Investor relations (IR) teams constantly deal with all forms of data, such as annual revenue, quarterly guidance, progress against key initiatives, and relationships with limited partners (LPs). Tasked with crafting a compelling story about fund performance, portfolio company enhancement, and strategic value, IR and fundraising professionals struggle with synthesizing scattered data streams. When it comes time to document historical conversations, fundraising information, deal pipelines, or other relevant data, they’re left searching through spreadsheets and email chains. IR teams need purpose-built investor relations software that provides a single source of truth when storing data and visualizing their fundraising data analysis so they can reach fundraising goals.

Bring unity to your firm’s data

Fundraising is back in full swing in 2021 after a slowdown during the early stages of the pandemic. DealCloud’s semiannual Dealmaker Pulse Survey, conducted in November 2020, found that 26% of firms were not only proceeding with their plans but also raising larger-than-expected funds. With fundraising ramping back up, it’s more important than ever to have investor relations software in which IR professionals can consolidate, analyze, and use vast amounts of data to make better-informed decisions and reach fundraising goals.

As firms implement automation and improve fundraising data access, IR professionals can devote more time to cultivating existing investors and building connections with new prospects. Typically, IR professionals are prepared to answer 90% of the questions that LPs ask during the fundraising phase; however, responding to that last 10% often requires hours of research and number-crunching. Powerful integrations combine proprietary data with third-party data sources like Preqin, PitchBook, S&P Global Market Intelligence, and others — all of which are embedded into the DealCloud platform through DealCloud DataCortex — eliminating the need to manually search for information. Accessing this data within investor relations software like DealCloud helps IR professionals synthesize complex data to tell a story about fund performance and progress towards fundraising goals.

Put data into action with reports and insights

Today’s most-successful IR professionals rely on reports and fundraising data analytics to inform their decision-making so they can reach their fundraising goals. With relationships and transactions constantly evolving, IR professionals need real-time reports that help them zero in on the most time-sensitive and high-priority items.

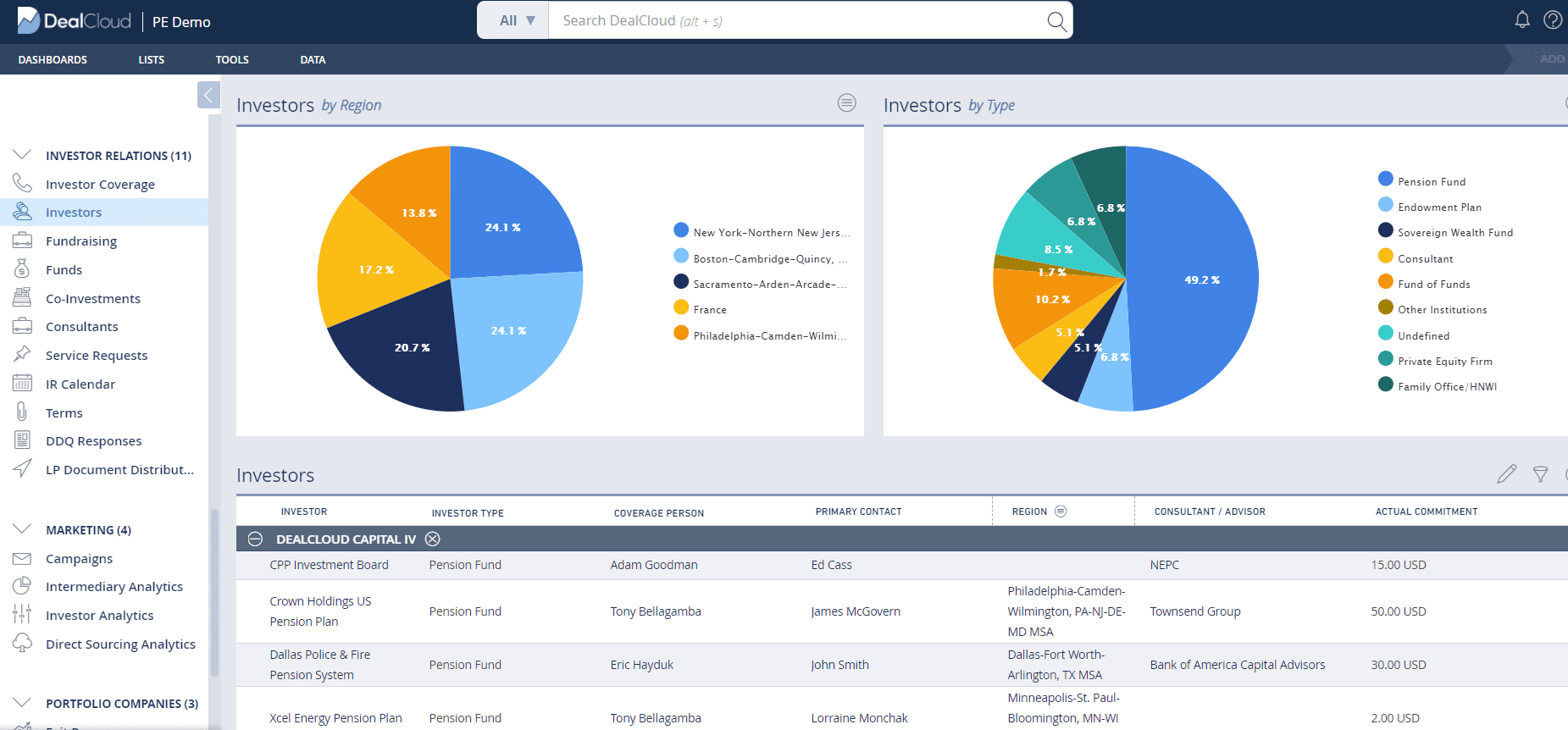

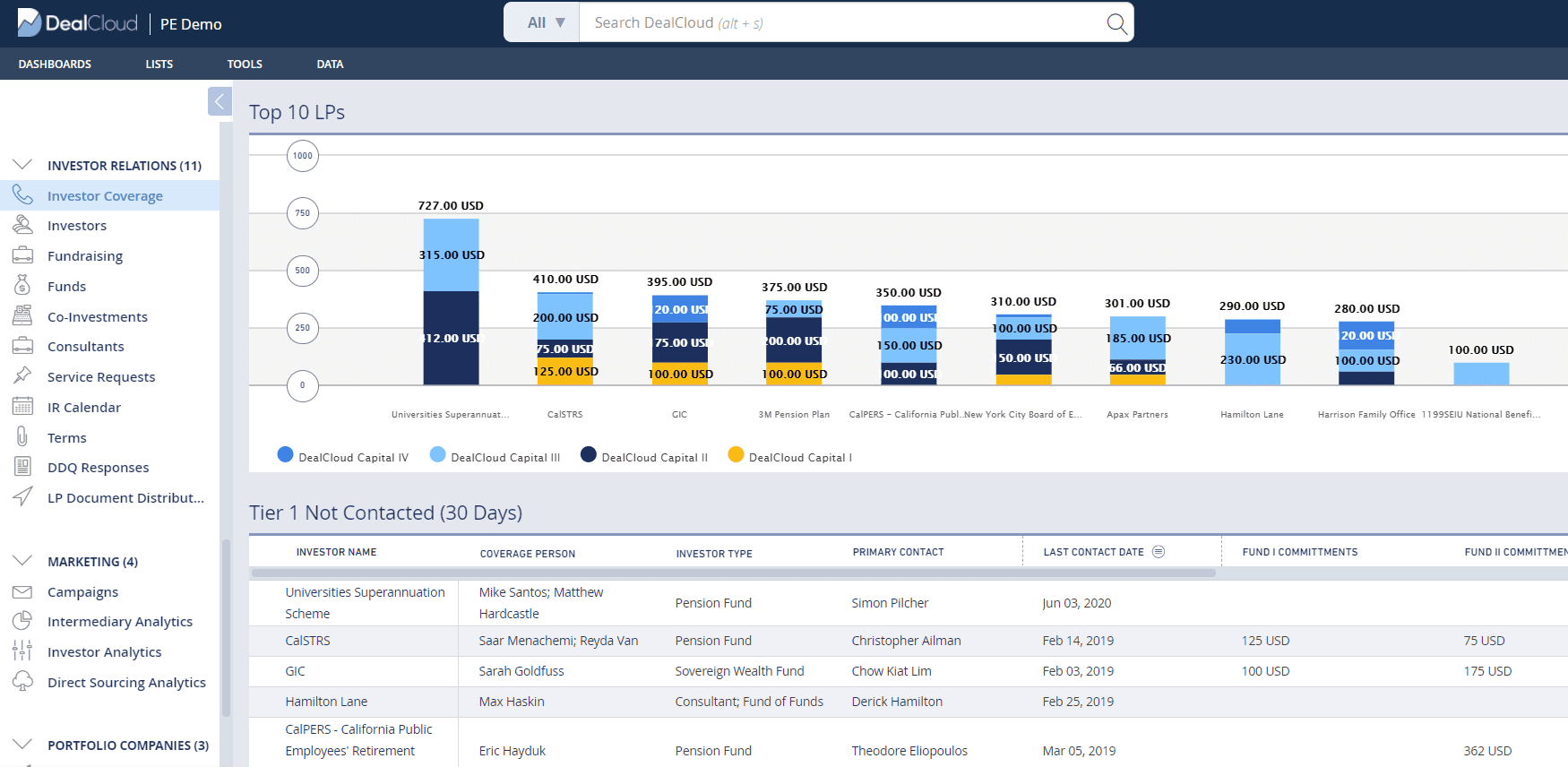

In DealCloud, IR professionals can track multitudes of data using custom dashboards. For example, in order to reach fundraising goals, IR professionals must keep track of investors and investor coverage. Using the below dashboards, IR teams can access investor information in real time.

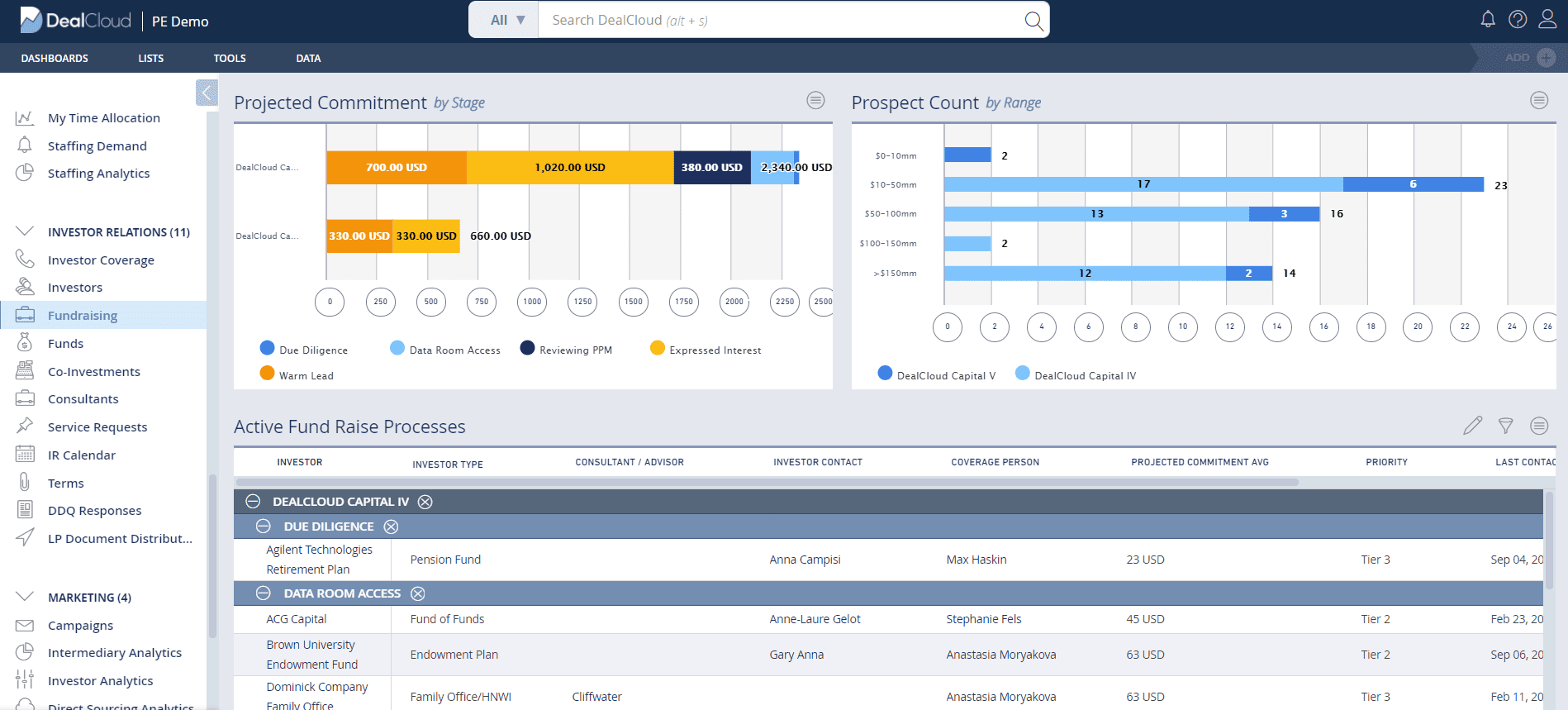

Dependent on old general-use applications like Microsoft Excel, most IR professionals lack access to the sophisticated capabilities of modern solutions — including viewing data dashboards and creating preformatted reports — making it nearly impossible to capture the full picture of fundraising data in a timely manner. Generating simple, clear, and user-friendly views of important information with a single click — directly within investor relations software like DealCloud — empowers IR professionals to compete effectively and reach fundraising goals.

IR professionals can track fundraising goals using the Fundraising dashboard in DealCloud.

DealCloud unifies data, systems, and people with fully interactive reporting on the most important metrics, accessible anywhere, at any time. Because DealCloud was designed with busy IR professionals in mind, you can customize every dashboard, chart, graph, tearsheet, data sheet, and profile to meet each user’s preferences and interests.

Use centralized data for smarter, more efficient fundraising

Firms today enjoy access to a wealth of capital that they can leverage to build stronger IR machines and reach fundraising goals. The most successful IR firms have embraced investor relations software to track and organize activities, streamline communication, and manage the flow of information.

Gone are the days of making do with generic software; instead, a purpose-built solution like DealCloud systemizes foolproof relationship management and fundraising data management. DealCloud centralizes all of your firm’s most critical proprietary and third-party data, providing firm-wide access and visibility into the fundraising data analysis and insights required to act quickly and decisively. No matter your firm’s size, strategy, or operating model, the DealCloud platform allows your IR professionals to access a single source of truth that simplifies data management to help reach your fundraising goals.