Capital markets firms are actively evaluating their data management platform (DMP) solutions and finding a relatively high degree of market awareness about the shortcomings and pain points in this area. According to KPMG’s report, Data Management Trends in Capital Markets: Turning Tides, 27% of capital markets respondents have issues with data quality when using their current data management solutions. As the fast-changing private capital markets continue to increase in value and opportunity, deal-makers need real-time insight into the flow of capital across the entire capital markets landscape to form the best market coverage strategy and remain competitive.

Intapp DealCloud’s third-party data management solution, DataCortex, provides deal-makers with access to real-time industry contact data, private and public company data, deals, news, and sources. The software also helps them understand exactly how to create a market coverage strategy and maximize opportunities in the capital markets.

Data management solutions keep track of leads

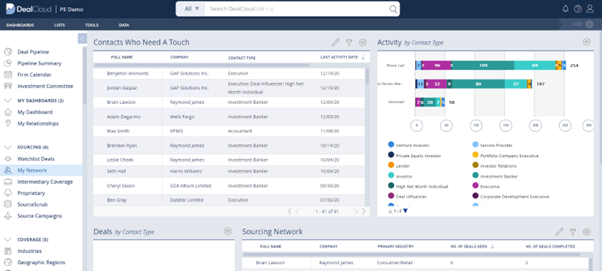

For capital markets deal-makers, one of the most important parts of data management is having the capabilities to store all aspects of relationship management — including contacts, interactions, and other vital details — in one place to help inform a market coverage strategy. Using the DealCloud platform, deal-makers can create custom dashboards to track and organize their data. Deal-makers can also utilize the “My Network” dashboard (below) in DealCloud’s data management solution, allowing them to track all contacts who need to be notified, activity by contact type, sourcing networks, and more.

DealCloud’s DMP software helps strengthen relationship intelligence by allowing users to access proprietary and third-party contact data from data providers, such as Pitchbook, FactSet, Preqin, and others, using DataCortex. Having this relationship data in one single source of truth helps deal-makers track leads, make more informed decisions, and expand market coverage.

DMP software utilizes data for improved market coverage

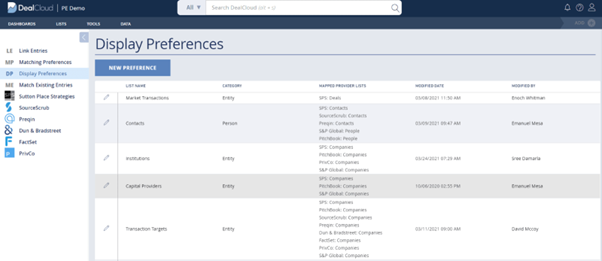

Increasing market coverage means identifying new opportunities. By leveraging DataCortex, DealCloud’s third-party data management solution, deal-makers can search and query market data in real-time without ever leaving the DealCloud platform. The resulting companies, contacts, and deal information are then matched and combined with a firm’s proprietary data — creating a single, cohesive record that is displayed based on the user’s preferences. When new data is available or updates are provided to existing entries, these new data points are automatically synchronized, significantly reducing the need for manual input and helping avoid duplicate entries. DealCloud’s reporting and analytics capabilities in conjunction with DataCortex help deal-makers use their third-party and proprietary data to identify prospects and build market coverage.

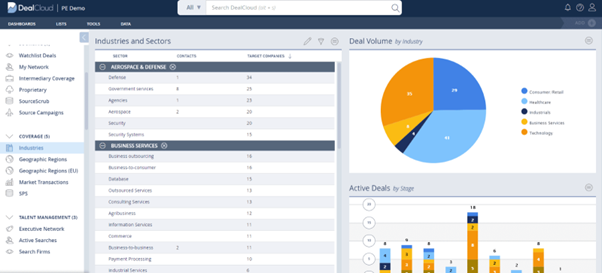

DealCloud’s data management solution allows deal-makers to create different dashboards to help them view and create their market coverage strategy. Leveraging the “Industries” dashboard (below) in DealCloud, for example, lets deal-makers maintain visibility into developments in specific industries and sectors, view deals by volume and stage, and track emerging trends.

Learn more about how DealCloud can support your firm’s market coverage strategy.

Data management software brings focus in expanding market coverage

DealCloud’s data management solution empowers deal-makers to harness the cumulative intellectual capital of their people and processes. With the DealCloud platform, capital markets professionals get a single source of truth to help them manage relationships, execute deals, and easily connect with external solutions and third-party data providers. Deal-makers can create a market coverage strategy by discovering private companies to concentrate on for acquisition targets as well as competitive intelligence across specific industries and verticals — all in one place.

DealCloud enables capital markets professionals to build a strong market coverage strategy and further map out the landscape of potential partners, competitors, and acquisition targets. DealCloud’s data management tools have a proven track record for transforming firm knowledge into actionable intelligence.

To learn more about Intapp DealCloud’s data management solution, schedule a demo.