In order to be competitive in today’s modern deal-making landscape, capital markets professionals are orienting their key decision-making activity around a combination of both proprietary and third-party data. In light of this trend, DealCloud and FactSet have announced a partnership in which dealmakers can get FactSet data into CRM platforms like DealCloud.

Now, modern dealmakers can act more quickly and confidently by leveraging modern data verification methods, data visualization strategies, and expert reporting and analysis. There’s also a myriad of ways dealmakers can save time and reduce the administrative burden associated with data entry (a pain point felt by all deal professionals globally).

In a recent webinar I co-hosted with FactSet, we presented key actionable ways dealmakers can leverage FactSet’s data from within the DealCloud platform. These tips and tricks can help any deal professional – in private equity, investment banking, asset management, or another capital markets firm – deal with their increasing reliance on data that is growing with every day, month, and year that goes by. These tips are tricks are particularly useful for firms that are looking to capitalize on time not spent on deals during the COVID-19 crisis.

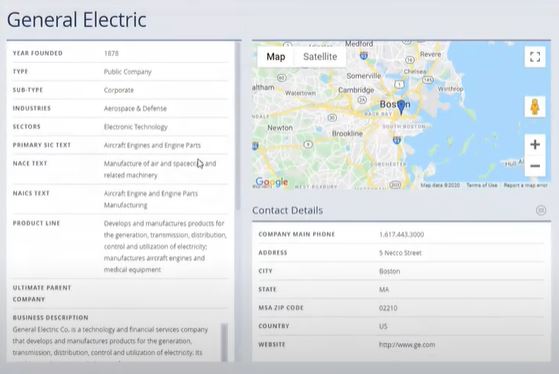

1. Auto-populate company profiles with FactSet data (e.g., revenue, EBITDA, gross income, etc.)

Ask any analyst or associate-level employee working at a capital markets firm and they’ll tell you that entering data into a CRM is both frustrating and time-consuming. Now, with the FactSet data integration into DealCloud, all it takes to populate an entire page worth on data is a quick click of an icon on a given company page in your CRM. To be sure you’re syncing the right information, you can even sync the FactSet company ID.

2. Create related entity maps to better understand corporate structures and identify subsidiaries

Corporate structures can be extremely complex. For deal professionals, wrapping your head around the entire history of ownership and transactions can be difficult. Luckily, FactSet’s research keeps track of these details as part of their sophisticated data intelligence so that you can simply leverage that data from within DealCloud instead of endlessly copy/pasting data into your CRM.

3. Search for nearby companies, initiate a calling campaign for local teams

FactSet’s data includes intricate details on over 79,000 companies. If your firm is currently experiencing a lull in dealmaking due to COVID-19 disruptions, your team may want to initiate a search for companies in FactSet’s database that you aren’t yet in touch with. If, for example, your deal professionals are assigned geographic territories, they can now more easily call on companies in their “strike zone” by leveraging FactSet’s location data, including country, state, city, and zip codes.

4. Update/refresh your industry classifications and sub-sectors or map FactSet industry classifications to your proprietary taxonomy

Many capital markets have their own proprietary way of categorizing transactions, companies, and contacts based on industry/sector and sub-sectors. FactSet’s taxonomy is extremely in-depth and includes every nuance of every industry. Especially while deal activity is at an all-time low, we suggest taking a deep dive into your firm’s categories and classifications, cleaning them up, and getting your team to agree on the new/revised structure. Taking control of and organizing your industry classifications can save time and help your team work more efficiently once deal activity gets busy once again.

5. Include FactSet data on all company tear sheets (e.g., year founded, employee count, ticker/exchange, etc.)

If you leverage DealCloud for its extensive reporting capabilities, we highly recommend integrating FactSet’s data into your firm’s downloadable tear sheets. By populating your customized tear sheets with a combination of FactSet and proprietary data, you can quickly and easily generate more valuable company summaries, deal reports, etc. Having this capability helps deal professionals rest assured that their data has continuity from inside DealCloud to their exportable reports.

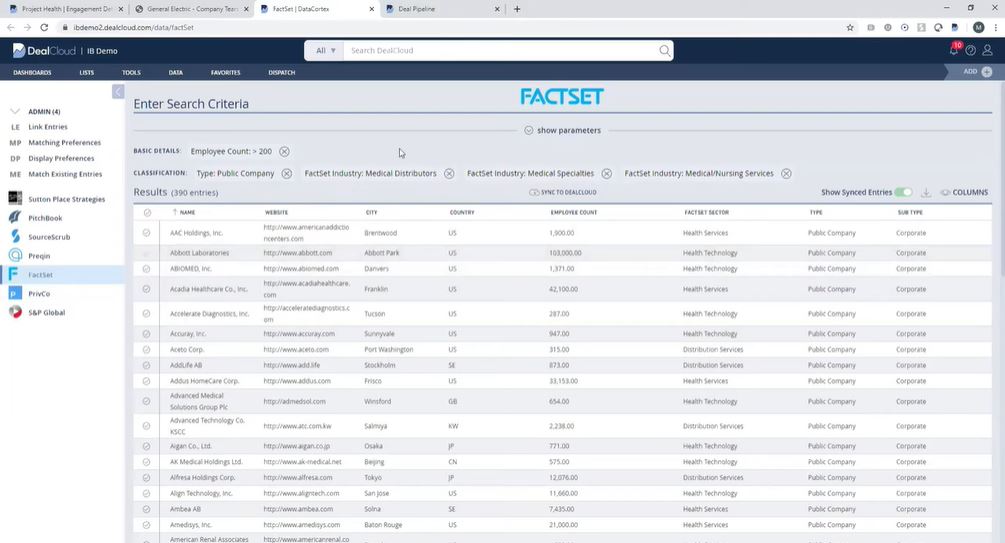

6. Run queries through DataCortex to populate buyers lists with FactSet data

Within DealCloud, capital markets professionals can search and query the FactSet database, which negates the need for constant cross-reference between disparate platforms. As always, firms can configure their matching preferences to ensure that no duplicates are being created and instead, new entries are created with confidence and existing entries are enhanced and enriched with FactSet data.

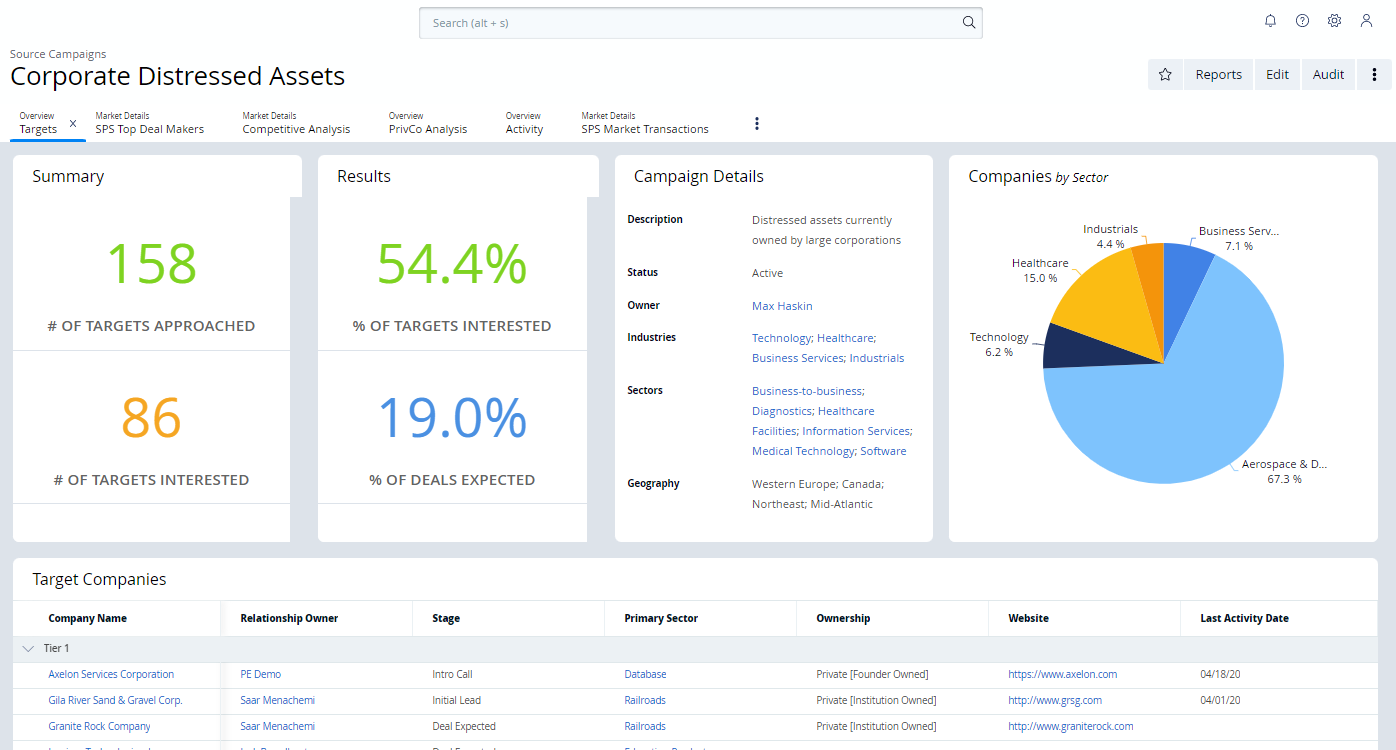

7. Build comparable company analyses based on FactSet data

With the DealCloud platform, deal professionals can easily look at an entity’s key data points and find other entities that have similar characteristics. This is particularly helpful when building lists of companies for add-on and roll-up activity. When firms have FactSet’s data integrated into DealCloud, their universe of companies is bigger and therefore their comparable company analyses are more robust. From there, your firm can create dashboards filled with data about company that all meet your investment theses.

While the above tips and tricks are useful for private equity, investment banking, and other firms, the potential use cases for integrating third-party data from a trusted advisor like FactSet into your proprietary data platform (DealCloud), are endless. To learn more about DealCloud’s DataCortex integration with FactSet, click here.