According to Deloitte’s 2022 Commercial Real Estate Outlook, 8 in 10 respondents say their firms lack a fully modernized core system that easily incorporates emerging technologies. In fact, most commercial real estate (CRE) firms continue to depend on legacy technology systems that often hamper progress and their ability to innovate. For CRE firms to remain competitive in today’s ever-changing industry, they need to leverage purpose-built technology, including real estate investment management software.

DealCloud — purpose-built investment management software for real estate firms — delivers a best-in-class solution for CRE professionals, right at their fingertips. Discover how DealCloud can help you manage your deal pipeline, discover properties, and better centralize and report on data.

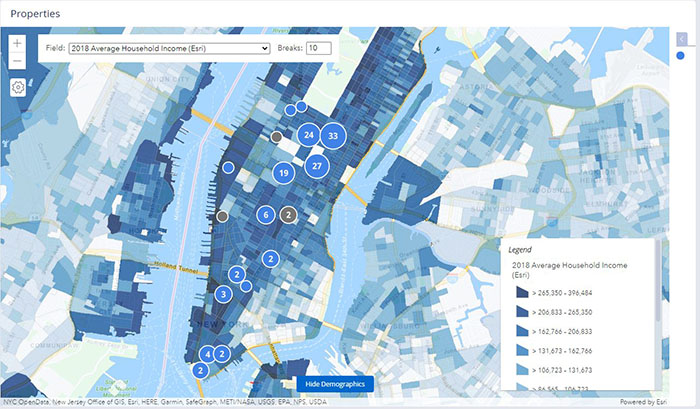

Geographic and demographic intelligence

By leveraging real estate investment management software like DealCloud, real estate investors can evaluate their own properties and deals alongside vital demographic information. Through a partnership with Esri, a leader in mapping software and data, DealCloud removes the need for teams to navigate between disparate data and intelligence sources. Instead, teams can review proprietary data alongside rich geographical attributes, such as total population and median income, directly within their real estate investor relations software.

Users of this software can also view layers on the map to help visualize the data landscape and gain a complete overview of properties they’ve invested in or considered in the past. The software also provides robust information about the neighborhood accessible in a single report, helping users easily and quickly determine the strength of an investment.

Map-based discovery

With DealCloud’s investment management software for real estate, CRE investors can complete a full analysis right from the map without accessing each entry’s detail page. New features for DealCloud’s real estate investment management softwareinclude a map-pin design and clustering mechanism to facilitate exploration and discovery; updated map-pin pop-up windows that provide summary information and images; filters that narrow properties by entry characteristics; and maps driven by latitude and longitude values that allow deeper exploration of properties and plots of land.

Interactive reporting

Today’s most successful real estate investors rely on reports and data analytics to inform their decision-making and strategy development. With transactions constantly evolving, real estate investors benefit from real-time reports that help them zero in on the most time-sensitive and high-priority items. By leveraging DealCloud’s real estate investment management software, CRE investors can report on their properties and generate detailed reports with a click of a button.

DealCloud unifies data, systems, and people with fully interactive reporting. Users can customize every dashboard, chart, graph, tear sheet, data sheet, and profile to meet their preferences. For example, investors can schedule reports to be sent to themselves or others as a PDF or Microsoft Word document at a cadence that works best for them. DealCloud’s real estate investment management software also lets teams use either a web or mobile interface to download and design preformatted reports based on any data set.

Measurable results

Real estate investment management is complex and requires technology platforms that can rise to the task. Offering enhanced pipeline and properties visualization, map-based property discovery, and streamlined analysis, DealCloud’s real estate investment management software provides the most comprehensive real estate investment management solution available. CRE investors can use this purpose-built real estate investor relations software to centralize all property data in a single location as well as sort, navigate, and pull the data they need in a matter of seconds.

Schedule a demo to learn how DealCloud’s real estate investment management software can help you accelerate data discovery, improve institutional knowledge sharing, and track deal pipeline updates.

To learn how Kayne Anderson Real Estate leverages DealCloud, download our case study.

To learn how Kairos Investment Management Company uses DealCloud, download our case study.