Economists, strategists, and research firms have already completed extensive research on the market impacts of the COVID-19 pandemic. Intapp Strategic Consulting has considered the implications of this research on law firms and has identified three key themes for the coming year.

Demand for legal services will change, and shrink

Although business-to-consumer (B2C) industries have been most immediately affected by the pandemic, market sentiments have driven extensive shifts in the nature of legal services demanded across all industries. Our own research indicates a net drop in total work volume, with additional pricing pressure likely to follow.1

Reports show that 94% of Fortune 1000 firms2 have experienced disruptions related to COVID-19, which gives a strong indication of the pandemic’s impact across global industries. Although the effects on many industries have been well documented, it remains less clear what the follow-on impact will be for legal services demand.

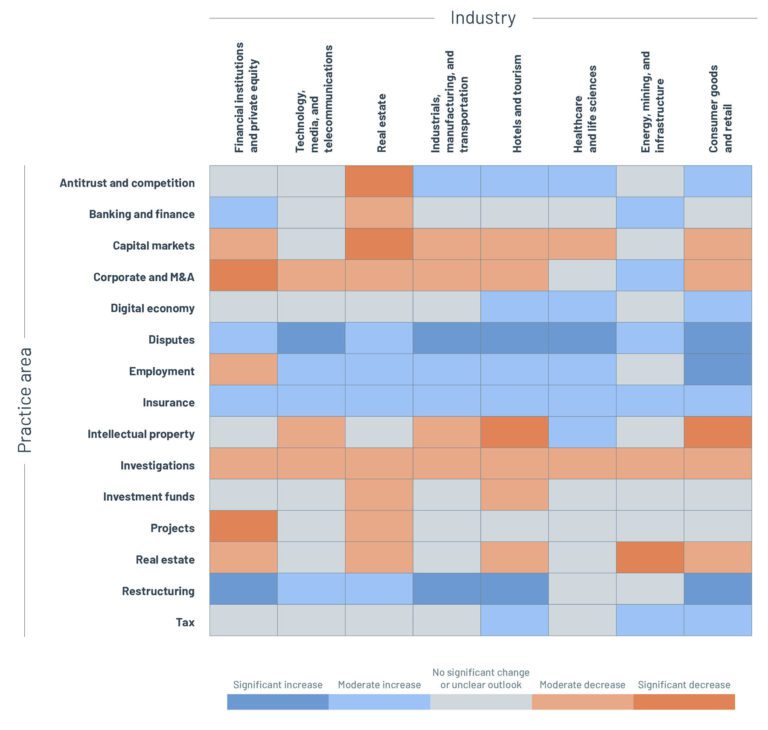

To provide insight to client firms, Intapp Strategic Consulting has developed a demand impact model, which assesses business issues facing each industry and the subsequent implications on legal services.

The Intapp demand impact model outlines the anticipated demand shift across five levels of impact, from severely negative to heavily positive. Although the assessment outlines directional changes in service volumes, our ongoing research will help quantify these impacts as well as the effects of related pricing pressures.

Overall, we anticipate that the COVID-19 pandemic will cause a drop in the total volume of legal services clients demand. Across all industries, we anticipate the following outcomes:

- Countercyclical services — such as restructuring, insolvency, and disputes — will see increased demand. However, lessons from the 2008–09 recession indicate that this increase will be softened by a likely decrease in overall client legal spend.

- Although certain transactional services (e.g., mergers and acquisitions) will see a short-term drop in demand, we expect increases in restructuring, loans, and credit facilities as lenders strive to determine their exposure and manage the fallout of insolvencies in their portfolios. We anticipate a similar demand shift for tax services in a few months, once a clearer picture of the business landscape becomes available.

- Antitrust and competition and investigations will likely see a softening in demand as regulators revise their focus to support their respective governments in supporting new pandemic–related legislation.

Our research also suggests the following opportunities across specific industries:

- The energy, mining, and infrastructure industry is a critical infrastructure sector in many geographies (e.g., the United States) and we thus expect it to face relatively fewer industry impacts from the COVID-19 pandemic.

- Healthcare and life sciences will continue to lead the fight against COVID-19. We believe legal services demand will remain buoyant as a result of heightened business demand and significant change, such as employment and supply chain issues, not to mention increased government intervention.

As firms seek to manage their exposure to the effects of this pandemic, our research offers a point of reference for where that risk is likely to be more greatly felt.

Law firms that serve small businesses will feel the greatest impact

The financial impact is greater for small businesses across all industries, primarily due to liquidity challenges, which in turn fall more heavily on law firms servicing such clients.

A recent JP Morgan report3 highlights how small businesses with limited cash buffers and irregular cash flows are least likely to survive economic downturns. The impact of the pandemic on consumer demand and, consequently, on cash flows has been evident, with industry indicators reporting significant spending declines (e.g., a 75% decline in transportation spending and an 85% decline in sports and entertainment outlays4).

As we go to press, many experts estimate the duration of the economic contraction in the United States and Europe will span Q2 2020 at a minimum,5 which exceeds the cash buffer days — i.e., the number of days of cash outflows a business can pay out of its cash balance, were its inflows to stop — of 75% of small businesses across all but one industry.6 These two factors of severity, combined with the duration of cash flow impact, create the perfect storm of existential threats for smaller businesses in particular.

Law firms that serve a client base heavily skewed towards small business will need to manage their risk, which may range from immediate cash management concerns to more structural changes, depending on the severity of their exposure.

Our recommended tactics include:

- Cash management activities — collection of overdue fees, reduction in acceptable work-in-progress thresholds, and potential renegotiation of payment terms.

- New opportunity identification — provision of legal advice aligned to newly introduced legislation to buoy the economy, or to shifting client requirements.

- Clients and industries realignment — reorientation of firm strategy toward existing strengths in other clients and industries.

The effects will soon spread beyond B2C industries

Economic contraction in B2C industries was most immediate, but analysis indicates that other industries are already starting to see contractions, too.

The economic impact of subdued services consumption has become apparent following the introduction of regional and national lockdowns. Another significant impact of the lockdowns is their effect on productivity across many industries. Analysis by the London Business School indicates that in many industries, less than half the total workforce is able to work remotely.7

As a result of reduced consumption and productivity, initial estimates by Goldman Sachs highlight quarter-on-quarter annualized growth rates of negative 24% in Q2 2020. Half of this GDP reduction relates to consumption categories requiring face-to-face (F2F) interaction, while the other half is driven by non-F2F consumption related effects.

Next steps: Aligning actions to long-term strategy

Many firms have already rightfully taken immediate countermeasures to sustain stronger cash management positions. Once firms have embedded immediate countermeasures, ongoing scenario planning should focus on medium-term (6 months and beyond) implications rather than short-term results.

Firms should leverage leading indicators across the industry to inform their plans for medium-term shifts in market demand across industries and practices, as well as the associated impacts on the size and shape of their practice areas and supporting operations going forward.

Intapp is already undertaking ongoing research to support our law firm clients with this market intelligence. We can help firms leverage analysis from the last financial downturn to better manage shifts in practice focus, reallocation of resources and cashflow interventions required to successfully navigate through the current economic climate.

We recommend that firms use these scenario plans in alignment with a long-term roadmap to prudently manage their business through the ensuing period in alignment with their ultimate strategic goals.

For more ways to help your firm address pandemic-related concerns, visit intapp.com/covid19.

To learn more about Intapp Strategic Consulting, visit intapp.com/consulting-services.

1 Intapp COVID-19 weekly pulse survey, intapp.com/covid19.

2 Fortune, “94% of the Fortune 1000 are seeing coronavirus supply chain disruptions: Report”, fortune.com/2020/02/21/fortune-1000-coronavirus-china-supply-chain-impact, February 21, 2020.

3 JP Morgan Chase & Co. Institute, “Facing uncertainty: Small business cash flow patterns in 25 U.S. cities, institute.jpmorganchase.com/institute/research/small-business/facing-uncertainty-small-business-cash-flow-patterns-in-25-us-cities, August 2019.

4 Goldman Sachs Economic Research, “U.S. daily: A sudden stop for the U.S. economy,” goldmansachs.com/insights/pages/gs-research/us-aily-20-mar-2020/report.pdf; March 20, 2020.

5 Goldman Sachs Economic Research, “Roaring into recession,” goldmansachs.com/insights/pages/roaring-into-recession.html, March 26, 2020.

6 JP Morgan Chase & Co. Institute, “Cash is king: Flows, balances, and buffer days — evidence from 600,000 small businesses,” institute.jpmorganchase.com/institute/research/small-business/report-cash-flows-balances-and-buffer-days, September 2016.

7 International Council for Small Business with the London Business School, “The economics of a pandemic: The case of COVID-19,” icsb.org/theeconomicsofapandemic, March 23, 2020.1