Amid an ongoing era of large-scale shifts in climate and political unrest, companies are doing their part to engage environmental, social, and corporate governance (ESG). These are solutions that implement factors that measure sustainability and social impact by engaging or supporting volunteering ethically oriented practices. Companies use ESG to improve their community impact and build a positive reputation.

Why investing in ESG matters

Investing in ESG is crucial as it encourages companies to address environmental, social issues alongside their core business. This is essential for long-term success. Businesses can create change in marginalized communities and the environment, rather than just using initiatives as marketing tactics.

Investors who choose socially and environmentally responsible companies have avoided most bankruptcies, says BofA Global Research. Companies using ESG data and tactics perform better financially than those not focused on environmental and social concerns.

How ESG reduces risk

Several risks can put a company’s success at stake, risks that ESG investing could have avoided. When a business has poor worker treatment, this can lead to unhappy and stressed employees, who do not value the company’s business and brand.

They are more likely to leave their jobs, leading to a higher turnover rate. This makes the company spend more money on hiring, training, and onboarding new employees. When companies engage their staff, those employees have more positive interactions with customers. They are also more productive and make more profit.

Companies with low diversity can harm their success by missing out on valuable perspectives and intellectual capital. Companies that hire diverse candidates grow faster and make higher financial returns in their industry.

ESG data and tracking can protect the economy from the negative effects of climate change. Environmental challenges go farther than reputation and regulatory risks for companies, they can cause resource scarcity which can devastate an entire economy. Natural disasters, poverty, and political unrest can result from environmental risks. When companies and investors focus on ESG initiatives, it can help prevent the worst outcomes of the climate crisis.

Choosing a software to track & report ESG

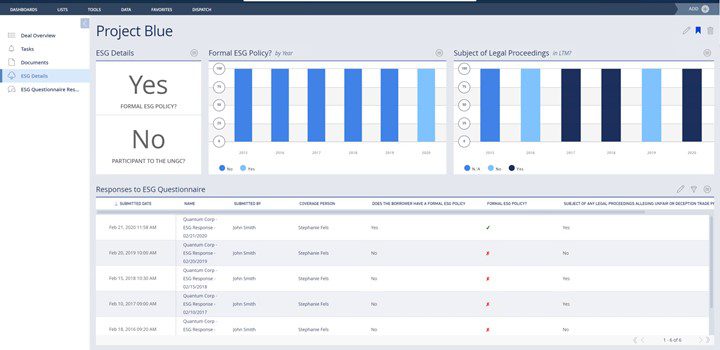

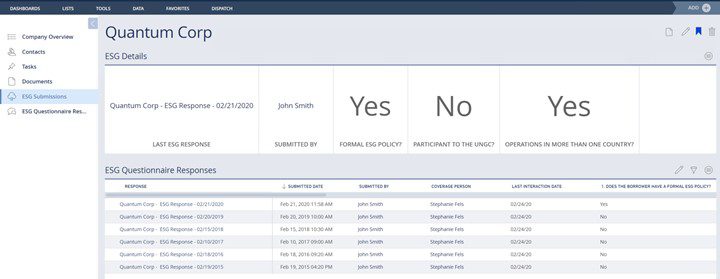

Finding a software solution that helps track and report ESG efforts is important. To engage in sustainable investing, you need transparent ESG data, which you can find all in one place. Intapp DealCloud’s deal management solution offers the ability to track and have automated ESG reporting data.

Schedule a demo to learn more about how Intapp DealCloud can help you track and report ESG data and efforts.