A recent Campaign Monitor article revealed that 89% of marketers use email marketing as their main lead generation channel. This comes as no surprise, considering how effective email marketing for financial services has helped firms better connect and communicate with clients, prospective deal partners, and other stakeholders. What’s surprising, however, is how few investors have taken advantage of the same email marketing tools to originate deals.

Private equity firms need to understand the value and impact that email marketing system management offers. Learn steps investors need to take to execute a better email campaign management strategy, and discover how email campaign software can support your firm’s business development process.

1. Define Your Email Campaign Goals

When creating your email marketing campaign, first recognize that no two campaigns are exactly alike. Email marketing for financial services and private equity firms must address each firm’s unique goals. You may, for example, wish to create a private equity email marketing campaign for lead generation and conversion. You may also wish to create a newsletter to promote webinars, articles, and updates about the firm, or build awareness of your firm’s role as a thought leader.

Before launching a private equity email marketing campaign, professionals must first define their firm’s overall goals, such as:

- Boosting click rates and open rates

- Promoting more end-of-funnel conversions (such as deals sourced) from email nurture campaigns

- Increasing email subscribers

Each goal requires a different approach and a different email template. Learn more about some of the different email campaign system templates available and how they support various goals.

Email Template Option #1: Newsletter

Email newsletters are an excellent way for financial services firms to easily nurture all contacts in their CRM, providing readers with weekly, monthly, or quarterly highlights, and informing them about new acquisitions, announcements, as well as recently published articles, whitepapers, and case studies. When you’re sending recipients relevant content, they’re more likely to engage with your emails, resulting in increased click rates and open rates.

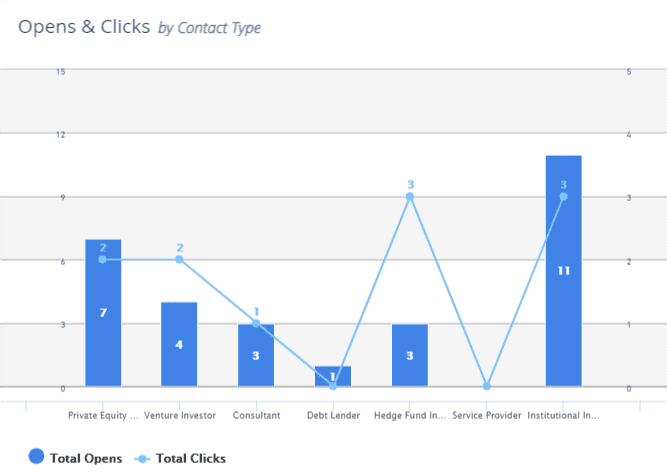

The DealCloud Dispatch dashboard displays the number of opened emails and clicks from your campaign. Users can sort this data by contact type.

Email Template Option #2: Deal Announcements

Deal announcements are another great way to support email marketing for financial services and engage with CRM contacts. You can send these to your recipient list in real-time; however, be mindful of the number of deal announcements you send each week to help reduce the number of people who unsubscribe. Sending recently closed deal announcements and providing real examples of companies that use your services will result in more end-of-funnel conversions from email nurture.

Email Template Option #3: Event Promotions

Whether you’re sponsoring an event booth, hosting a company-sponsored event, or launching an investor roadshow, it’s important to send pre- and post-event email promotions. Informing your CRM contacts of upcoming events encourages them to not only attend but to meet and connect with your firm while at the event. Your contacts may even forward your email to others outside of your recipient list who are also attending the event, which could result in an increased number of email subscribers or new contacts.

2. Compile a Segmented Recipient List

Private equity email marketing campaigns often underperform because firms don’t send emails to the right people. Compiling a solid audience list for your email marketing campaign ensures that your firm doesn’t create email content for the wrong people, and that your audience doesn’t unsubscribe or mark your emails as spam because the content isn’t relevant to their needs.

Email marketing for financial services must always have a segmented recipient list to ensure success, meet your firm’s goals, and ultimately increase profitability. According to Campaign Monitor, segmented campaigns can result in a 760% increase in revenue.

When creating segmented audience lists, firms often include geography and company size; however, firms must also take three more important steps:

- Contacting the right people who specialize in industries that are relevant to the email content

- Selecting people who’ve previously submitted a form on the firm site to access gated content

- Crafting potential target client lists based on people with whom the firm would like to work

It’s important to note that compiling a sizable list of recipients for your email campaign isn’t a quick and easy task, nor is it a one-and-done effort. Each segmented recipient list will constantly change and need updating; nevertheless, taking time to build and maintain these distribution lists is time well spent. When in doubt, smaller lists are better than massive lists, which can cause your firm’s emails to get caught in spam filters.

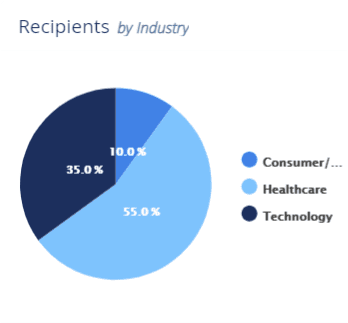

DealCloud Dispatch provides charts that display the breakdown of a recipient list by industry.

3. Automate Your Email Campaign Process

Creating a detailed audience list requires a lot of effort, which is why many professionals turn to automation platforms like DealCloud Dispatch, a private equity email marketing solution. Dispatch helps firms automate email campaign processes by connecting to existing data lists in the firm’s CRM platform. Dispatch users can launch email campaigns without having to import, export, or segment targeted leads; all contact information is already integrated within the DealCloud CRM.

Putting together a recipient list may be difficult, but creating a strong email format that renders properly and that users can consistently apply as a template is even harder. The flexibility of Dispatch provides firms with the ability to directly code HTML on the emails, allowing you to easily adjust the look and feel of your emails and promote your firm’s content.

4. Track Marketing Data Alongside Other CRM Information

Private equity firms can use a number of valuable insights gained from running an email marketing campaign. By investing in email marketing software that collects important data — including bounces, unsubscribes, and other engagement — firms can learn how recipients engage with campaign content. Dispatch stores this information — which all users can access — in the CRM, thereby eliminating the need for multiple record sources or complicated API data syncs. This helps incorporate the marketing data into investors’ day-to-day workflows and provides private equity firms with a more holistic way to analyze their processes.

Additionally, Dispatch unifies reporting and data analytics within the CRM platform so users can view engagement metrics directly in Dispatch. Reviewing Dispatch reports helps marketing and business development teams better prepare for their next campaigns by focusing on what resonates the most with their target audiences. Using Dispatch can help your firm’s marketing and business development teams drive new opportunities and nourish existing relationships in a scalable way.

Schedule a demo to learn how Dispatch can help your firm launch better email campaigns.