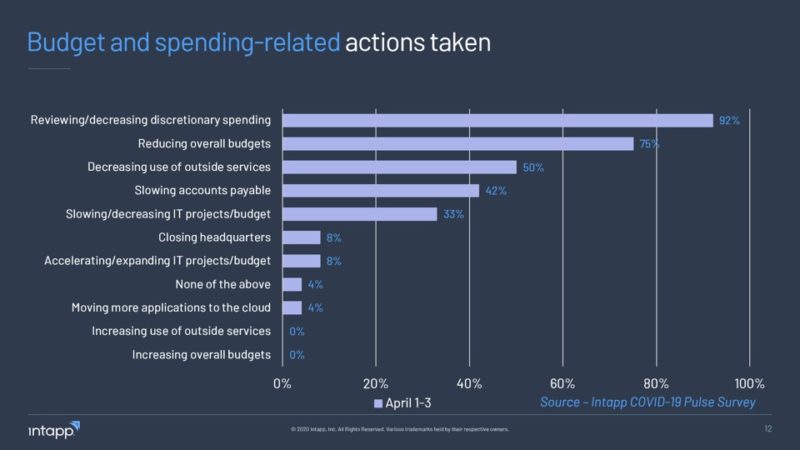

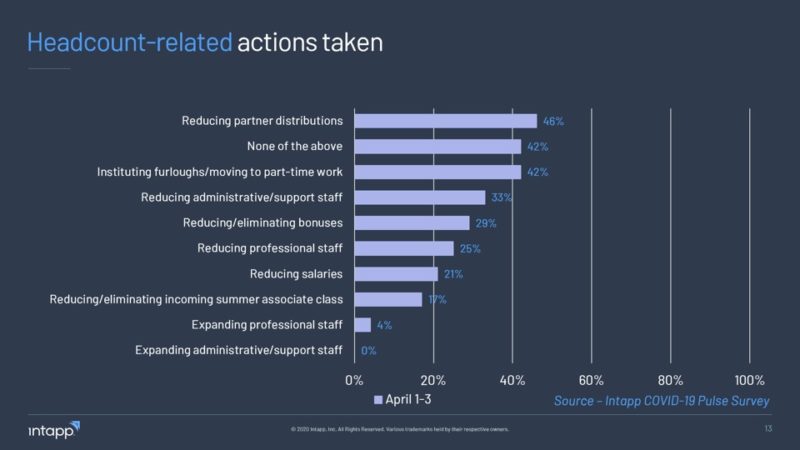

Given these effects, firms have taken action to reduce discretionary spending (92%), reduce overall budgets (75%), and reduce use of outside services (50%). These spending measures are more common than personnel-related actions such as reducing partner distributions (46%) or furloughs (42%). Perhaps unsurprisingly, about two-thirds of firms report they are now grappling with employee morale issues.

As states and countries continue to shelter in place, perceptions of the longevity of the impact of this pandemic/recession continues to increase. Although a majority of respondents expect COVID-19 impacts to last for a 90-day to 6-month period, 17% of respondents now believe this pandemic’s impacts will be felt for one year or more; no respondents believe the impact will stop within the next month.

Similarly, in this study period, most respondents now expect that this pandemic will have a “moderately severe” to “severe” impact on demand during the next two quarters.

At the upcoming Intapp Connect Virtual Summit, we’ll provide additional commentary on the pandemic’s impact within our industry, as well as strategies for optimizing your firm’s responses. We hope to see you there!

In the meantime, we’ll continue to share survey results as we collect and analyze the data. We encourage you to explore our resources page to find practical insights geared toward the needs of professional services organizations.