According to a recent article from Deloitte, “Banks’ competitive advantages should continue to be their ability to manage risk and complex financial matters, conducting business in a highly regulated market, driving innovation to serve client needs, protecting clients’ privacy, and maintaining trust, all at scale. No matter what, banks will remain trusted custodians of customers’ assets.”[1]

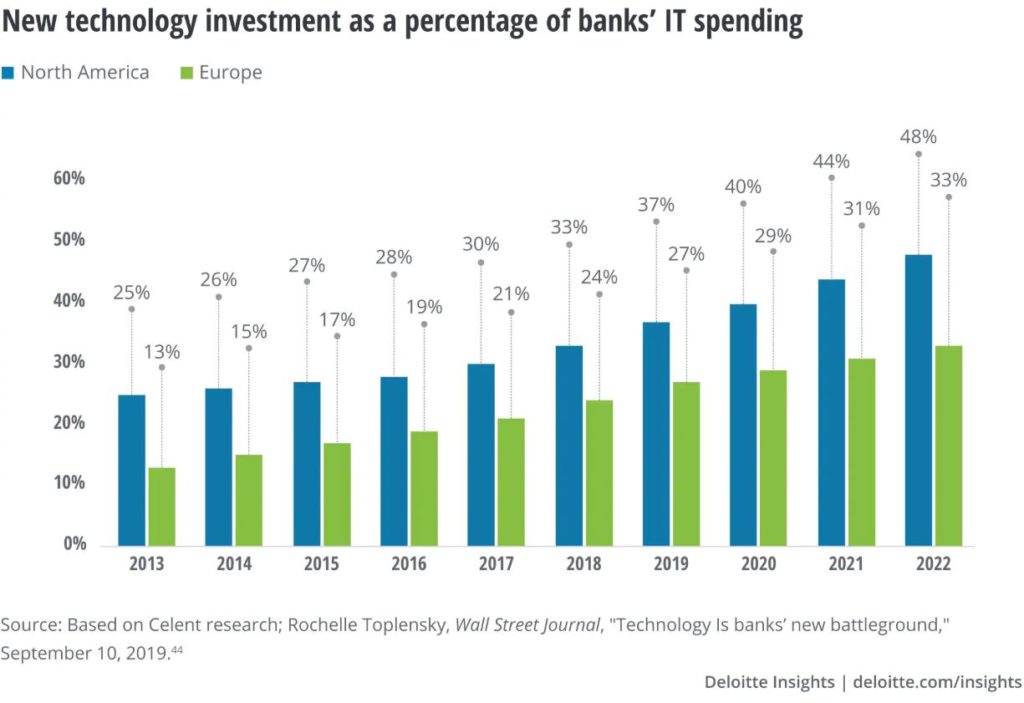

This means that the client journey is more complex than ever. Clients — especially business owners and their executive teams — know more, do more, expect more, and it’s an investment banker’s job to meet those expectations by elevating the client experience to a more robust and interconnected process. In doing so, clients will be happier, more productive, and will ultimately see more long-term success. This is prompting investment banks to allocate more of their IT budget towards internal investment banking technology tools.

This client experience elevation is known as a 360-degree customer view. What it means is taking a step back and using all past and present data to turn a contact into a client, as well as when it comes time to help a client make important decisions. This means understanding the client’s preferences, behaviors, and priorities for the transaction they are about to undertake and integrating that information into your client service approach. According to Gartner Research, “organizations need to evolve from product information management to product information intelligence.” This research shows that only 5% use a 360-degree client view to grow their businesses, however, it is those 5% that greatly benefit from the implementation of the system.

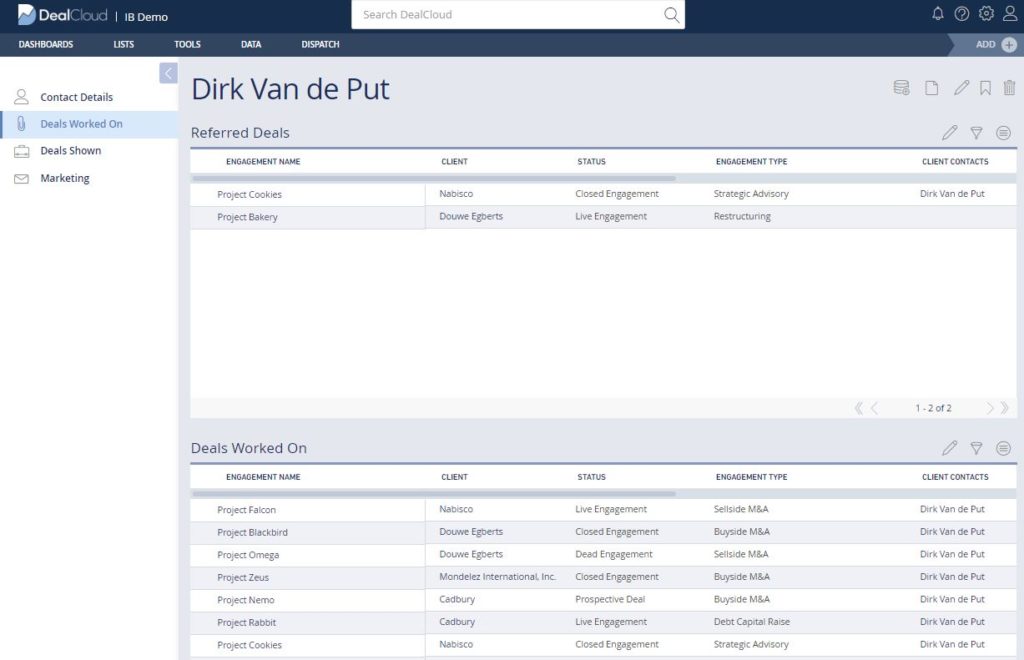

This 360-degree client view has benefits that stretch from the strategic to the interpersonal. One benefit of the 360-degree client view is the ability to better understand the client’s past experiences. Especially when representing companies where the executives have past deal experience, we suggest keeping logs of this either through proprietary records or through third-party data feed like Pitchbook or Sutton lace Strategies (see below). This helps provide a more rounded and complete client experience, one that not only understands what the client has done, but also understands what the client is going to do, and how you can best prepare yourself and your team to anticipate these moves.

By profiling executives based on their referral and past deal experience, bankers are better equipped to navigate new transactions with those executives. Especially when serving in an advisory role, it’s very helpful to have a full view of what familiarity executives have – or don’t have – with their options for financing, selling, and buying.

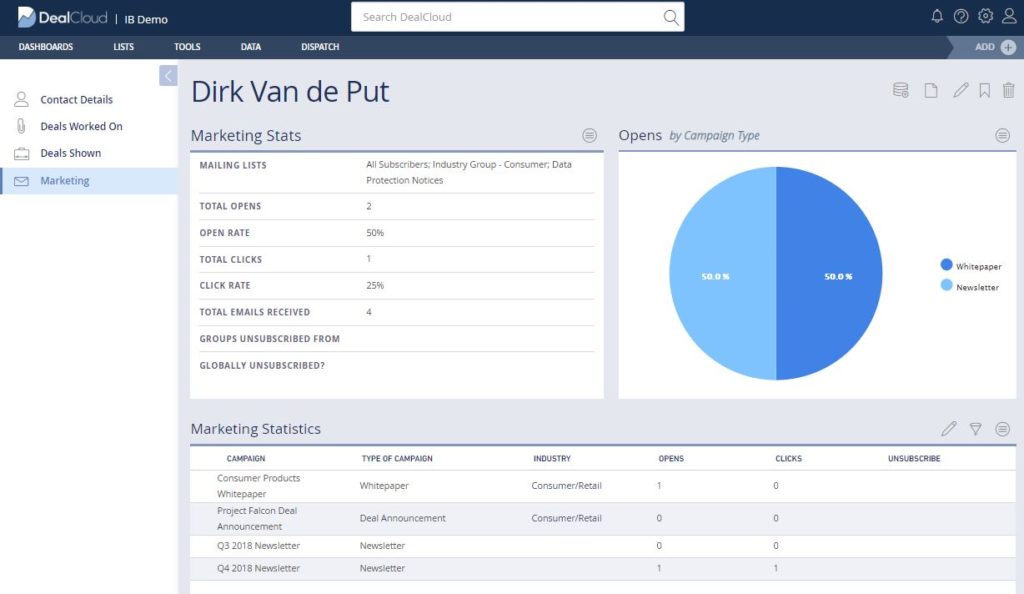

By being able to see the big picture and utilize past and present client data, teams can also create more targeted marketing campaigns where specificity lends itself to success. For example, you may be more apt to communicate consumer/retail-specific industry trends (via an industry-specific distribution list) to an executive if you know that they focus on that niche. This will make the potential client or existing client feel supported and will offer them valuable content.

By centralizing marketing data, investment banks can also quickly determine whether or not an executive or company is up-to-speed with your firm’s latest research insights, important news/updates, press releases, etc. that are distributed via email marketing. This leads to a better 360-degree client view because it helps bankers better understand how engaged that individual/firm is with your content.

This improved customer relationship will also lead to improved customer loyalty; a happy client is more likely to think of your firm when their next exit, add-on, or other transaction comes into view, and it’s that loyalty that will make your firm more successful and more reputable over time.

Put simply, a 360-degree customer view will improve your business by improving your experience with and knowledge of the client. More targeted market strategy, better customer service, and enhanced customer loyalty are just some of the ways that utilizing the 360-degree client view will help improve the number of “at-bat” opportunities your firm has to gain new clients, and will help grow the business.

This article was co-written and researched by Aryanna Garber.