Where is your client data? Is it all in one place? Is it easily accessible? Does it lend itself to efficient work processes? If not, you are missing out on one of the most effective ways to systematically grow your M&A advisory firm: technology. Certain purpose-built technologies, like DealCloud, take your client data, organize it, and visualize everything in reports and dashboards that trusted members of your team can access at any time. CRMs and similar platforms built specifically for the capital markets industry can act as an organizational tool, and are primed to become your most valuable asset (with the exception of your people, of course!).

1. Better client service

First and foremost, M&A advisory and corporate finance is all about the clients. It is your job to know your client preferences, behaviors, and priorities, to understand what your clients have experienced in the past, and to anticipate what they will need in the future. A purpose-built technology, such as a CRM solution that’s tailored to your financial advisory firm’s unique needs elevates your level of client service and allows you to provide the best experience for your sellers and buyers. The organized data in this technology platform allows you to see the big picture, analyze all the data, and better understand what your client needs. This will ensure your clients stay happy and loyal, guaranteeing they will stay with you throughout the inevitable ups and downs of every transaction, effectively ensuring successful fee collection and long-term success for your business.

A CRM platform can make the “big picture” view of your firm easily accessible to everyone at your firm, from analysts and associates to VPs and Managing Directors.

2. Simpler task management and calendar visibility

A centralized technology system doesn’t only help the clients, but it also helps you in your firm’s daily, weekly, quarterly, and annual organization. CRM and other technology platforms are also widely known as effective tools for managing team and firm-wide calendars as well as the assignment and performance of tasks. Having your data organized and easily accessible streamlines work processes, and leads to greater efficiency for every team in your business. For example, having a centralized platform for all deal data and due diligence tasks allows bankers and advisors to quickly understand the status of a given transaction and what the next steps should be or how the firm is tracking against its deal flow goals.

Does your firm support clients on a large range of transaction types? Your firm’s specialties and offerings should be easily monitored in your CRM.

3. Less human error

With a CRM system, the likelihood of human error or unnecessary data duplication decreases as efficient and thoughtful workflows increase. Any member of your team has access to the same information and can easily obtain that data to work seamlessly within and across teams. And if you don’t want specific teams or individuals to access certain information, your CRM platform should allow you to easily configure user permissions.

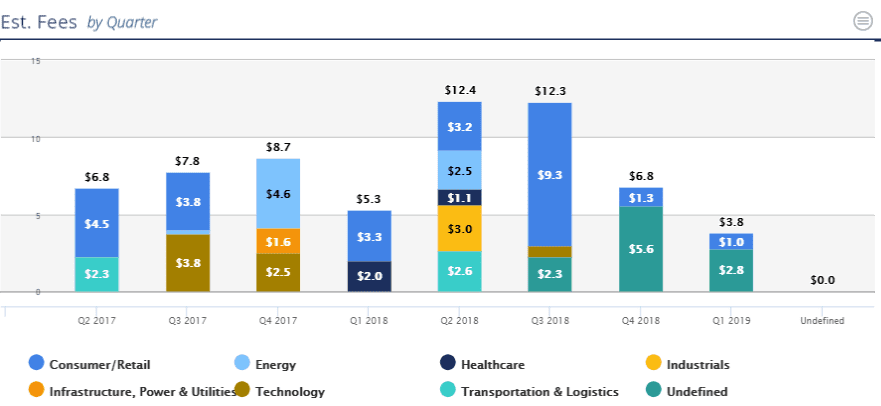

4. Enhanced reporting and analytics

Furthermore, the organization of a technology platform improves how you analyze and report data. With easy access to phone calls, meeting notes, and transaction documents such as IOIs, LOIs, NDAs and more, any member of your team can create accurate reports and better infer how to use that data to guarantee success in the future.

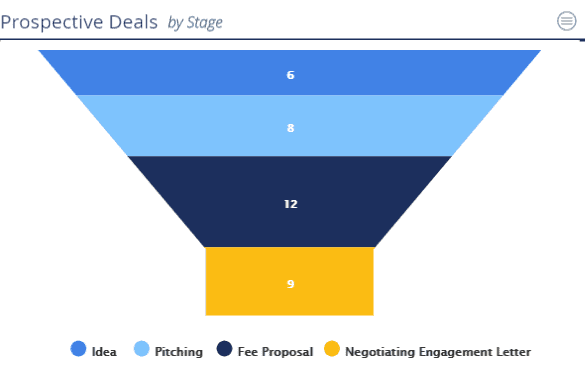

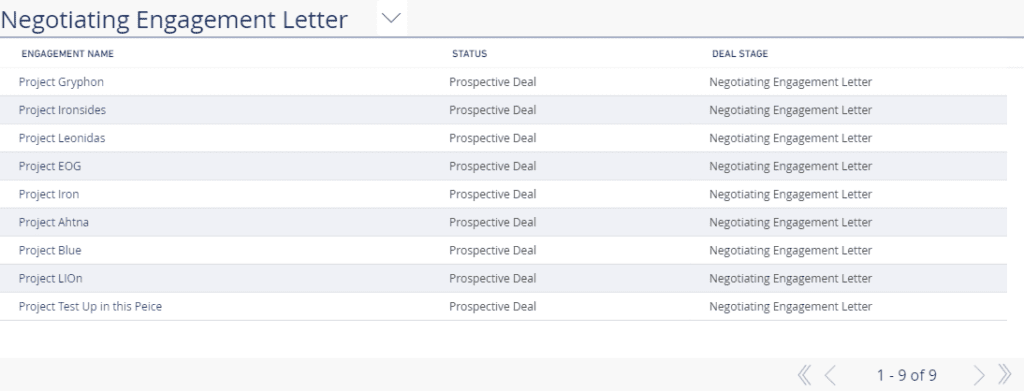

5. More seamless pipeline management

A CRM system also helps with pipeline management. In other words, you can monitor each step of your progress and follow exactly where you are, where you’re going, and where you have been. You can keep track of the companies you are working with, and the ones that got dropped along the way, as you move down the pipeline of a specific transaction. A CRM solution for financial advisory firms can organize and synthesize, at any given time, which opportunities are in the pipeline and utilize that data to tell you and your teammates how best to proceed. Pipeline management is an essential tool for advisory firms when it comes to understanding the deals you are executing on, and a centralized deal and relationship management system makes that possible.

Conclusion

From client services to pipeline management, a CRM system will greatly improve the day-to-day workings of your firm. Guaranteeing customer loyalty, increasing internal efficiency, and generally improving the organization, accuracy, and accessibility of your client data, a CRM system is a tool that your business simply cannot do without.

To learn more about setting up an investment banking and M&A advisory-specific CRM at your firm, get in touch with the DealCloud team today.

Writing and research support provided by: Aryanna Garber