Dealmakers may start out justifiably excited when deals originate and sail through prescreening, but experienced dealmakers know not to set their expectations too high. No matter how much time and effort a firm puts into a deal, there’s a realistic likelihood of potential deal management roadblocks, and the deal may eventually falter.

Thankfully, firms can avoid many of these pitfalls with some basic knowledge and foresight. The more you know about the most common deal execution hazards, the better you’ll be able to anticipate them. Check out some of the most common deal execution bottlenecks and learn to bypass them before they wreak havoc on your hard-won transactions.

Confirmation Bias

Confirmation bias in private equity often results from pride in discovering an opportunity. If a dealmaker spots a potential investment, they’re naturally more inclined to want to see it through. Dealmakers often convince other team members that a purchase is worth pushing through the sales process, and disregard red flags that would otherwise be unsettling.

Both general partners (GPs) and limited partners (LPs) fall into this trap, especially in a frothy market where valuations keep climbing along with undeployed capital. There’s a temptation to buy something — whether in a particular industry, growth stage, asset class, or geography — just for the sake of buying something.

The record levels of dry powder testify to this desire. Sponsor shops feel more pressure than ever to allocate committed capital. When a business development professional sources a promising deal, confirmation bias often pushes it past checks that would have otherwise stopped it during the vetting stage. For example, you may be tempted to move forward with a target that fulfills every mandate in your investment thesis but doesn’t quite align with your new ESG commitments.

Ignoring a few lower-priority criteria just because a private company checks the “more important” boxes will eventually snarl the deal during execution. To avoid this deal management pitfall, improve the deal sourcing process by establishing a clearer investment thesis and regularly discussing your commitment to it. You should also recommit to comparing opportunities against mandates before they become deals.

Failed deals are costly at any stage, but less so at the beginning of execution. Although it’s valuable to take measured risks with acquisition, learning to quickly let go of targets when red flags arise is equally valuable.

Incomplete Due Diligence

Most deals that fall through do so at the valuation and due diligence stages, when important undisclosed facts emerge. Until this point, both sides present their ideal selves in hopes of attracting the most profitable deal.

Recall the famous Vodafone/Mannesmann deal: The acquiring party mispriced their hurdle rate by overestimating Mannesmann’s unreal goodwill, overpaying and creating what analysts called “investors’ worst fears.” The fumble cost Vodafone $45 billion in future write-downs. Additional due diligence would have prevented this retraction by properly valuing intangibles — such as brand awareness and consumer trust — on the balance sheet.

Avoid bottlenecks and blunders at this stage by taking your time despite fierce competition. When estimating or forecasting, be critical instead of assuming best-case scenarios. Run multiple financial scenario models based on varied factor combinations, and ask yourself whether your investors can appreciate the risk-reward balance of each model.

Ineffective Negotiations

None of the legwork you put into a deal matters if your team can’t agree on a deal’s terms. Deals often fall into disarray during the negotiation process for numerous reasons:

- Acquisition target leaders don’t feel valued. They perceive only lower-level players at the negotiating table, offering what they feel is lowball pricing.

- Resistance points arise too late. When mismatched values, intentions, or finances turn up later in discussions, one party always feels the other waited too long to disclose, which erodes trust and slows the deal.

- Players want to avoid negative repeats. If you have a reputation for bidding too low, sellers will spend more time ensuring they won’t be underpriced. “For the seller, if its business is in order, the financials stack up, and there are no skeletons in the closet, there should be no reason to give away any discount in pricing or terms,” write co-authors Anna Faelten, Michel Driessen, and Scott Moeller in Why Deals Fail. “Similarly, the bidder will win the prize without getting a reputation for a negotiation strategy that appears to outsiders to be continually chipping away at the price.”

To avoid frustrating execution slowdowns and unproductive talks, involve senior management from the beginning of negotiations. Short, concise, high-level touches and follow-ups go a long way, and partner visibility speaks to your seriousness and soothes management’s jitters. It also conveys your long-term intentions to sell-side intermediaries — an important demonstration that improves deal velocity. Be sure you have a way to record each connection and automatically extract insights from that relationship.

You can also sidestep this bottleneck by quickly conducting valuation and due diligence. Firms should be thorough during due diligence, but that doesn’t mean they should drag their feet throughout the entire deal lifecycle. Know your talent allocation so your firm won’t lag in these phases, and let your deal execution team focus solely on the appraisal and diligence stages so that you can set the transaction’s pace.

Finally, honor everything your team predicted or proffered in previous phases. “We pioneered what we call founder-friendly private equity,” says Tony Hill, Principal of Business Development at Trivest Partners. “Any time we transact with a business owner in the lower-midmarket, we always make a set of promises to them around the things that we will not do as part of the transaction.” Hill explains that his targets’ managers can expect to avert common snags like founder rollovers or escrow in indemnification when the group closes deals.

Unfamiliar and Unpredictable Human Behavior

Human behavior can also derail a deal. The most innocent cases of people-foiled deals involve clashing cultural values and communications. “In emerging markets, generally the deals are more likely to fail due to the seller and buyer taking a very different view of the market growth potential of the target,” says capital markets lawyer Allan Taylor in Why Deals Fail.

But experienced dealmakers know that misconduct, cold feet, and manipulative curveballs also slow or stop deals. “We almost closed on a deal earlier this year after about 10 months of work,” recalls an anonymous buyout dealmaker in the Wall Street Oasis online discussion forum. Due to an unfortunate business move by the owner, the run rate, EBITDA, and profitability went down 70% overnight.

Sponsors can often dodge these dicey situations by committing to clear, open, honest communications from first contact. If there’s a cultural difference, learn all you can about the target’s business and social traditions. Take the lead on setting expectations by conveying your detailed plans and asking what managers anticipate.

Another way to avoid surprises is by building a reputation of being professional, fast, and trustworthy. Private equity specialists at the University of California, Berkeley’s School of Law explain that, when you conduct yourself with standards, others will too, leading to fewer broken agreements.

Finally, stay in touch on a social level with every party involved. Purely transactional relationships are easier to discard, so encourage team members to occasionally connect with target managers, intermediaries, and vendors on a personal level.

Manual Deal Execution

Manual data entry and analysis processes frustrate many deal teams, as these slow and complicate otherwise high-velocity transactions. This bottleneck happens when a private equity house grows — in assets under management (AUM), employee count, verticals, or even asset classes — but fails to invest in advanced tools to support that growth.

Acquisitive teams often try to work transaction tasks into their existing CRMs, which they soon discover are designed for managing relationships, not tasks. Eventually, many firms abandon these systems altogether and return to spreadsheets and emails to manage execution processes.

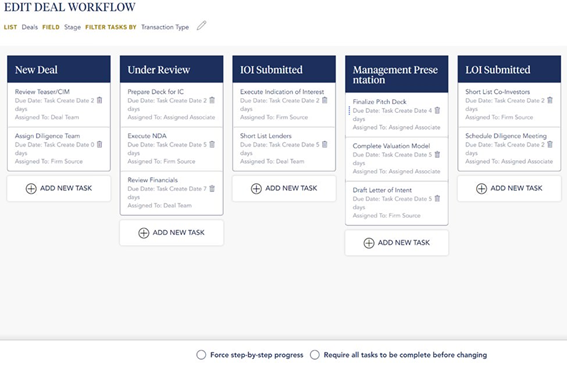

Firms can eliminate manual work — and the operational constraints it causes — by automating deal workflow with Intapp DealCloud, the only effective, private equity–specific deal management software that manages deals and relationships simultaneously. Users no longer need to try to fit relationship intelligence into their workflow management system or attempt to cram collaborative task processes into a generic CRM.

Leaders can customize their workflows in a variety of ways:

- Design unique dashboards

- Assign steps to team members

- Set due-date expectations

- Grant special permissions

- Set up real-time input notifications

- Require tasks to be done in a specific order

Best of all, leaders can revisit their dashboards at any time to answer questions about deal velocity and team performance that naturally arise as deals move through the pipeline.

Learn how Intapp DealCloud streamlines deal execution with workflow automation: Schedule a demo today.