Investing in the right CRM for M&A is critical to successfully managing arduous and complex corporate M&A deal processes. With deal activity in 2022 expected to remain strong, the time is now to invest in firmwide systems and process management solutions. According to the latest Dealmaker Pulse survey report, 89% of investors predict the same level or increased deal closings in the coming 6 months as experienced in the past 6 months. The many people involved in M&A deals have different priorities, expectations, concerns, and goals, and they must efficiently work together. To balance the needs and complex relationships of corporate development teams, it’s vital to choose the right CRM software. The right CRM should help companies seamlessly organize, share, and analyze deal pipeline information. A firm should choose an M&A CRM system that offers real-time, actionable insights, ensuring all deal participants stay on the same page. Dealmakers should also prioritize a system that meets their company’s unique needs. Deals in healthcare, manufacturing, technology, and consumer products all differ, and corporate development teams need industry-specific software that can address the many nuances. This blog highlights why purpose-built technology for M&A is crucial for sourcing and originating deals, as well as managing the deal lifecycle and post-close analysis. We’ll also explore the different technical capabilities companies need to remain competitive.

Sourcing and originating deals

To stay competitive in the fast-paced M&A environment, it’s imperative to deploy a CRM that provides transparency and insights for sourcing and originating new deals. Corporations that have an active M&A strategy must access a single source of truth to quickly capture potential and current deals, deal stages, and stakeholders. By streamlining the initial stages of pipeline management, corporate development professionals can invest energy in strengthening new and existing relationships rather than wasting time manually updating data or searching through unreliable spreadsheets.

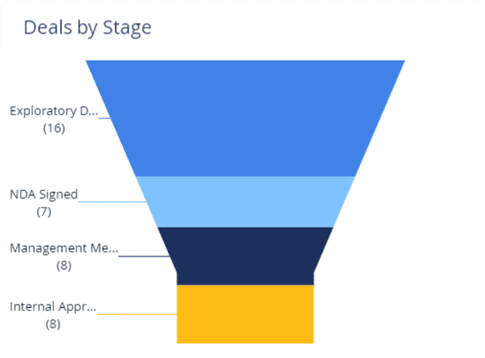

Organize Corporate M&A Transactions by Deal Stage to Help Corporate Development Teams Quickly and Easily Assess Progress to Goals

Whether you’re having initial discussions, hosting management meetings, or performing due diligence, CRM software can help you by providing a clear and up-to-date view of the M&A pipeline.

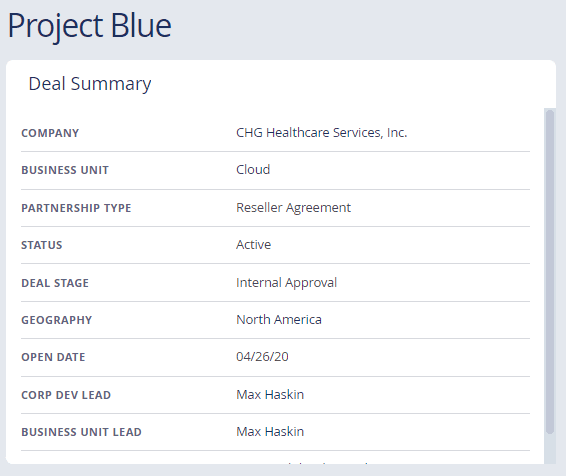

Corporate Development Professionals, C-Suite Staff, and Other Stakeholders Can Easily Surface Key Deal Information

Being granular at the start of a new deal is crucial, especially given the likelihood that a given deal will fall apart or not close. M&A-specific CRMs provide detailed summaries of every deal to ensure all stakeholders can access the information they need – including risks and opportunities – at any given time.

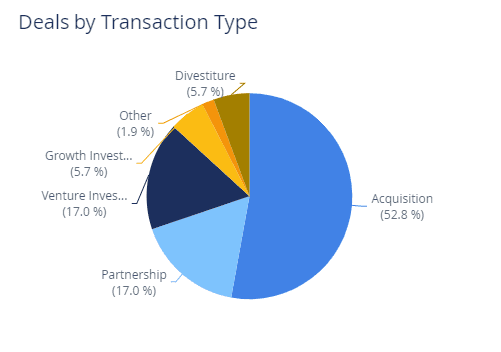

Corporations Can Track Deal Flow by Transaction Type to Assess Progress Towards Overall M&A Strategies

Corporate development professionals know that every M&A deal is unique. Purpose-built CRM for M&A can capture deals by transaction type so corporations can effectively manage diversified strategies.

“We have a large group of people who devote a significant amount of time to sourcing and developing acquisition opportunities,” said Sean Alford, Senior Vice President of Corporate Development at Ziff Davis. “As a result, we have a robust pipeline of deals in many different stages across many different geographies and in many different sectors of the TMT space. DealCloud has been critical in helping us to organize, monitor, and manage this pipeline.”

Managing the deal lifecycle

Once a deal is underway, firms can leverage customizable functions within CRM platforms to empower stakeholders to track and accelerate every deal in every stage of the pipeline. To successfully close deals, corporate development teams must constantly collaborate and communicate. Purpose-built technology like Intapp DealCloud gives companies the cloud-tools they need to update deal details regularly. This allows team members to work diligently and meet both personal and team goals. Tracking deal progress is also vital for accountability. A company’s CRM should provide legal, IT, accounting, and deal teams visibility into targets and key deadlines.

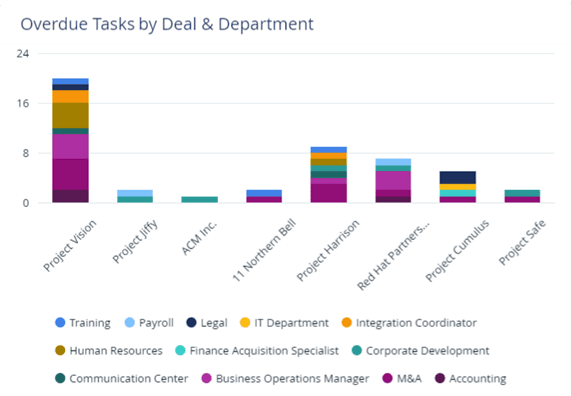

Corporate Deal Team Members Can Assess Outstanding Work by Various Departments to Help Close Corporate M&A Deals

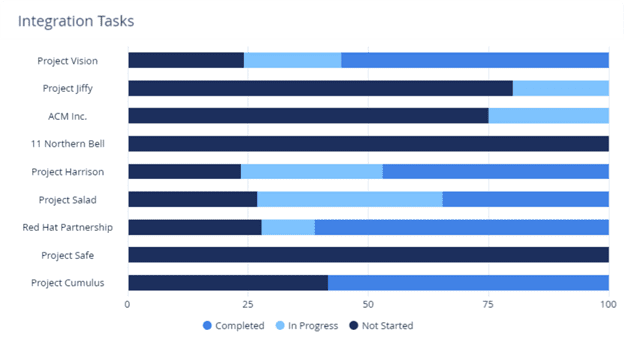

Having measurable processes that successfully capture both internal and external workflows is important for dealmakers, especially in merger scenarios. For example, having oversight into key integrations and outstanding tasks is relevant for all M&A stakeholders.

Corporate Development Leaders Can Easily Track Progress Toward Mergers and Corporate Integrations

The right CRM for M&A will connect data, people, and processes, accelerating deal pipelines and wins for your corporation.

Post-close analysis and reporting

Investment insights should be actionable at every stage of every deal, even after transactions close. Dedicated CRM platforms with advanced data capabilities make both historical reporting and forecasting for future M&A transactions seamless. DataCortex, for example, offers a fully integrated solution that quickly produces complex reports, analyzes industry trends, and evaluates potential synergies between companies. DataCortex also helps M&A professionals make data-driven decisions based on past, present, and future opportunities.

A CRM for M&A deal processes

The M&A deal process is complex at every stage, and requires a CRM built to address all its complexities. DealCloud was designed to help corporate M&A teams manage their deal pipelines and relationships. DealCloud offers a flexible, configurable system that can meet the unique needs of M&A transactions. To manage complex relationships, due diligence workflows, and pipeline management processes, you need a CRM that provides overviews of roadblocks and progress. DealCloud offers a single source of truth for all stages of a deal, including the early stages when everyone needs to stay informed.

Schedule a demo today to learn how DealCloud’s can help you manage the complex M&A deal process and remain competitive.