Leveraged finance and debt markets are popular but risky. Around $11 trillion of corporate debt will mature globally between 2022 and 2026, as per S&P Global’s ratings research. S&P experts also believe that the U.S. corporate default rate could more than double during a recession.

As dealmakers continue to face economic uncertainty in the global capital markets, many are turning to long-held relationships, data, and technology to help originate quality deals in the leveraged finance and debt capital markets.

1.Keep an eye on the latest trends in risk

Economic risks change often, so it’s crucial to know which risks affect your deals and how to manage them well. Corporate debt has increased due to several factors. These factors include problems with supply chains, inflation, higher interest rates, and easy access to cash.

- Supply chain issues — Companies take on more debt when their supply chains are disrupted; when their supply chains remain disrupted for extended periods, they can eventually succumb to rising costs.

- Inflation — Similarly, if inflation continues to increase, companies may cease to be profitable and become unable to pay their loans.

- Rising interest — As interest rates rise, many companies refinance their debts or take on new debts to pay off the old ones. Eventually, those debts will catch up to them.

- Easy cash — Higher interest rates mean that lenders (and private equity investors) are still throwing cash at many companies. This can predispose some companies to take on more debt than is prudent.

When businesses take out loans to build capital and purchase assets, they put themselves in a vulnerable position. Private equity firms often use borrowed money to buy and improve companies before selling them. However, the success of this depends on solving the main problems the business is facing.

2. Concentrate on defensive industries

Economic volatility can exponentially increase risks within the leveraged finance market. Dealmakers can address this by targeting industries that remain historically strong during a recession, such as the pharmaceutical, bio-sanitation, food, technology, media, and telecommunications industries.

Most industries that are resilient to economic crises are those in which spending is largely inflexible, such as health care. Other industries may have more unique drivers; for instance, lower-cost entertainment may see boosts during recessions as consumers pull back their spending.

By focusing investments on defensive industries that are less vulnerable to negative economic impact, leveraged finance dealmakers can maximize their impact and ROI.

3. Monitor company activities using third-party data

Use up-to-date third-party databases to monitor private company activities that could indicate excellent opportunities.

Third-party databases track key metrics, including funding rounds, layoffs, and C-suite movement. Identify companies within your target industries that are showing signs of struggle — such as failing to meet their quarterly profit goals — that could make them good options for leveraged finance.

Make sure your databases and dates are up-to-date and complete. Otherwise, your company won’t be able to seize opportunities or analyze the best action.

Intapp DealCloud connects with external data sources like PitchBook, FactSet, and Preqin. This allows you to analyze and monitor company activities and be the first to take advantage of new opportunities. Discover key information such as:

- Whether a company has already entertained a leveraged buyout

- What the organization’s posted cash flow is

- How many recapitalizations the company has gone through

- Whether a company is in the middle of restructuring

- What the company’s balance sheet looks like

- Whether the organization has relationships with other specific companies

4. Brush up on your business law

Leveraged finance and M&A markets require bespoke contracts, careful negotiation, and, in most cases, specialized legal knowledge. These companies handle complex legal structures and issues, including the legal consequences of leveraged finance and debt capital market transactions.

Without some legal knowledge, it becomes difficult to determine whether something really is a good deal. You don’t have to do underwriting, but you should know the basics of mergers, insolvency, and acquisition financing. Learn how to answer questions such as:

- What’s the difference between a first lien and a second lien?

- What are the regulatory implications of a different capital structure or financing structure?

- Which debt markets are most likely to run into legal issues?

By brushing up on business law, you’ll be more likely to ask the right questions and catch issues earlier in the process.

5. Pack your deal sourcing pipeline into a single platform

The credit and leveraged finance industry is due for a technological overhaul. By consolidating your deal sourcing into a single platform, you can:

- Increase collaboration with your deal origination team

- Consolidate the information that you need so you can access it when you need it

- Gain access to detailed analytics, both on a per-client level and across all clients

The DealCloud platform simplifies the process of finding leveraged finance deals for professionals in the credit markets.

The software’s complete, all-in-one Direct Sourcing dashboard tracks leads from initial acquisition and beyond. By configuring this dashboard, users can view and organize their target companies by category or tag. In doing so, lenders can sort and view companies by team member, stage (such as initial lead, intro call, and deal expected), and other categories.

The Direct Sourcing dashboard also provides a holistic and historical view of sourcing and origination efforts over time. This is vitally important data for leadership teams at credit and leveraged finance firms.

6. Leverage technology to develop relationships

Professionals in debt capital markets must keep their strategies and relationships strong due to increased competition and available funds. Due to complex relationships, using Rolodexes and spreadsheets to store information is no longer acceptable.

Firms continually develop relationships with a wide array of professionals and firms at every stage of the transaction lifecycle. Without the correct technology, finance and credit professionals risk losing connections and letting relationships become stagnant.

DealCloud’s software is crucial for managing relationships. It brings together communication data and helps firms transform everyday activities into valuable information. This is especially useful when searching for leveraged finance deals.

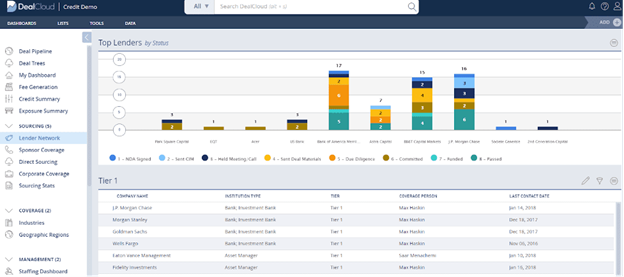

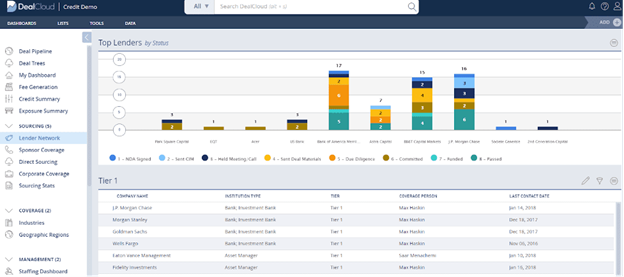

Using the Lender Network dashboard in DealCloud‘s leveraged finance software helps users utilize their relationship data effectively. The dashboard enables users to easily keep track of their networks, which is critical when sourcing leveraged finance deals.

Credit professionals also have a full view of co-investors and fellow deal participants using the Lender Network dashboard. Easy-to-use filters allow lenders to view firms based on strategy and institution type, as well as the stage that lenders are at in the deal process.

7. Mine “big data” to source more deals

Leveraged finance professionals seek to enhance efficiency in all aspects of their business operations. After all, a speedy response or bid can be the difference between a closed deal and a dead deal.

Credit and leveraged finance professionals use both their own data and data from others to make well-informed decisions. With the right technology, professionals can collect the data they need without sacrificing efficiency and speed.

DataCortex is a tool that assists in managing and utilizing various types of data within the DealCloud platform. This tool enables the transformation of data into valuable information. The software enables you to make critical decisions more quickly and identify new, meaningful opportunities when sourcing leveraged finance deals.

The DealCloud platform connects disparate data sets across systems, operationalizes processes for optimal efficiency, and redefines what your firm can accomplish in a single day. With DataCortex, you can easily run complex reports, analyze industry trends, and evaluate potential synergies in the same hub where you originate deals and manage relationships. This helps finance professionals and their firms make more money, reduce risk, and stay competitive in the market.

8. Automate your outreach

Professionals in the leveraged finance and debt capital markets must maintain strong relationships with their contacts — but not every interaction has to be a phone call. Instead, use automation to send newsletters and drip campaigns to keep your company in people’s thoughts. You never know when a contact will decide to take the next step, or when they’ll need to talk to someone about the perfect opportunity.

Dispatch tracks email activity, metrics, and analyses to help you improve your relationships with fewer hours logged. Refresh prospect touch points and build relationships through automated mail, and track how frequently leads interact with your content. You can even trigger emails based on prospect behavior.

You can use automated newsletters and emails to build authority, even with people who aren’t ready to negotiate a deal. Display your expertise within the market and show them that you’re the partner they’re looking for.

9. Manage your compliance

Just as compliance requirements are constantly changing, your business catalog and potential conflicts are constantly expanding. Identifying and resolving these conflicts can be difficult in a market as integrated and complex as leveraged finance.

It can also be difficult to complete due diligence for different situations, as processes may consist of various different steps — from disclosing financial sponsors and third-party lenders to following broader due diligence processes for investment banking and leveraged loans.

You can improve your conflict resolution and risk management with a consolidated compliance platform. DealCloud automates conflicts of interest. This helps to speed up deal execution and minimize errors. As a result, you can close deals faster and maintain their quality.

10. DealCloud: The dealmaking solution built for leveraged finance

Leveraged finance professionals will sustain clear competitive advantages in the debt capital markets if they leverage and embrace the transformative potential of technology to improve operational efficiency, adapt to changing conditions, and executive on their differentiated strategy.

There are many ways leveraged finance and credit professionals can use DealCloud’s leveraged finance software to source deals. DealCloud assists participants in the leveraged finance market to improve their efficiency and strategic approach. It achieves this by offering a centralized platform for all deal information, relationships, and data.

DealCloud centralizes intelligence, turning it into insights that help your firm and people grow. With Intapp DealCloud’s leveraged finance software, your firm can successfully institutionalize its deal and relationship processes.

Schedule a demo to find out how you can better source leveraged finance deals in the debt capital markets.