When sourcing venture capital deals, your firm needs a clear plan to ensure its pursuing the right deals. This plan should include:

- Developing a sound investment strategy

- Nurturing a robust network

- Leveraging industry-specific intelligence software

- Building a strong presence at industry events

You’ll also need to have the right people and tools in place to carry out this plan and win these deals. So how exactly do you establish a successful plan for sourcing deals? And what technology can help?

We’ve detailed these best practices to help you navigate the highly dynamic and strategic process of sourcing venture capital deals. Learn how your team can discover startups and new opportunities to improve your firm’s profitability.

1. Define your investment thesis to identify ideal transactions

Too often, venture capitalists chase ultimately incompatible deals, taking time and resources away from more promising opportunities. To avoid this pitfall, you must first improve your investment thesis.

An investment thesis is a set of values against which you compare business ideas. The more aligned an entrepreneur’s venture is with your firm’s thesis, the more viable — and, hopefully, profitable — the opportunity is likely to be.

As you follow news and trends in the venture capital industry, you’ll develop stronger preferences about the market you want to target. Then, you should compare potential investments to that specific market, research rising companies, and map out what your capital and connections can do for those companies. This preparation will save you time when sourcing venture capital deals. It will also produce better deals at the sourcing stage and improve your overall deal flow.

With DataCortex, you can leverage third-party data providers — such as PitchBook, FactSet, and Preqin — to gain valuable insights into the industry you plan to invest in. You can quickly identify opportunities that align with your investment thesis and make critical decisions by accessing real-time actionable data and analytics.

Many startups have fizzled because investors jumped in without first defining their investment theses. Learn from their mistakes and be careful not to take on any deals that won’t bring value and don’t align with your firm’s thesis.

2. Nurture new and existing contacts

Strong relationships have always been — and always will be — the fastest route to sourcing new, profitable deals. Existing connections offer referrals and insights, while new connections broaden your exposure to innovative startups and emerging opportunities.

To maintain a strong deal flow and powerful network, venture capitalists must efficiently manage both current and new relationships. A disorganized workflow can put these relationships in jeopardy and cause confusion and slowdowns within your firm.

For example, a dealmaker may forget to reach out to a vital contact, cooling the relationship. Or a dealmaker may not realize that they’re focusing on a target company that one of their coworkers already has a connection to. As a result, that dealmaker spends extra time and effort trying to build a relationship with that company from scratch — when they could have just asked their coworker to provide a warm introduction to kick off the deal process.

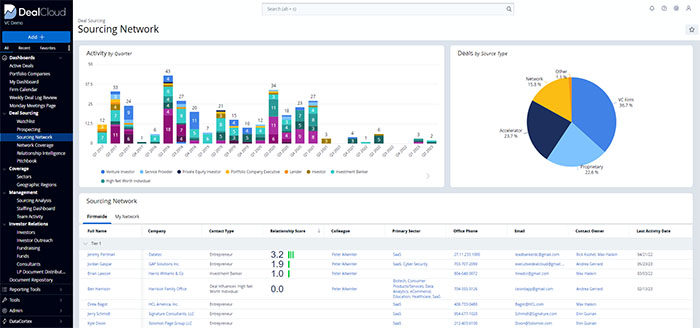

To prevent missteps like these, you can use Intapp DealCloud’s venture capital deal management and sourcing technology. DealCloud lets you keep track of your network contacts and any activity with those contacts — all in one place. With DealCloud, you can ensure all key information is accessible to the right team members at your firm.

In addition to tracking every relationship, DealCloud users can categorize, tag, organize, and report on their relationship data. From tracking your executive network pipeline to looking up funding history data, your dealmakers can quickly find the information they need to make better decisions.

3. Use deal sourcing intelligence tools

Gear up with tools and reports that let you access critical background information and help you source profitable investment opportunities. A pipeline management solution like DealCloud lets your teams easily access and leverage any field or data set, regardless of fund size or investment preferences.

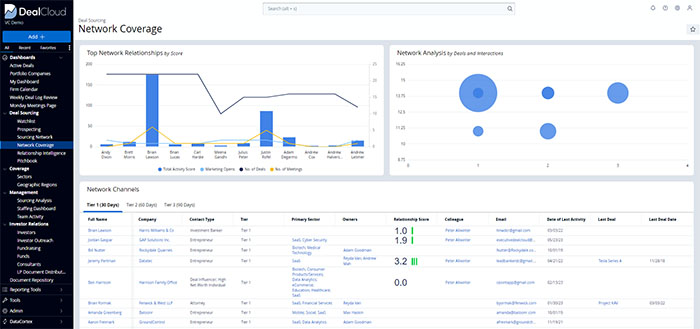

DealCloud’s provides your firm with fully interactive reporting. Your team can use the Network Coverage dashboard to view deals and introductions by sources and date. They can quantify the value of their collective network and measure the effectiveness of their outreach efforts in a single view.

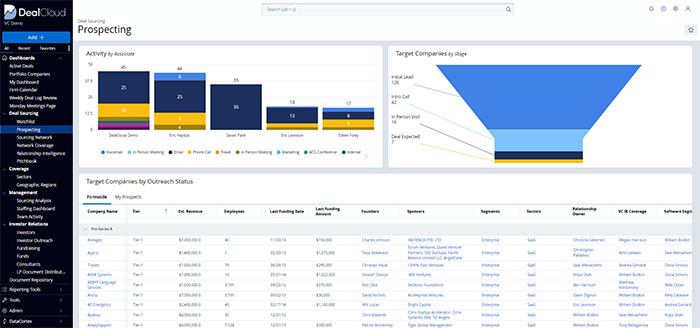

Dealmakers can also use DealCloud to track prospecting and origination activity, including meetings and communications. Your dealmakers can also monitor target companies by stage.

With integrated tools such as SourceScrub, your team can also find and automatically collect real-time private company data. By integrating third-party data providers within a single source of truth, your team will have more time to focus on high-touch tasks like relationship building and due diligence.

DealCloud also offers a robust desktop and web application as well as a mobile app. Users can easily source new deals from wherever they are and keep pace with the fast-moving venture capital landscape.

4. Attend events and join networking groups to grow your referral base

More successful deals originate from relationships and referrals than from any other source. An HBR survey of nearly 900 venture capitalists concluded that more than 30% of deals originated from leads from former colleagues and work acquaintances.

When sourcing venture capital deals, you first must source relationships. By actively engaging in industry events and professional communities, you’ll expand your network and deepen key relationships.

5. Attend industry events

The connections you make at industry conferences and networking events could potentially lead to your next big deal. That’s why it’s important to collect business cards and contact information when you attend. It’s also critical to make sure that you don’t lose this data and can easily find it later when you need it.

DealCloud’s mobile app makes adding new contact information almost effortless. Your professionals can scan business cards directly into DealCloud using the in-app business scanner equipped with optical character recognition (OCR). Once they’ve added a new contact, DealCloud retrieves information about that individual or firm — so your team member can gather any additional, actionable data right away.

Additionally, your professionals can use the DealCloud Outlook add-in to track all communication activity when planning and conducting a meeting or call.

6. Join venture capital–focused groups on social media

By joining industry-specific groups on social media platforms like LinkedIn and X, formerly Twitter, you’ll have insight into the top players and topics in the industry. You can also use these groups to network with colleagues, who can help you determine what companies to target next.

To find ongoing discussions about sourcing venture capital deals, make sure to leverage the following:

- Relevant hashtags — Each day, consider searching X for hashtags like #venturecapital, #startups, #entrepreneurship, #business, #privateequity, #vc, #funding, #investing, and #venturecapitalist. It only takes a few minutes to discover what related topics are trending on social media and who is actively contributing to these discussions.

- Influencers — For maximum visibility, be the first to comment on popular venture capitalists’ threads. Use the hashtags above to look for posts with the most engagement and follow those authors. Be ready to jump in on their next post with your thoughts.

- Email newsletters — Did you know you can reply to most email newsletters? Venture capital commentators love to hear from their audience members, so respond to continue the conversation they initiate.

For more profits, source better — not just more — venture capital deals

Firms that want to source better venture capital deals need to stop wasting time on mismatched, untenable businesses. Instead, they need to clarify their investment theses.

To improve the quality of your deals and increase your overall success rate, you need to use the best services and tools to stay organized and spend your time wisely. And you need to continually grow and nurture your network to meet more relevant founders with viable ideas.

Intapp DealCloud’s enterprise-grade, single-source technology is built to help you source high-quality venture capital deals. With DealCloud, you can find the deals that will provide the most value for your firm and execute those deals more effectively.

Contact us today to learn more about how Intapp DealCloud’s venture capital deal management and sourcing technology can help your firm accelerate its success.