Anti-money laundering (AML) compliance and client due diligence (CDD) requirements are increasing rapidly, creating new challenges for risk and compliance professionals around the world. In response, today’s leading firms are focused on creating viable anti-money laundering processes and demonstrating compliance with the help of purpose-built technology, including integrated, configurable AML solutions.

Leveraging technology to ease the compliance burden

During a recent roundtable, “Improving AML Compliance, CDD Practices, and Risk Assessment,” a panel of legal experts explored key issues affecting firms in today’s environment. Emphasizing the importance of rigorous risk compliance and the need for an internal review of current firm practices, the panelists offered recommendations to expand risk-awareness efforts and cited the importance of technology in AML efforts.

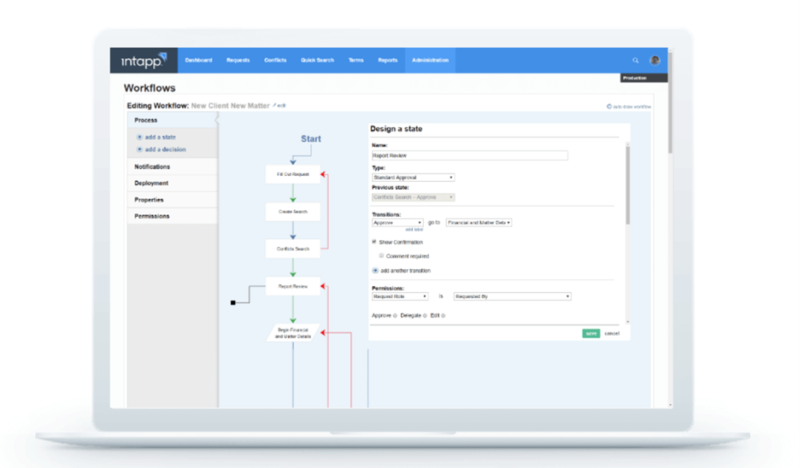

Intapp Intake — part of the Intapp Risk & Compliance suite, purpose-built to help firms manage intake, address conflicts, simplify terms, and create and maintain ethical walls — gives your firm a flexible and complete approach to managing client and matter onboarding, automating due diligence, and demonstrating compliance throughout the client matter lifecycle.

Staying current with requirements and best practices

One of the greatest challenges professional services firms face is the continually evolving nature of expectations around risk and due diligence. Regulations and best practices guidance are ever-changing, putting pressure on firm staff and systems. Your firm can streamline compliance using the cloud- and AI-based technology in Intapp Intake.

Using Intapp Intake, you can stay on top of best practices:

- Remain aware of evolving client and market conditions that could impact risk. assessment with automated real-time monitoring and notifications.

- Quickly assess risk levels to escalate or resolve issues by generating AML risk scores based on key inputs and firm business rules.

- Accelerate AML compliance with a solution built on the insights and best practices of leading firms.

- Demonstrate compliance at any time using comprehensive audit and escalation reports.

Accelerating business acceptance

In today’s competitive, fast-paced environment, it’s critical to accelerate the management of the entire business intake process. Intapp Intake was designed to help your firm efficiently take on new business while carefully managing regulatory, financial, and reputational risks. Intapp Intake gives you a configurable interface that automates manual intake processes, helping you tackle new business tasks:

- Improve intake efficiency and accuracy by integrating the Intapp AML solution with your key firmwide systems, third-party data, and a reputable ID verification partner.

- Accelerate business inception by standardizing your intake process and propagating key information across your firm’s systems.

- Eliminate slow, costly, error-prone manual processes when addressing potential concerns like risk assessments, verification of UBOs, directors, PEPs, and revalidation.

- Streamline document sharing and manage client interactions using a secure external client portal (available as an optional add-on).

Intapp Intake protects your firm’s reputation and confers additional competitive advantage to power a solid compliance strategy.

To learn more about how Intapp Intake can improve your AML process, download the AML compliance data sheet.

For more information on using Intapp Risk & Compliance for complete, flexible management of client and matter onboarding as well as complete due diligence processes with a full audit trail, schedule a demo today.