Despite the wild and turbulent twists and turns that 2020 has presented, buyers and sellers still rely on intermediaries to manage the day-to-day developments of every deal ― and nothing short of the ideal outcome is acceptable. As many investment bankers are operating from their home offices at this point in time, it’s more important than ever to have technology that supports banker efficiency and firm-wide transparency. The most sophisticated investment bankers leverage dashboards comprised of real-time data to inform what activities and projects they work on each day. Over the last six months, we’ve heard from countless investment banks that these kinds of operational improvements can make bankers feel as productive at home as they were in the office.

That’s why best-in-class investment banking professionals leverage purpose-built technologies like DealCloud to take client data, organize it, and visualize everything in reports and dashboards that trusted members of their team can access at any time, from any device, and from any remote working location. Leveraging detailed dashboards in the DealCloud platform can help you streamline processes and workflows to run a sophisticated deal process from start to finish.

Below, we’ve outlined three key dashboards that can help investment banking and advisory firms harness the cumulative intellectual capital of its people and processes to achieve success on behalf of its clients.

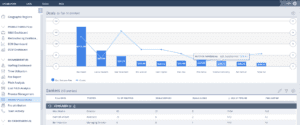

Dashboard #1: banker productivity

Using the Banker Productivity dashboard in DealCloud (as seen below), users can view deals by bankers and industry, position, and activities including number of meetings, deals sourced, deals closed, size of pipeline, and fees earned. Dealmakers are given real-time insight into what work is being done and by whom through DealCloud’s banker productivity and activity tracking dashboards.

Each member of your team can use DealCloud to perform and track activity, which can then be viewed and assessed by your firm’s leadership team. Better yet, the firm’s leadership team can configure notifications or PDF summary reports to be sent to their inbox at any cadence of their choosing (hourly, daily, weekly, or monthly, etc.) to stay on top of their team and ensure expectations are being met while bankers are remote.

To see how some investment banks leverage banker productivity dashboards to gauge activity and progress towards business development goals by role at the firm (e.g., Analysts and Associates vs. Vice Presidents and Directors vs. Managing Directors), click here.

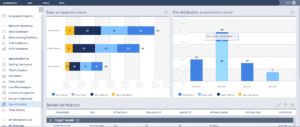

Dashboard #2: fee attribution

Is your investment banking firm still spending time and effort manually and statically tracking its fees? Since every firm conducts fee attribution differently, our technology allows for many unique configurations. Using the Fee Attribution dashboard in DealCloud (seen below), users can view fees by engagement and banker, by approval date and banker, and view banker attribution.

This makes it easy to keep a real-time, 360-degree view of fee attribution and helps you uncover deeper insights from your data as well as helps you plan for the future, effectively alleviating the burdens of traditionally time-consuming or labor-intensive processes.

To read our recent piece on fee generation strategies for investment banks and advisory firms in the time of COVID, click here.

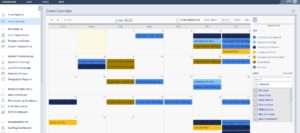

Dashboard #3: firm-wide calendar

One major challenge facing investment banking firms today is lack of transparency. Investment bankers are required to know what’s going on across their firm daily, weekly, quarterly, and annually. No matter the size of your firm, there’s sure to be many moving pieces to many different deals at any given time and it’s critical that your team meets their deadlines and stays focused.

Having your activity organized and easily accessible increases firm transparency and leads to greater efficiency for every team in your business. The firm calendar dashboard in DealCloud can help you manage and increase visibility into firm-wide business development efforts and travel plans at any time of year.

While technology can ultimately enhance outcomes, it also has the power to reduce administrative burden, costs, and banker inefficiencies. At DealCloud, we have successfully implemented over 150 investment banks (such as Raymond James, Stephens, and Perella Weinberg Partners), and throughout that process our team has solved for many of the biggest pain points that these firms face. As a result, we’ve developed our platform to enable these firms to optimize workflows, deal processes, and more.

To learn more about the DealCloud platform, schedule a demo.

DealCloud’s deal and relationship management technology empowers dealmakers to harness the cumulative intellectual capital of their people and processes. With the DealCloud platform, dealmakers get a single source of truth to help them manage relationships, execute deals, and easily connect with external solutions and third-party data providers. Get in touch today to schedule a demo and learn more about DealCloud’s solutions and services, as well as the markets we serve.