Investment bankers (IBs) need to know what other institutional financiers are doing. However, most industry publications only cover macro, obvious investment banking trends and developments such as inflation, interest rates, war in Europe, supply chain snaggles, and employment numbers.

Here, we cover exactly how these macro developments are affecting intermediaries in 2023 and how IBs are responding to those pressures and opportunities. Discover what your group can do in response to the bigger economic conditions.

1. Investment banks are enjoying increasing options for creative financing

Every year, industry commentators forecast the coming months by describing “the current economic uncertainty.” Despite some unpredictable factors, the most influential factors for IBs in 2023 have become favorable. IBs will now have more options to exercise their creativity this year than they have before.

One such factor that IBs are currently facing is the presence of higher interest rates, which translates into an increase in net interest income for IBs, especially the bulge brackets (BBs). Not only does this division experience higher revenue from interest, but it also enjoys expanded margins as spreads diverge. The increasing weighted cost of capital (WACC) that gives deal sponsors pause won’t slow them enough to threaten most IB division net profits, because competition among sponsors remains fierce.

Driving this competition is the still-high amounts of dry powder (for financial acquirers) and liquidity (for strategic acquirers) that are itching to be deployed. Falling valuations mean sponsors will get more business assets per dollar, increasing acquirers’ hunger for new opportunities. Whether your IB provides financing, advisory services, or both, you’ll be in the unique position to source and facilitate many of those deals.

The result of all these positive markers is an expanded number of options for IBs to exercise their creativity in the financing market as they aim to win, serve, and retain clients throughout 2023.

Experts at Goldman Sachs Investment Banking offer some specifics of how this creativity may play out in the financing market. “If you look at the transactions that have been getting done by private equity, many of them are highly structured or they have bespoke capital structures,” says Stephan Feldgoise, Co-head of Global Mergers and Acquisitions at Goldman Sachs. “Maybe they have a lower level of leverage and potentially accessing the direct lending market for that leverage. In some transactions, private equity clubs are funding all equity and then refinancing later. And in some of those, they may be looking at smaller deal sizes as well where they can use more equity in the mix or less leverage.”

To encourage your group to think outside the box this year, keep tabs on what other IBs are doing. Novel and smart initiatives can be found in industry publications, online discussion forums, and your own network of limited partners (LPs). Set up a Google alert to regularly get updates from a variety of news sources — all about customized financing that other bankers are offering throughout 2023.

2. Sector-specific deal volume and size are rebounding

For banking teams like yours, 2023 has arrived with a never-before-seen combination of headwinds and tailwinds. These conditions brought forth a sector-specific value rebound trend, meaning that pockets of industry will thrive while many of the winners from the past 3 years will stagnate and falter.

The headwinds are obvious to anyone who gets the news: an inflationary environment, war in Europe, corporate credit risk, and even volatility in the capital financing markets.

On the other hand, the tailwinds are widespread, less evident, and tend to be sector-specific. Niche tailwinds include lessons learned from recent supply chain snaggles and infrastructure pressure-tests, settling valuations, improved investment terms, and subgenre sectors and events such as:

- Clean energy — Scientists have just facilitated a fusion that created more energy than it required

- Cannabis — CBD oil’s unmatched rise in ecommerce sales and consumption;

- Biotech — the explosive growth in bioengineering businesses and jobs;

- Airline — U.S. passenger airline job growth was double that of the rest of the U.S. economy throughout 2022 (much more than the expected rebound from the effects of COVID-19).

In the past, IBs used outlooks based on general CEO confidence to predict rebounds and forecast upcoming deal volumes and sizes. However, The Conference Board’s Measure of CEO Confidence for 2023 revealed that this across-the-board approach to evaluating the economy doesn’t necessarily work for specific sectors.

According to the 2023 report, 16% of CEOs believe that, in general, economic conditions today are better than 6 months ago, while 55% say that conditions have worsened. Contrastingly, 23% of CEOs (and growing) now say their own industry’s economy has improved in the last 6 months, while only 43% (and decreasing) say conditions in their industry are getting worse.

Source: The Conference Board

To navigate this trend nimbly, you’ll need to reevaluate your current talent allocation. Most IBs are structured with a product coverage group, a regional coverage group, and an industry coverage group. As certain sectors rebound faster and higher than their counterparts, don’t be surprised — be ready. Make space in your industry group for analysts and associates to come over temporarily from regional and product teams. Have training in place to get laterally moving associates up to speed and able to respond to the trend before other intermediaries.

3. Investment banking talent wars are intensifying

Expect white-hot competition through 2023 for the smartest, most dedicated IB associates and analysts.

Finding finance talent may seem like an impossible challenge. “82% of employers struggle to find finance talent,” Fortune writes, while Accenture calls hiring in finance today a “nightmare.” But with the right mindset, the war for IB talent is one you can come out of victorious.

First, remember that there are two sides to every story. For every finance leader who complains about good dealmakers leaving for higher pay or better promotion opportunities, there’s another finance leader offering those dealmakers those very benefits.

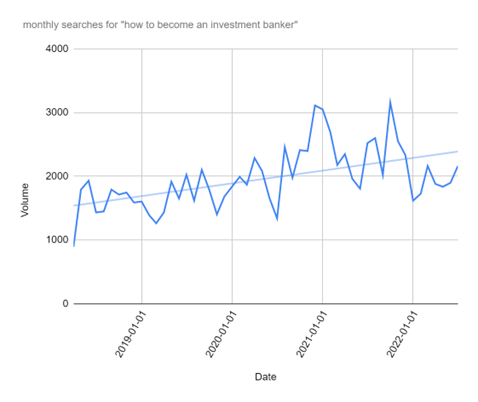

Second, notice the steadily growing interest in entry-level investment banking roles — and how this interest doesn’t seem to falter or fade in light of recent “black swan events.”

Source: DealCloud via ahrefs search volume data

To attract the best and brightest in investment banking, take a few proactive steps before you venture any further into 2023:

- Set a reminder to check honest, peer involved IB compensation standards each year.

- Offer slightly better pay options and performance bonuses than rival institutions.

- List ways your firm stands out by articulating your perks and development programs in job descriptions.

- Follow through with commitments to meet or exceed career development goals of newcomers.

You already know your credibility means everything to your future success as you source and finance deals — but do you treat your employee experience as well and thoroughly as your marketplace reputation? If not, 2023 is the year to start.

4. Early-stage deals are increasingly requiring white-glove handling

There’s a reversal and a growing gap developing in the venture capital (VC) bid-ask spread (i.e., the difference between what startup founders demand and what capital VCs are willing to deploy). Because of this, IBs will see more financial and strategic acquisitions of early-stage businesses that missed out on the founder-friendly capital raising heyday of 2020 and 2021.

Source: PitchBook analyst note, “When Dry Powder Stays Dry”

“Venture growth’s Dealmaking Indicator has grown 2.2 times more investor-friendly from the last quarter of fiscal year 2021 to Q4 FY22,” states a recent Pitchbook report. “This is caused primarily by shifts in the demand and supply of capital ratio, increased prevalence of investor protections, and an increase in the time between subsequent funding rounds for companies.”

VC supply and demand doesn’t respect regional or industry boundaries, but it does greatly impact your product offerings.

We reached peak founder-friendliness in 2021 and 2022. Entrepreneurs took note and haven’t stopped generating new ideas.

Source: Census.gov

However, the VC funding they anticipate based on earlier years simply won’t be there when they come to call this year. The result will be more M&A activity and private equity buyouts than founders anticipate — or prefer.

Navigate this minefield with white gloves. Delicately handling early-stage deals helps builds relationships and fortifies your team’s reputation as the intermediary that cares more about people than profits.

Be cognizant of heightened emotions involved in these deals. Founders often love the businesses they create, and they may resent the position they’re in (i.e., selling instead of “raising rounds” with often-unrealistic aspirations of the over-idealized IPO). Deal sponsors may not be as used to the sentimental “skin in the game” that owners themselves have invested, so help general partners and M&A managers understand the delicate nature of negotiations.

5. Investment banking divisions are embracing more public experimentation

The last 2 years saw several retracted pivots by IBs, and consumers, LPs, PE sponsor groups, and corporate development teams are increasingly supporting IBs’ exploratory efforts. This development subsequently encourages more innovation in the financing markets.

Previously, strategic experimentation by such large or influential financial institutions would be discouraged and avoided. Transaction financing involves so much trust that innovative ideas had to be tested quietly, if at all, so as not to spook stakeholders.

Consider Goldman Sachs’ decision to shutter their foray into consumer banking. The Economist covered the “failure,” punishing the firm by teasing, “Goldman Sags” (a headline barely gentler than the savage “Goldman Suchs” title the editors had strongly considered.) Interestingly, though, Goldman Sachs’ share price weathered the upset, signaling stakeholders’ understanding even appreciation of the effort.

This tolerance and acceptance of exploratory moves is new to the IB sector, and it seems that it’s here to stay. For example, stakeholders are increasingly embracing investment banks’ partnerships with insurance companies along with their paused-then-quickly resumed stock buyback practices. In ESG, Morgan Stanley is partnering with scientists to put beacons on litter to track its travel through our rivers, uncovering insights that will eventually improve the environment.

Remember that failed initiatives aren’t failures if they were done in the name of experimentation. In fact, many “failed” experiments can be considered successes worth publishing — if you do it with finesse. Here’s how:

- Build a reputation for being a curious group that explores creative solutions. Champion innovators and entertain both internal and external ideas that could support your mission and values.

- Hire a sector-specific PR expert or agency who has a track record of going beyond crisis management and media placements. Choose one who can help shape a narrative and ask how they’d posture future experiments to be successful, even if it’s as a learning experience. Review lists like CommunicationsMatch and the Financial Brand.

- Invite select stakeholders along for the ride. Tease the new development with an email that says something like, “We’re trying something new, and want you to be involved as our trusted team. For fun, submit your predictions: How do you envision this turning out?” Be sure to keep them updated along the way.

- Thank stakeholders for their loyalty. Express your admiration for clients and service providers who stick with you through the experiment.

Your group may not be keen on undertaking the examples of experiments and pivots listed above, but the examples do show a growing understanding of and appreciation for innovation in a historically risk-averse (and creativity-cool) industry. Take advantage of it.

Improve internal and external collaboration to navigate IB trends for 2023

In Deloitte’s Future of Investment Banking report, analysts reveal that improved collaboration is the number-one driver deciding 2023’s institutional deal financing industry’s leaders and laggards. Imagine navigating the trends explored here with the collaboration tools and processes you use today. Now imagine navigating 2023 with faster, more intuitive collaboration tools and processes.

Having a firmwide, purpose-built deal and relationship management system in place can help you with tasks such as:

- Narrowing down your expanding options.

- Capitalizing on the coming sector-specific rebounds.

- Attracting the best talent.

- Handling an influx of tricky early-stage deals.

- Conducting more visible experiments.

Equip your team with technology that enables all these achievements. Intapp DealCloud is the only system built specifically for IBs in uncertain years like 2023. By providing your team with intelligent workspaces that leverage Microsoft Teams, robust and secure document management, and personalized external collaboration features to empower external stakeholders, DealCloud puts you in the position to address new trends for 2023 and beyond.

Take a tour of Intapp DealCloud to learn more.