In the capital markets industry, many say “it’s all about who you know.” Building and maintaining a network of relationships with key industry players is vital to deal sourcing, business development, fundraising, and additional related functions that aid in a private equity firm’s success – and yet – many firms still aren’t leveraging these networks in the most lucrative way. In a recent Forbes article, Grant Thornton reported that “our survey of 217 middle-market portfolio companies revealed that just 10% of their private equity fund investors have made or are currently making […] valuable introductions for them. At the same time, nearly 85% of companies consider these connections to be pivotal to their success.”

For the modern capital markets professional who understands this vitality, finding the proper technology to assist in the storage, organization, and maintenance of their professional network is a need-to-have. In this article, we will highlight the rise of relationship-driven AI trends, the importance of relationship intelligence and the leading industry tools available to private equity and other capital markets firms today.

Understand the landscape: What is relationship intelligence?

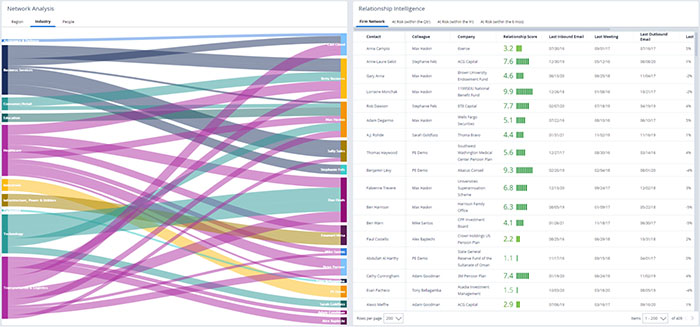

CRM relationship intelligence solutions — a type of private equity software — give dealmakers a competitive edge by identifying and leveraging the strongest relationships within the firm. Not only does relationship intelligence software help you store and share your firm’s professional ecosystem of connections, it also creates relationship scores based on the volume, recency, and type of engagement a connection receives by passively harvesting metadata from emails, calendars, and other events. These scores can help deal professionals quickly identify strong relationships that could produce new deals, and attend to weak relationships that may be at risk of loss or damage.

Rather than continuing to waste time on manual data (due to a lack of specialized private equity software), M&A transaction professionals can now connect their email activity to the firm’s pipeline management solution and other private equity software solutions, assured that every piece of correspondence, file, and meeting will be automatically updated.

Identify and expand your professional network

Although it’s critical to build and maintain personal and professional networks, a firm gains a true competitive edge in the capital markets industry by helping users understand and make use of the collective ecosystem of the entire firm’s connections and contacts. When you store and organize key relationship information in a central pipeline management solution, your firm can establish a relationship network that promotes firmwide transparency and serves as a single source of truth.

When firms better centralize their relationship ecosystems using a CRM with relationship intelligence — like Intapp DealCloud — more opportunities emerge. The relationship intelligence technology within DealCloud uses metadata to scan your network and help you quickly identify connections who have relationships with target companies and deal participants, helping you initiate introductions to key players and source more deals. The relationship score helps you to better serve connections that need attention so you can build upon relationships that are the most likely to yield new business. Storing this information within DealCloud also provides you with the assurance that vital connections don’t churn when an employee leaves the firm.

Maintain relationships with key deal sources

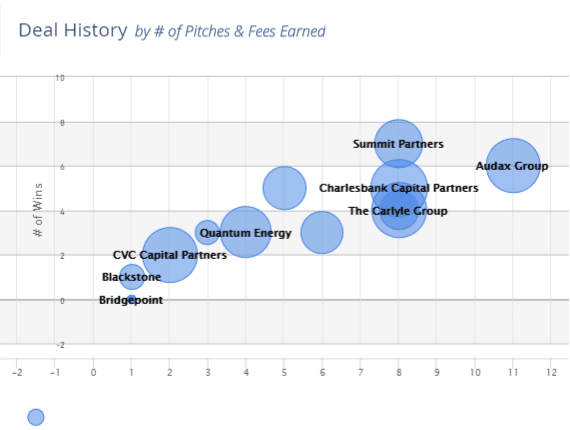

Staying engaged with key players in your private equity firm’s deal network is vital. When a private equity firm’s networking foundation is strong, existing deals can lead to even more deals. Staying attuned to the health of your firm’s relationships ecosystem is the best way to find these lucrative connection opportunities. Although this was once a time-consuming task — and nearly impossible to manually maintain — modern tools like DealCloud relationship intelligence can automate your relationship network so you can focus on action and results.

Using and understanding your relationship score is one of the best and simplest ways to quickly examine the health of a connection and determine the best way to proceed with communication. A high relationship score means a contact is receiving consistent communication from your firm. A low score shows that contact likely hasn’t received attention in some time. When this information becomes instantly available within your pipeline management solution, your team can resolve issues more quickly and source new deals with greater confidence.

Once your network expands from your personal connections to a firmwide matrix, a realm of connections suddenly opens up in a transparent and actionable way. You’ll swiftly gain full insight into the wellbeing of every individual’s network, letting you offer direction with informed confidence in your strategy. Visibility into overlapping connections reveals introductions to target companies that you may not previously have known to look for. With relationship intelligence, your firm’s relationship ecosystem becomes a streamlined, robust tool for deal origination and fundraising success.

Create perfect communication

When firm stakeholders have visibility into all deal communications within the firm, they’re better able to understand how and when conversations are happening in order to gain clarity and create consistent messaging with current and prospective clients. This builds better firmwide transparency and helps stakeholders present a united front to clients that bolsters relationships.

With DealCloud’s relationship intelligence solution, communications data — email opens, clicks, and other relevant metrics — automatically syncs to the firm’s CRM, allowing everyone within the firm to access valuable information and actionable insights. This simplifies answering questions like: Which emails didn’t my client open? What links did they click? When was the last time we chatted on the phone? Then you can use insights from relationship intelligence to address outstanding concerns in your next communication with that client.

DealCloud also lets you internally prioritize and assign ownership to each contact, ensuring the most relevant person maintains informed, consistent communication with key relationships on the firm’s behalf. This, in turn, provides firms with stronger coverage models and better overall relationship management.

Using DealCloud relationship intelligence, you can transform one of the most vital pieces of successful dealmaking — building and maintaining a network of strong relationships — with organized, transparent, prioritized, and streamlined process.

Schedule a demo to learn more about Intapp DealCloud’s fully customizable pipeline management solution including relationship intelligence technology.