According to data provider Refinitiv, “private equity buyouts and investments with a price tag below $500m are at a record [high], and now account for more than 30 percent of the industry’s dealmaking by value, the highest level in almost a decade.” While several blockbuster deals have captured the attention of the news media, the broader trend has left many private equity, venture capital, and other capital markets participants such as investment bankers and M&A advisors wondering how much more competitive the market will get in 2020 and beyond.

At the heart of this market dynamic is private equity fundraising, which hit an all-time high in 2019 according to a recent Pitchbook analysis. With dry capital already north of $246 billion in 2019 (the previous high was in 2017 at $238 billion, and before that $235 billion in pre-recession 2007), private equity investors are clamoring for new and innovative ways to deploy capital without diluting the pathway to value creation. The answer? Incorporate smaller, down-market deals into the fund’s origination approach.

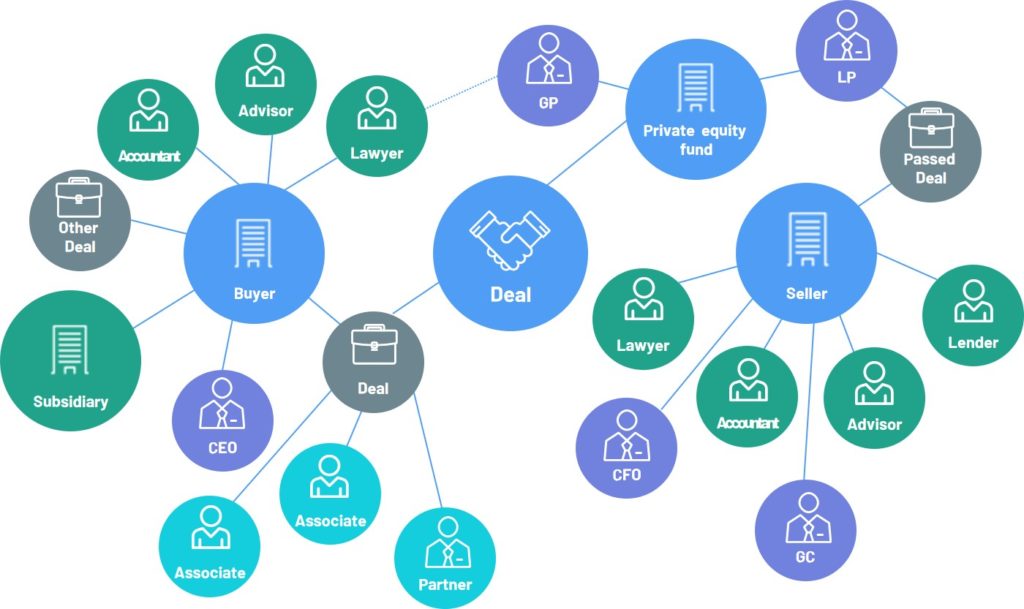

In order to compete in this modern, more competitive and crowded climate, it’s important that investors redefine their deal sourcing network to include less traditional participants such as attorneys, lawyers, accountants, consultants, tax executives, and others that fall outside of the investment banking and M&A advisory categories. These relationships can uncover unique and otherwise opaque transaction opportunities, and can also provide valuable support in the deal process. We recommend setting up reports and dashboards to help investors maintain regular and thoughtful communication with key relationships, especially when the relationship web is diverse and complex.

Relationship ecosystems in the capital markets are increasingly complex, and maintaining relationships with a diverse set of market participants is more important that ever.

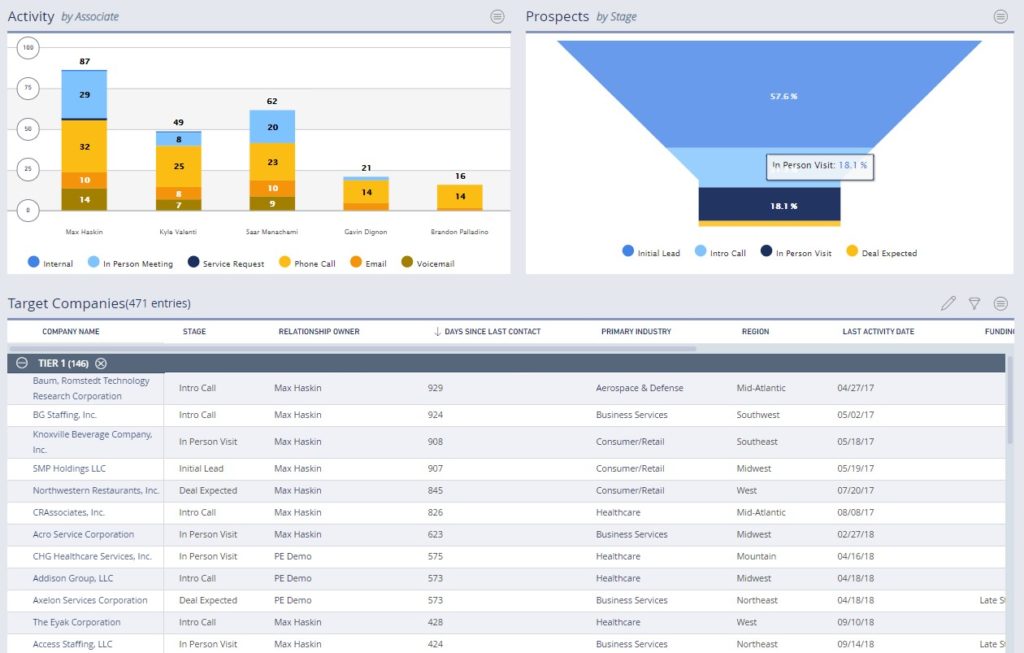

In order to fill a deal pipeline with smaller, down-market deals, it’s critical that investors maintain constant communication with a diverse set of deal sources. By setting up reminders and dashboards, relationship managers and originators can keep track of every relationship with ease.

By utilizing data and analytics to both identify potential deals and to navigate the due diligence and negotiation of the deal itself, firms can effectively position themselves to close more deals and generate higher returns.

Earlier this year, we analyzed several buy-and-build strategies, and a recent Financial Times article confirms that these trends are still in play, especially given the shift down-market. This strategy, “acquiring and assembling a string of small companies within a sector then exiting through a listing or sale,” also requires a firm to have precise relationship intelligence. While deal sources are extremely important, so are proprietary efforts. Investors an effectively track one-on-one conversations with business owners whose companies fit their investment thesis in a given industry. In doing so, they can formulate the strategy, visualize which companies to buy, and strategize how to build them up together.

Investors can keep tabs on their proprietary relationships with business owners that may be looking to exit. This helps investors formulate better buy-and-build strategies for smaller deals.

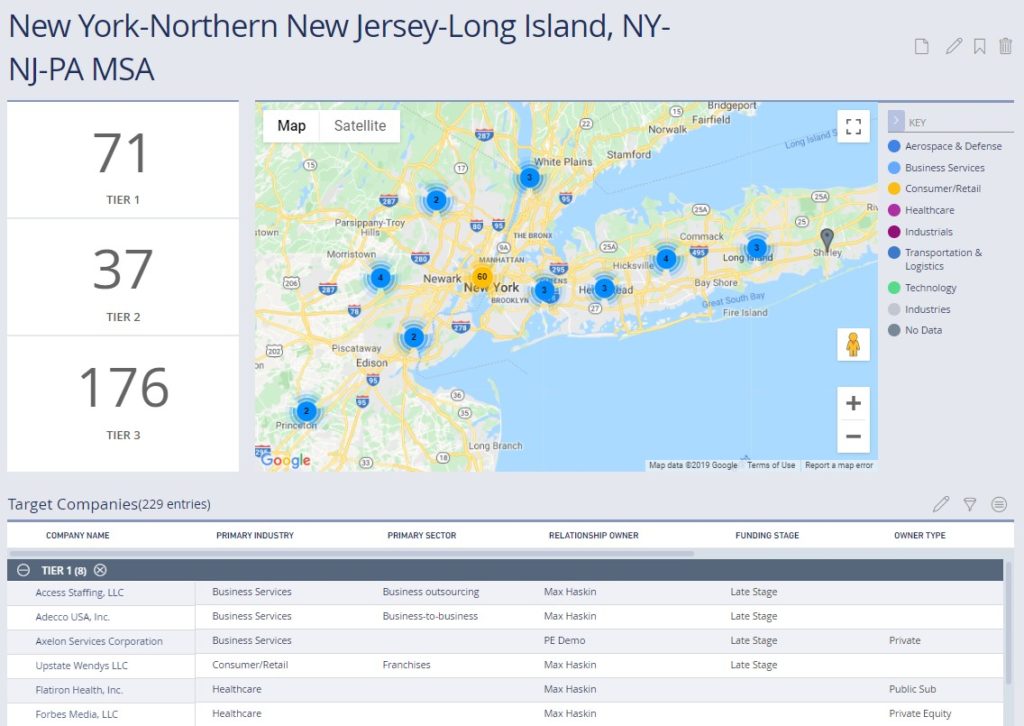

In addition to the significant time and resources required to close a deal, business development professionals are increasingly stuck with the burden of allocating resources to industry events and conferences, and networking opportunities. We highly recommend that firms think critically about their geographic coverage models, including who the best points of contact are in a given city, which industry/investment theses they related to, etc.

Investors should be able to quickly assess the strength and relevance of their relationships in any given region. Especially when deals are small, it’s important to fill trips to a given city/region with meetings with as many deal sources and proprietary relationships as possible.

Undoubtedly, investors will feel the fatigue of needing to cover more market participants than in years’ past, but that is the nature of the market in 2019, 2020, and beyond. By simply incorporating relationship intelligence into their approach, however, they can work smarter and ultimately deepen the relationships that lead to better dealflow.

To learn more about DealCloud’s purpose-built relationship management solutions, click here. You can also click here to download our recent thought leadership piece highlighting the importance of intelligent deal ecosystems.