How many phone calls does it require for investment banking business development teams to reach a prospective client? Eight.

A banker I recently met shared that detail in a conversation about a topic that seems to come up all the time – accountability. Most executives want greater accountability from their employees, and most employees want greater accountability from their peers – yet very few have the time, energy, or strategy to make accountability a long-term strategic differentiator at every level of the organization.

And it is easy to see why accountability initiatives often fail – they always have a cost, but rarely result in measurable short-term benefits. So as soon as I learned about the eight-call rule, I had to know more about how her investment bank came up with the idea. And why eight? It fascinated me because if it is true, it should cause a major shift in the firm’s business development strategy. No longer should total dials or total connects matter. What matters is how many prospects the investment banker has called eight or more times.

Optimizing operations for success at eight calls

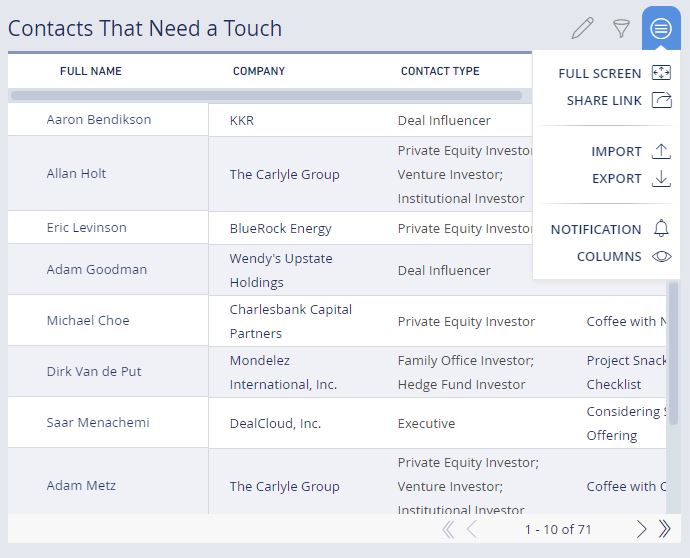

A successful investment banking firm needs a way to log all contacts with a prospective client. This firm, through its business development teams, was logging thousands of activities each year. That contact was key, but the firm was not treating that logged activity as business intelligence that could be analyzed and visualized for competitive insights and to improve its prospecting operations. The firm needed a platform with greater power and more tools than a conventional CRM platform. Our platform – called DealCloud – is a deal, relationship and firm management platform built specifically for the complex needs of dealmakers. It is used by over 800 capital market firms across 25 countries, and is fully optimized for mobile and the busy lives of on-the-go dealmakers.

The firm implemented our platform and recognized a significant spike in the success rate after eight calls, and immediately set out to pinpoint what other strategies would benefit them. After looking into other areas of the business, they learned that three is the average number of calls needed to reach an investor. Then they realized that it didn’t have to be calls, it could be any touchpoint – an email, a message with the administrative assistant, or a voicemail. Those insights allowed them to further refine their operations. With the right tools in place, the firm was able to significantly improve its contact rate, thereby increasing its win rate in just a few months. Even more importantly, the firm introduced a new attitude of accountability. Because the data was there for everyone to see, it was no longer acceptable to call a few times and give up. Eight was the number, and so the mantra became: “eight calls or keep dialing.”

This success occurred because management understood that if they were going to perform at the highest level, they needed accountability from every member of the firm. They also understood that accountability could not be willed into the culture of the firm; it must sewn into the fabric. For them, that meant collecting data in a single, purpose-built platform, tailored to meet their specific needs. Next, it meant designing a program that encouraged ownership and emphasized productivity. The investment banking business development teams knew upfront that they would be accountable for logging their activity. They also knew that their peers and managers would be able to see their results. But the reason they succeeded in building accountability was because the business development teams understood that if everyone did what they were supposed to do, they would work better as a team, be more productive and ultimately, better compensated.

The reason I’m so fascinated by the eight-call rule is because it is the exactly the type of insight I wish I had when I was working at a private equity firm. The firm I worked for accrued an amazing amount of insight into its transactions, its deal participants, and its investors. But its employees didn’t have a way to share that collective knowledge across the organization. Thus, it was not possible to enforce accountability, nor was it possible to reward it because no one was able to analyze the firm’s collective activity. I used my experience to create DealCloud.

The eight-call rule is just one example of how a powerful platform can identify insights that change behavior, prompt productivity, and instill a shared sense of accountability.

If you would like to learn more about how DealCloud can help your firm discover new insights that prompt productivity and instill accountability, please visit www.DealCloud.com.