A key element of any private equity firm’s strategy is sourcing deals, which is often done through an advisor such as an investment bank or corporate finance firm. In fact, many private equity firms source certain industry- or size-specific deals from intermediaries that specialize in those categories. But few PE firms actually see a return for these efforts. In fact, according to a recent Sutton Place Strategies research report, private equity firms see an average of 17.2% of their target market deal flow.

With so many opportunities being presented by so many advisors, many firms struggle with sorting the good from the bad. In this third article of our “Business Intelligent Thinking” (BIT) series, we analyse the power of leveraging existing relationship data and how that can affect the quality of deals sourced. With these best practices, you can report on your most valuable intermediary relationships and ultimately focus your firms’ efforts on the most fruitful relationships.

1. Layer data points for better, more meaningful analysis

The data we utilise to create deeper intelligence on intermediaries focuses on two areas of the transaction: the deal itself, and the relationships behind the opportunities being presented. By performing data analysis on these two components of the transaction, we’ve created a system that allows private equity professionals to better utilise pre-existing intermediary data intelligence, without changing your workflow.

Using DealCloud, you can automatically track the progress of the various deals you are shown by your entire universe of deal sources, and by extension see which companies perform best alongside your business model and investment thesis. The key pieces of information include:

- The quantity of deals sourced;

- The quality of deals sourced;

- The fees paid;

- The quality of relationship with the contacts involved in the transaction; and

- The quantity of meetings held.

2. Configure custom metrics for more actionable information

Within DealCloud, the calculation engine allows private equity firms to configure metrics that show the health, progress, score, or other measure for any data set. For example, these metrics allow you to track the length of time between interactions with one contact, and can be used to alert you when it’s time to check in with that person.

This feature can be used to configure an intermediary intelligence scoring system. This enables private equity firms to glean a better understanding of the health of its relationship with any given deal source, for both individual contacts and entire companies.

Importantly, the metrics that contribute to this scoring system can be tailored to your firm’s unique business model. As long as the user is permissioned to do so, they have the ability to weigh and re-weigh any factors used in the calculation of the metric. This gives investment professionals a clear, concise answer to the age-old question: “Who are my most valuable contacts?”

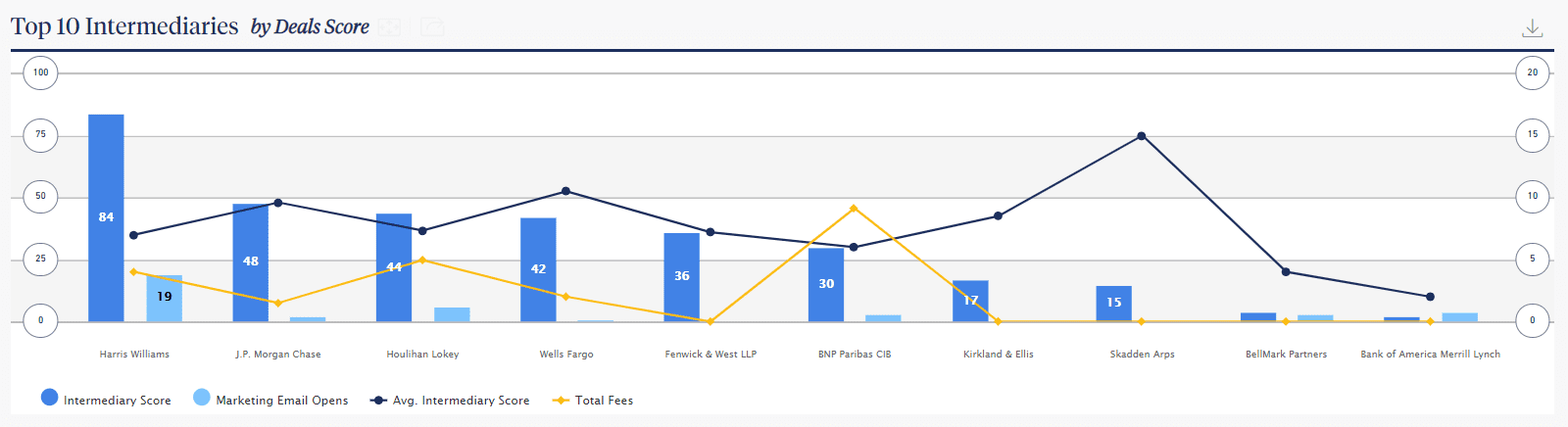

Shown below are some of the various scoring metrics that can be configured in DealCloud:

Conclusion

Following these two best practices will allow your firm to better utilise the data intelligence that you already collect, and the effort does not result in any extra work. These features help industry professionals quickly understand whom they should be targeting for their next deal, which firms they should interact with more often and overall, which intermediaries generate the highest ROI.

At DealCloud, we believe that the combination of Business Intelligent Thinking and first-rate data intelligent technology yields value to your business because it increases firm-wide transparency. Implementing these best practices allows you to focus on what is most important to you, streamlines your existing workflow, reduces the time spent on tasks, and helps you achieve your goals faster and easier than before.