The leveraged finance and debt capital markets are hot, but they’re also high-risk: According to S&P Global’s ratings research, an estimated $11 trillion in corporate debt will mature worldwide from 2022 to 2026. S&P experts also believe that the U.S. corporate default rate could more than double during a recession.

As dealmakers continue to face economic uncertainty in the global capital markets, many are turning to long-held relationships, data, and technology to help originate quality deals in the leveraged finance and debt capital markets.

Keep an eye on the latest trends in risk

Economic risk profiles change constantly, which is why it’s important to understand which current risks influence your deals, and how to effectively manage those risks. Currently, the top risk factors that contribute to the increase in corporate debt load are supply chain issues, inflation, rising interest rates, and easy cash.

- Supply chain issues — Companies take on more debt when their supply chains are disrupted; when their supply chains remain disrupted for extended periods, they can eventually succumb to rising costs.

- Inflation — Similarly, if inflation continues to increase, companies may cease to be profitable and become unable to pay their loans.

- Rising interest — As interest rates rise, many companies refinance their debts or take on new debts to pay off the old ones. Eventually, those debts will catch up to them.

- Easy cash — Higher interest rates mean that lenders (and private equity investors) are still throwing cash at many companies. This can predispose some companies to take on more debt than is prudent.

When businesses take out loans to build capital and purchase assets, they put themselves in a vulnerable position. Private equity firms will frequently use leveraged finance to purchase companies, improve them, and sell them — but the success of such an endeavor is predicated on resolving the major pain points the business is experiencing at that moment.

Concentrate on defensive industries

Economic volatility can exponentially increase risks within the leveraged finance market. Dealmakers can address this by targeting industries that remain historically strong during a recession, such as the pharmaceutical, bio-sanitation, food, technology, media, and telecommunications industries.

Most industries that are resilient to economic crises are those in which spending is largely inflexible, such as health care. Other industries may have more unique drivers; for instance, lower-cost entertainment may see boosts during recessions as consumers pull back their spending.

By focusing investments on defensive industries that are less vulnerable to negative economic impact, leveraged finance dealmakers can maximize their impact and ROI.

Monitor company activities using third-party data

Use up-to-date third-party databases to monitor private company activities that could indicate excellent opportunities.

Third-party databases track key metrics, including funding rounds, layoffs, and C-suite movement. Identify companies within your target industries that are showing signs of struggle — such as failing to meet their quarterly profit goals — that could make them good options for leveraged finance.

You must also ensure that your databases and originating dates are timely and comprehensive; otherwise, your firm won’t be able to act on opportunities while they’re still available, nor appropriately analyze the best course of action.

DealCloud integrates with third-party data sources such as PitchBook, FactSet, and Preqin so you can analyze and track company activities — and be the first to jump on the next hot deal. Discover key information such as:

- Whether a company has already entertained a leveraged buyout

- What the organization’s posted cash flow is

- How many recapitalizations the company has gone through

- Whether a company is in the middle of restructuring

- What the company’s balance sheet looks like

- Whether the organization has relationships with other specific companies

Brush up on your business law

Leveraged finance and M&A markets require bespoke contracts, careful negotiation, and, in most cases, specialized legal knowledge. The legal structures and issues that these companies deal with are intricate — as are the legal implications of leveraged finance and debt capital market dealings.

Without some legal knowledge, it becomes difficult to determine whether something really is a good deal. Although you certainly don’t need to do your underwriting yourself, you should understand the basics of mergers, insolvency, and acquisition financing. Learn how to answer questions such as:

- What’s the difference between a first lien and a second lien?

- What are the regulatory implications of a different capital structure or financing structure?

- Which debt markets are most likely to run into legal issues?

By brushing up on business law, you’ll be more likely to ask the right questions and catch issues earlier in the process.

Pack your deal sourcing pipeline into a single platform

The credit and leveraged finance industry is due for a technological overhaul. By consolidating your deal sourcing into a single platform, you can:

- Increase collaboration with your deal origination team

- Consolidate the information that you need so you can access it when you need it

- Gain access to detailed analytics, both on a per-client level and across all clients

The DealCloud platform brings many elements together to simplify the leveraged finance deal sourcing process for professionals working through the complexities of the credit markets.

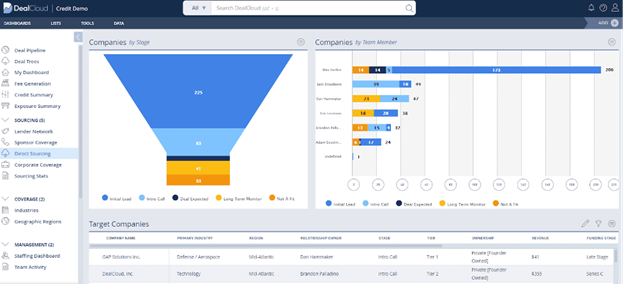

The software’s complete, all-in-one Direct Sourcing dashboard tracks leads from initial acquisition and beyond. By configuring this dashboard, users can view and organize their target companies by category or tag. In doing so, lenders can sort and view companies by team member, stage (such as initial lead, intro call, and deal expected), and other categories.

The Direct Sourcing dashboard also provides a holistic and historical view of sourcing and origination efforts over time. This is vitally important data for leadership teams at credit and leveraged finance firms.

Leverage technology to develop relationships

With competition and dry powder more prevalent than ever, it’s critically important for professionals in the debt capital markets to keep their strategies close and their relationships closer. Because of the increasingly complex nature of these relationships, storing information in Rolodexes and spreadsheets is no longer an acceptable method.

Firms continually develop relationships with a wide array of professionals and firms at every stage of the transaction lifecycle. Without the right technology platform in place, leveraged finance and credit professionals risk losing connections and letting relationships grow stale.

DealCloud’s leveraged finance software is essential for relationship management because it centralizes communication data and helps firms transform everyday activities into actionable relationship intelligence when sourcing leveraged finance deals.

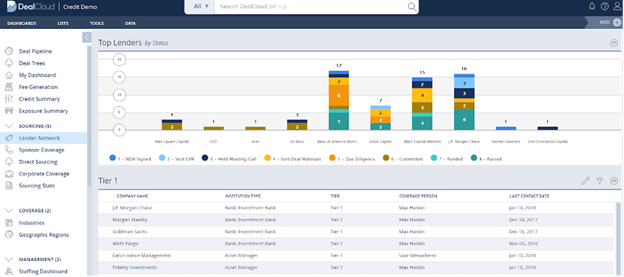

Leveraging the Lender Network dashboard in DealCloud’s leveraged finance software is just one way that users can put their relationship data to work. The dashboard enables users to easily keep track of their networks, which is critical when sourcing leveraged finance deals.

Credit professionals also have a full view of co-investors and fellow deal participants using the Lender Network dashboard. Easy-to-use filters allow lenders to view firms based on strategy and institution type, as well as the stage that lenders are at in the deal process.

Mine “big data” to source more deals

Professionals in the leveraged finance market are always looking for ways to improve the efficiency of their processes across all areas of their business. After all, a speedy response or bid can be the difference between a closed deal and a dead deal.

Additionally, credit and leveraged finance professionals orient key decision-making activity around a combination of proprietary and third-party data to ensure that they’re making the most informed decisions possible. With the right technology, professionals can collect the data they need without sacrificing efficiency and speed.

DealCloud DataCortex is an integrated data solution that allows you to manage proprietary and third-party data all within the DealCloud platform, empowering you to transform that data into institutional knowledge. The software enables you to make critical decisions more quickly and identify new, meaningful opportunities when sourcing leveraged finance deals.

The DealCloud platform connects disparate data sets across systems, operationalizes processes for optimal efficiency, and redefines what your firm can accomplish in a single day. With DataCortex, you can easily run complex reports, analyze industry trends, and evaluate potential synergies in the same hub where you originate deals and manage relationships. This allows leveraged finance professionals and their firms to accelerate profits, mitigate risk, and maintain a competitive stature in the market.

Automate your outreach

Professionals in the leveraged finance and debt capital markets must maintain strong relationships with their contacts — but not every interaction has to be a phone call. Instead, automate your marketing processes by sending out newsletters and drip campaigns to ensure that your company stays top of mind. You never know when a contact will decide to take the next step, or when they’ll need to talk to someone about the perfect opportunity.

DealCloud Dispatch tracks email activity, metrics, and analyses to help you improve your relationships with fewer hours logged. Refresh prospect touch points and build relationships through automated mail, and track how frequently leads interact with your content. You can even trigger emails based on prospect behavior.

At the same time, you can use automated newsletters and emails to build authority, even with those who aren’t yet ready to negotiate a deal. Display your expertise within the market and show them that you’re the partner they’re looking for.

Manage your compliance

Just as compliance requirements are constantly changing, your business catalog and potential conflicts are constantly expanding. Identifying and resolving these conflicts can be difficult in a market as integrated and complex as leveraged finance.

It can also be difficult to complete due diligence for different situations, as processes may consist of various different steps — from disclosing financial sponsors and third-party lenders to following broader due diligence processes for investment banking and leveraged loans.

You can improve your conflict resolution and risk management with a consolidated compliance platform. DealCloud automates the conflicts of interest process to help accelerate the execution of your deals while reducing the potential for human error — so you can close your deals faster while also ensuring their quality.

DealCloud: The dealmaking solution built for leveraged finance

Leveraged finance professionals will sustain clear competitive advantages in the debt capital markets if they leverage and embrace the transformative potential of technology to improve operational efficiency, adapt to changing conditions, and executive on their differentiated strategy.

There are many ways leveraged finance and credit professionals can use DealCloud’s leveraged finance software to source deals. By creating a single source of truth for all information regarding deals, relationships, and data, DealCloud enables leveraged finance market participants to operate more efficiently and strategically when sourcing and executing on debt deals.

DealCloud has a proven track record for centralizing firmwide intelligence and transforming it into the proprietary insights your firm and people need to grow. With DealCloud’s leveraged finance software, your firm can successfully institutionalize its deal and relationship processes.

Schedule a demo to find out how you can better source leveraged finance deals in the debt capital markets.