To help the legal community better navigate through our current uncertain times, Intapp is fielding an ongoing study to understand — in real time — how law firms are responding, and then sharing best practices and findings with the broader professional services community.

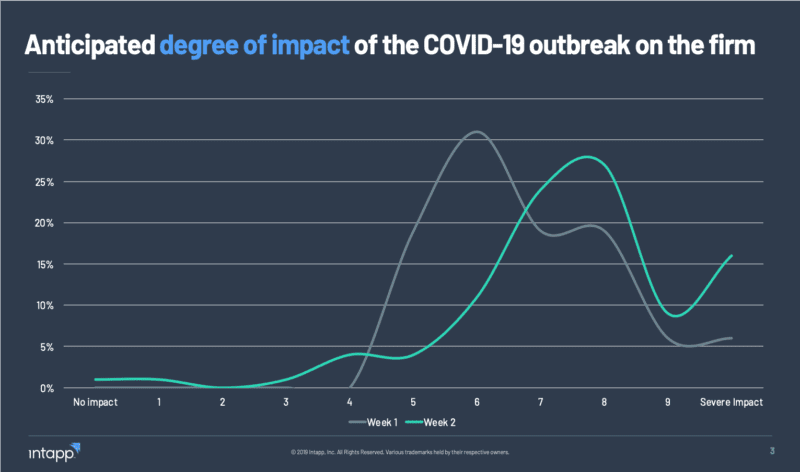

As life continues to change on a daily basis, everyone’s perception of the pandemic is shifting, and our survey results bear this out. There’s a marked rise in perceived severity, week over week, which illustrates the changing tide: More respondents believe there will be severe impacts on their firms.

Our high-level learnings about actions and sentiments evidence this evolving sentiment in the wake of the pandemic. These findings reflect the current survey period — March 18 to 20, 2020 — as well as key trendline changes over the past two weeks:

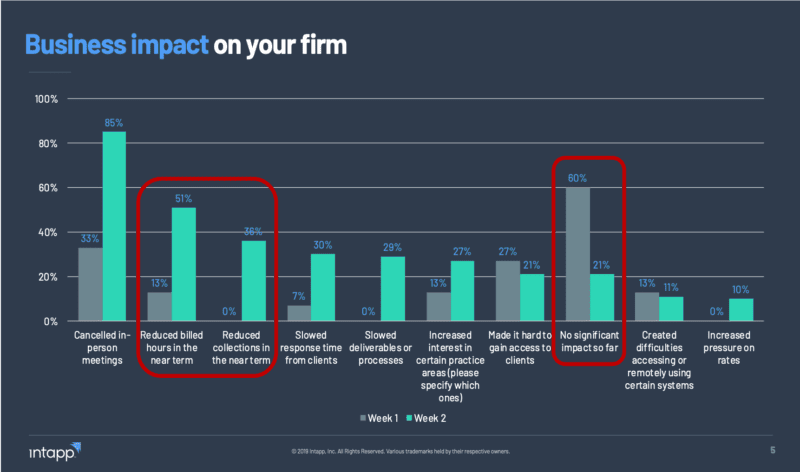

- Half of respondents report a reduction in billed hours at their firms.

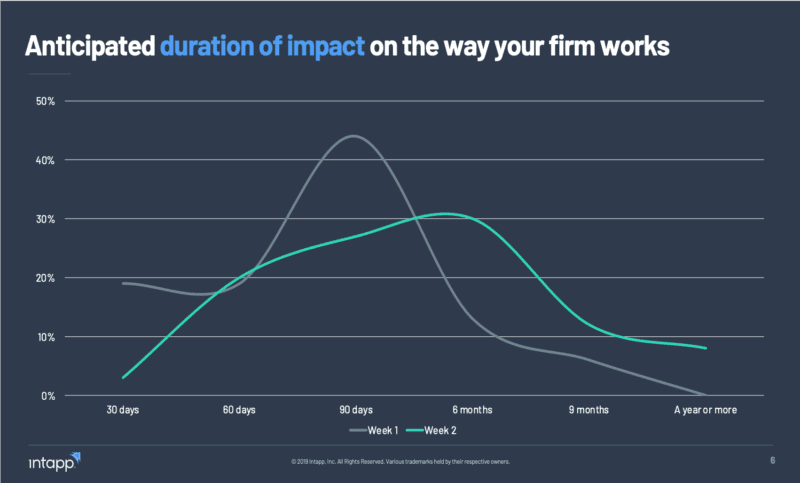

- In our previous survey (March 11 to 13), a definitive majority (80%) of respondents believed COVID-19 impacts on their firms would be felt primarily within the next 90 days. This time, half of those surveyed think the impact will last six months or more.

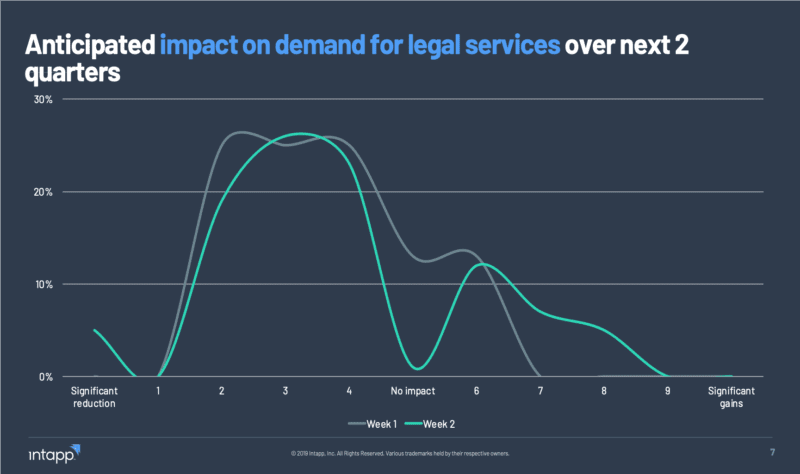

- Three-quarters of respondents believe that COVID-19 will create a negative effect on their firm’s revenue outlook in the coming six months; the other quarter of those surveyed anticipate a rise in demand for services, particularly in labor and employment, bankruptcy, and real estate practices.

For those of you who want to explore the data further, here are more-detailed findings:

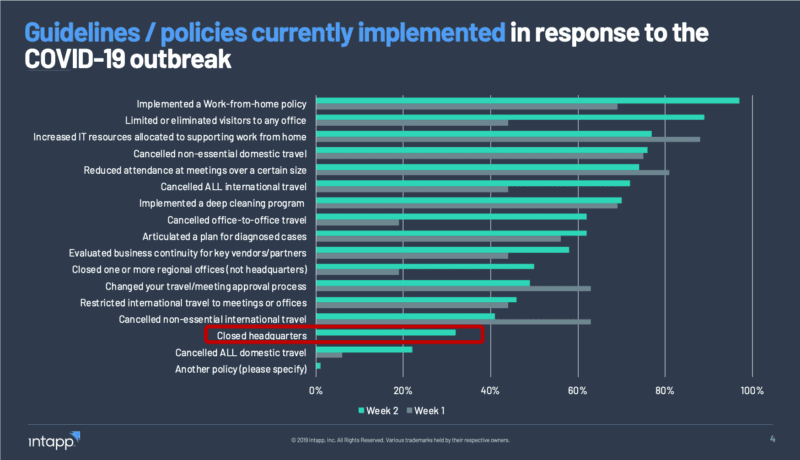

Firms have shifted internal policies and guidelines from preparing to support a remote workforce to becoming more responsive to local, regional, and national government orders.

- 97% of respondents’ firms have implemented a work-from-home policy, and 32% have closed their headquarters. These figures are up from the week prior, when only 69% had implemented a work-from-home policy and no firms had closed headquarters.

- A majority of respondents’ firms have now also implemented international or domestic travel restrictions: 75% cancelled all nonessential domestic travel, similar to Week 1; 63% cancelled nonessential international travel, up from 41% the prior week.

- Limiting or eliminating office visitors increased significantly week over week; 89% of respondents said their firms were doing so this week, compared to 44% the prior week.

- Last week, more than half (56%) of respondents’ firms had not evaluated business continuity preparedness plans for key vendors and partners. As the pandemic timeline progresses and its impact deepens, the number shrinks to 42% this week.

More firms are experiencing increasing demand in certain practices. This week, 27% of respondents’ firms report seeing increased interest in practices like labor and employment, bankruptcy, and real estate. This number doubled from the prior week, when just 13% of respondents’ firms experienced this impact. However, the majority expect a negative impact on demand again this week.

It has become increasingly difficult to conduct business in customary ways, with the biggest changes this week being the accessibility of clients and reduction in billed hours.

The anticipated length of impact continues to evolve, with more respondents expecting a duration of 9 months or longer, rather than the 90-day or less duration typically anticipated in Week 1. Almost no respondents now expect the crisis to resolve within the next month, compared with 20% in Week 1.

Most respondents still believe their firms will see a moderate reduction in the demand for legal services. However, more than a quarter of them believe this pandemic will create an opportunity in the market, with specific practices growing as the full effects of the pandemic manifest.

We’ll continue to share survey results as we collect and analyze the data. In the meantime, we encourage you to explore our resources page to find practical insights geared toward the needs of professional services organizations.