Despite many private equity firms reopening their doors and welcoming employees back to the office, it’s clear that the hybrid work model — brought on by the COVID-19 pandemic — is here to stay. During the pandemic, capital markets professionals discovered that it’s possible to produce quality transactions and make connections remotely.

Many professionals have expressed their desire to maintain this new normal of working from home. According to a recent survey by the Society for Human Resource Management (SHRM), 55% of workers across industries said they would prefer to work remotely at least 3 days a week. However, other investors, fund managers, and capital markets professionals still prefer the traditional office experience and miss the hustle of morning commutes and in-person connections.

Thus, many employers are promoting hybrid work environments, allowing employees to choose where and how they want to work. Learn how your private equity firm can successfully adopt a technology-enhanced hybrid work model that keeps your deal professionals connected.

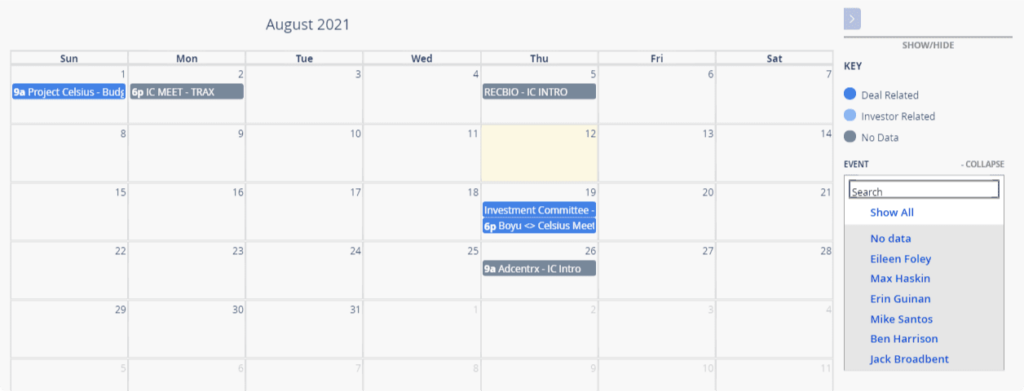

Maintain transparency with a firmwide calendar

With investors and other deal professionals working outside the office, maintaining firmwide transparency is vital to keeping everyone in the loop. Using software like Intapp DealCloud to maintain a single source of truth helps firms do just that.

Users can build out key dates and deadlines for their firm’s calendar within the platform, and make important information — such as travel schedules, conferences and events, meetings, and business development initiatives — available across the firm. It’s best practice to refer to these calendars during weekly meetings so your team can stay updated, review upcoming deadlines, overcome due diligence hurdles, and discuss any major challenges.

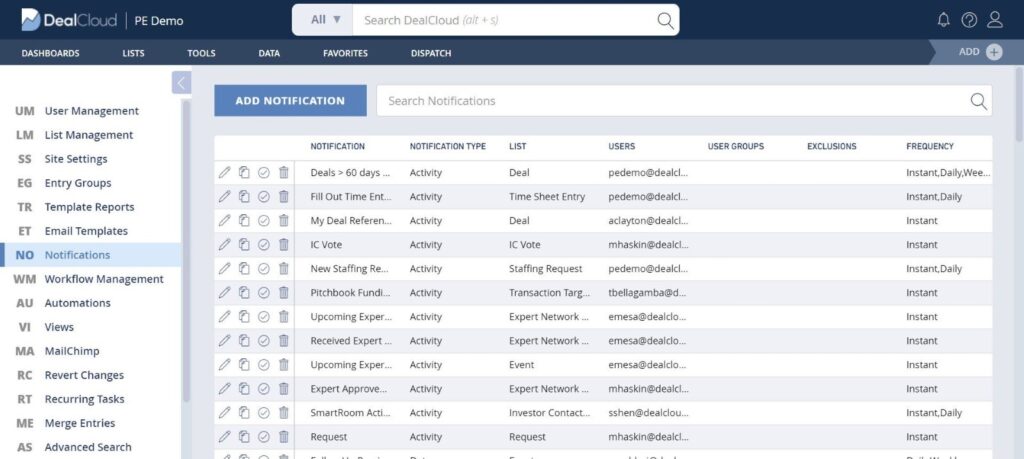

Automate updates and alerts

With high-priority transactions constantly changing, it’s vital that your deal team stays informed even when they aren’t in the office. By configuring notifications for deals in DealCloud, you can customize alerts to deploy at a cadence that makes sense for your team and those leading the deal.

Alerts can activate at a specific time, such as right before a weekly deal pipeline check-in, or they can be sent immediately after a deal status or stage change to keep the team constantly updated. Providing your dealmakers with real-time updates allows for less catch-up work, decreased administrative burden, and improved firmwide transparency.

Connect Your Tech

When a firm stores data across multiple systems, deal professionals waste time struggling to chase down updates and passwords. When operating within a hybrid work environment, deal teams need to be able to quickly access relevant data from wherever they’re working. Having a customized single source of truth for data and insights can help accomplish this.

DataCortex integrates proprietary and third-party data from providers such as FactSet, PitchBook, and SourceScrub into the platform. Users can run complex reports, analyze industry trends, and evaluate potential synergies, as well as originate deals and manage relationships — all within a single solution. Permissions and user groups features help ensure individuals can only access the information that’s relevant to them and their roles.

Ready to create a better hybrid work environment for your firm? Schedule a demo of Intapp DealCloud today.