People and professionals remain at the heart of all business, as a recent Gartner article explained. However, to truly succeed in their industries — especially in the capital markets sector and in the financial services industry at large — professionals must embrace technology and digitalized processes. Many firms in the financial services industry rely on relationship management platforms and CRM solutions to support their complex strategies and manage internal and external data. A growing number of these firms are now turning to purpose-built deal pipeline software to easily manage data, strengthen valuable relationships, and promote better deals.

Learn how DealCloud’s purpose-built, simple CRM software can help your firm develop a relationship-tiering structure, increase relationship intelligence insights, leverage third-party data to strengthen relationships, and adapt to your firm’s — and your clients’ — unique and evolving needs.

Develop a relationship-tiering structure

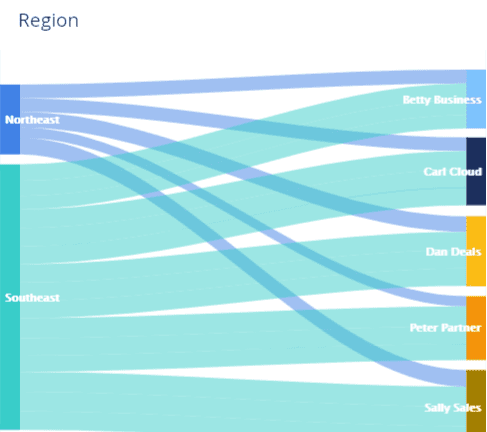

Capital markets professionals spend a great deal of time building relationships with their clients and continually maintaining and analyzing those relationships. DealCloud’s best-in-class CRM solution supports relationship management by letting users easily create a relationship-tiering structure that reflects both their firms’ and their clients’ unique needs. Relationship tiering simplifies the deal process by analyzing relationships with other contacts or firms, and providing visual overviews to help users better understand to significance of the underlying data. By using deal pipeline software, financial service firms can quickly grasp the potential value in a relationship and conduct better transaction management.

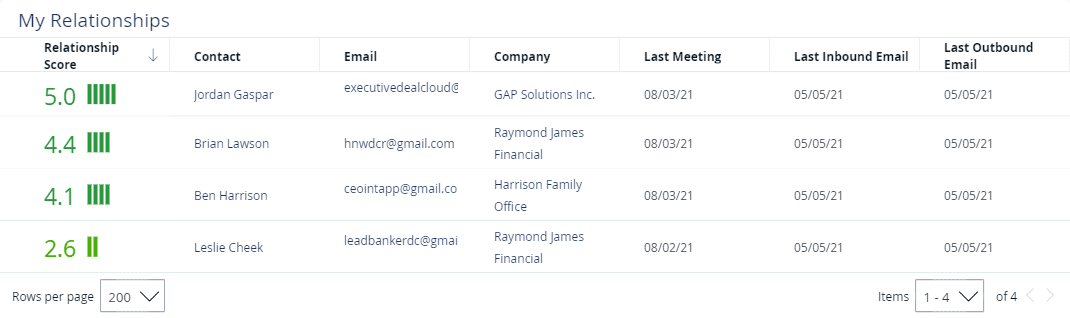

With DealCloud’s CRM solution, firms can utilize the My Relationships dashboard to see their network analysis, relationships, and key contacts by tier (Tier 1 Relationships, Tier 2 Relationships, and so forth.).

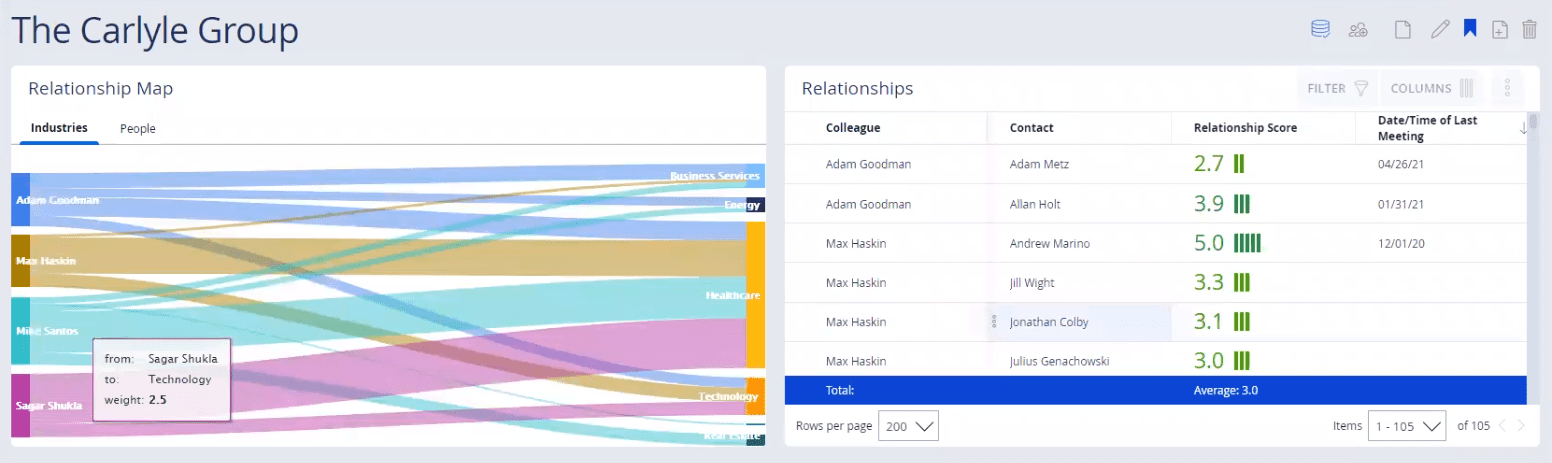

Within these dashboards, the Network Analysis chart shows a visual breakdown of contacts by regions, industries, and connections to other contacts in the respective tabs. To dive deeper into these relationships and connections, deal professionals and relationship managers can hover over the line that connects a region, industry, or person to a contact’s name. This will display information quantifying the strength of that connection with a weighted score between 1 and 5, with 5 being strongest.

Likewise, when looking at the My Relationships chart, you can quickly evaluate the relationship score between you and your contacts, also on a scale of 1 to 5.

Increase relationship intelligence insights

Deal professionals can gain a competitive edge by leveraging the strongest relationships within their firm to connect with parties of interest. To maintain an effective network, deal professionals must track the strength of relationships and nurture them to maintain or improve them; however, it’s difficult for dealmakers to promptly assess the health of their network and identify opportunities to improve relationships with key partners.

DealCloud’s Relationship Intelligence helps dealmakers improve deal sourcing, business development, fundraising, and related functions by using the reach and strength of their professional networks. The Relationship Insights dashboard shows a relationship score or data point that automatically calculates based on your interactions between a contact. As with other dashboards within DealCloud software, you can create pivot tables, charts, graphics, and other visualizations with this data.

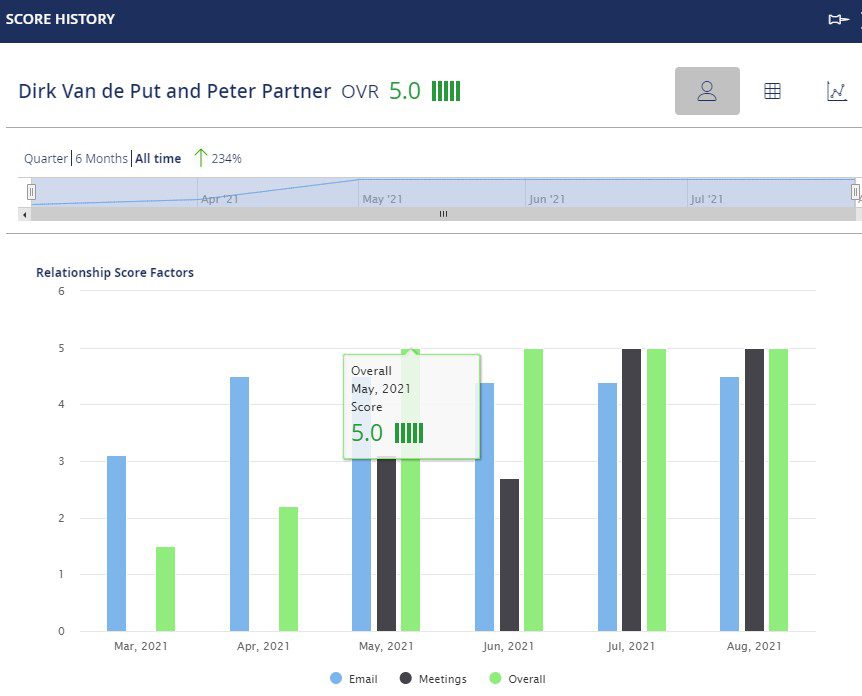

DealCloud users may also see the breakdown of that score by viewing the Score History. This page shows how a score was calculated based on factors such as the number of emails, conversations, and meetings between the user and the contact. You can also view relationship benchmarks, compare email scores to meeting scores, and examine relationship trends over time.

Leverage third-party data for better relationship coverage

Traditional CRM solutions only monitor a firm’s internal relationship data — a serious disadvantage for firms. By neglecting to collect and analyze critical external data, firms will struggle to identify new deal opportunities and successfully manage relationships. Conversely, having both internal and third-party data available in one AI-enhanced solution helps professionals both manage data and gain informed insights to win better deals.

DealCloud’s CRM software integrates third-party data solutions to provide key additional insights for financial service firms to simplify their deal pipeline and create better deals. DealCloud proudly partners with FactSet, PitchBook, Preqin, PrivCo, SourceScrub, Sutton Place Strategies (SPS), and S&P Global Market Intelligence so private capital markets professionals can easily access industry data in one platform — eliminating the need to toggle back and forth between sites and giving capital market professionals time back to focus on creating more relationships.

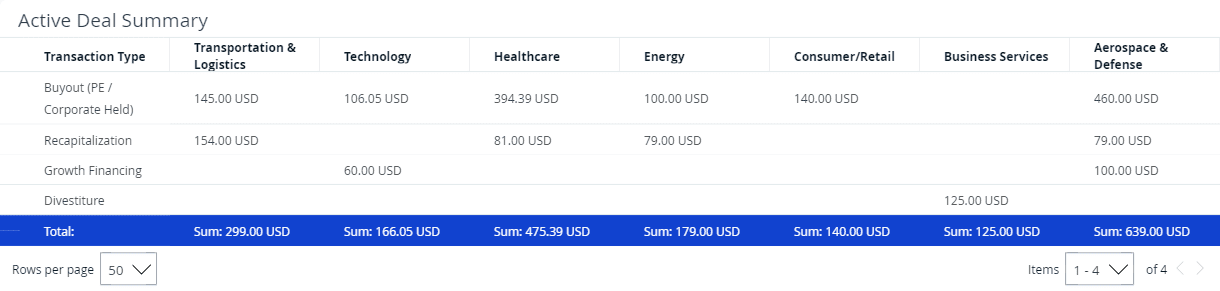

Professionals can also easily create and organize pipeline management dashboards within DealCloud’s deal pipeline software. In the Pipeline Summary dashboard, capital market professionals can customize the Active Deal Summary table to sort active deals by transaction type, including buyout, recapitalization, growth financing, and divestiture. Each transaction type details the amount spent in the following industries:

- Transaction and logistics

- Technology

- Health care

- Energy

- Consumer and retail

- Business services

- Aerospace and defense

The total amount spent within each industry is shown below the summary table.

Address your firm’s changing needs

The needs of financial service firms are constantly changing, and CRM integration processes need to be able to adapt to those changing needs. DealCloud’s deal pipeline software provides a flexible solution that addresses your firm’s need to simplify the deal pipeline and produce better deals and informed data insights. Using DealCloud, professionals can create and continuously update custom dashboards for their sourcing, coverage, talent management, capital markets, management, staffing, investor relations, and marketing needs.

Having your firm’s information accessible via the cloud is also important, especially as more organizations turn towards hybrid and work-from-home environments. The DealCloud mobile app lets you work and access real-time data wherever and whenever you want. You can also receive real-time notifications, ensuring that you stay on top of all deal-related updates.

The DealCloud platform allows us to focus the time spent on assessing investment opportunities and increase pipeline transparency throughout the entire deal lifecycle. DealCloud’s technology has improved our processes and made the whole team more efficient.

Oliver Thum, Elvaston

Investing in DealCloud’s deal pipeline management software is one of the best ways to avoid an unexpected deal failure. Expert, cloud-based relationship management and deal pipeline software makes it easy for dealmakers leverage real-time data to guide their day-to-day actions.

Schedule a demo to see how DealCloud’s CRM software can help your firm simplify and better manage deal pipelines.