Gone are the days of the simple “buyer, seller, advisor” deal. The beauty pageants seem never-ending: after competing with potentially dozens of other intermediaries (including CPAs, Main Street brokers, lawyers, etc.) to win an engagement, bankers are tasked with navigating the vast investor/buyer pool. To make matters even more complicated, new sponsors enter the market each and every day.

An investment bankers’ day-to-day tasks tend to be manual and time-intensive (e.g. emails, phone calls, meetings, road shows, conferences, etc.). This makes investment bankers the target of constant investor phone calls and “check-ins,” and a priority meeting for buyers while at conferences.

So how can investment bankers and M&A advisors make sense of the chaos? We’ve teamed up with Sutton Place Strategies to analyze the meaning of “true market coverage” in 2019 and beyond, as well as how firms can better track market coverage in their CRM. Read on to learn more about our recommendations based on your firm’s unique coverage relationship management model.

For those with a tried-and-true sponsor coverage model:

Today’s top firms, when compiling the initial list of acquirers, are looking at both proprietary and third-party data to not only structure their day-to-day dealmaking activity but to bring meaning to their conversations with sponsors. Below are a couple tips for how to elevate your sponsor coverage even further from where it is now: Track how many and which private equity firms were active on the buy- or sell-side over the last year. Not only will this help you see patterns that can help you better understand their investment thesis, but you’ll be better prepared with the data you need for touch-base phone calls and meetings. Below are the most active sponsors in Q1 2019 as per the SPS data.

- Track how many and which private equity firms were active on the buy- or sell-side over the last year. Not only will this help you see patterns that can help you better understand their investment thesis, but you’ll be better prepared with the data you need for touch-base phone calls and meetings. Below are the most active sponsors in Q1 2019 as per the SPS data.

- Set up alerts and notifications that power your business development engine. Are you receiving alerts when a private equity portfolio company has been held for 3+ plus years? This, for example, signals that the company may be coming for exit in the years ahead – and your firm will want to be ready to support the exit diligence and negotiations.

For those without a defined sponsor coverage model:

Holistic sponsor coverage is the pursuit of complete understanding of the universe of buyers that exist not only for a particular deal, but for every deal that your firm could potentially intermediate. If your firm is just getting started with defining a sponsor coverage model, we recommend the following:

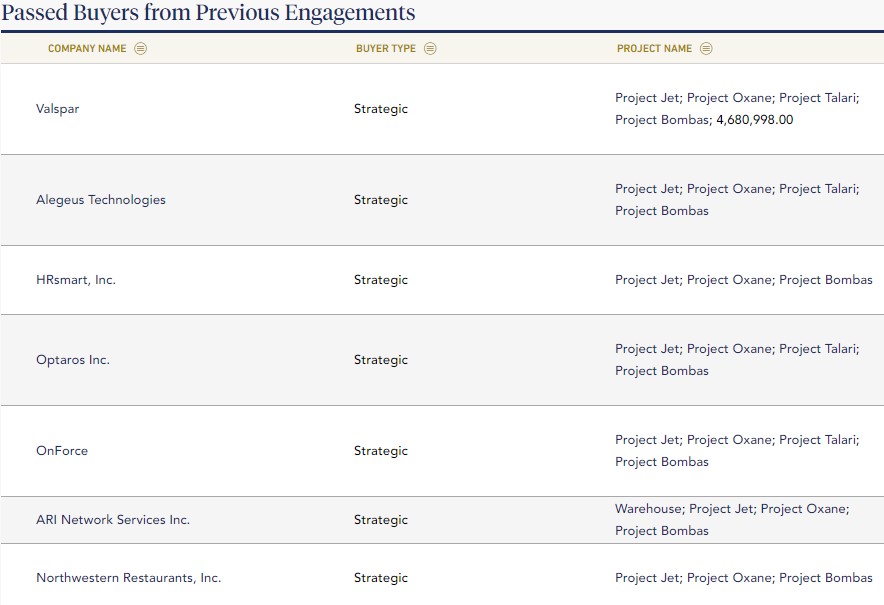

- Start to catalog and keep record of each buyer’s preferences and past behavior (i.e. closed deals, size and industry preferences, deals they passed on, etc.). This information, when entered into your CRM, will become a home-grown database that you can use to speed up buy list creation in the future. It can also help win new client engagements and establish credibility amongst CEOs.

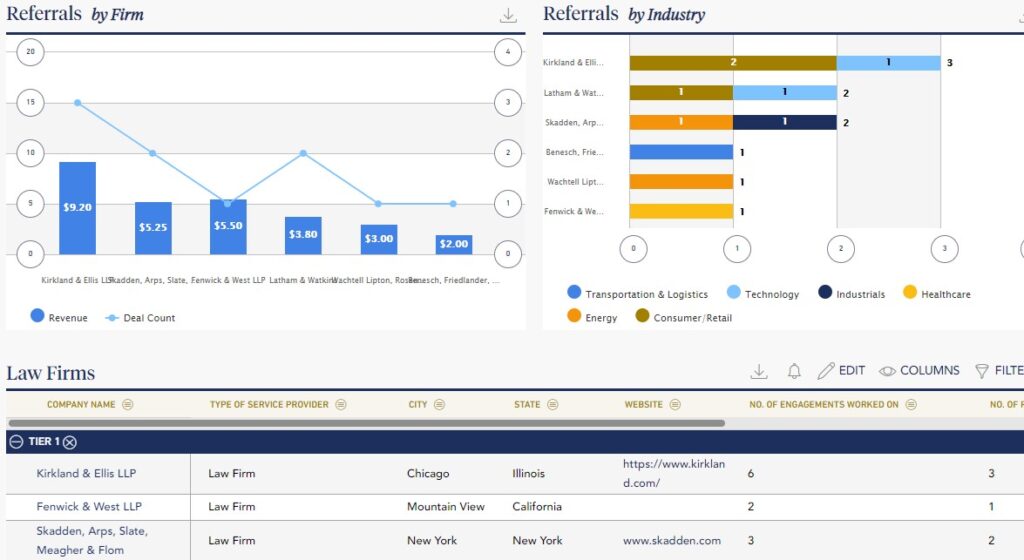

- Start to track “warm” leads through referral sources such as attorneys, lenders, etc. The better data you have around your “at bat” opportunities, the more strategically you’ll be able to apply your business development budget towards each firm. With Sutton Place Strategies’ data integrated into Intapp DealCloud, you have the entire M&A and private equity ecosystem of potential referral sources right at your fingertips, all organized based on your preferences and filters such as size, sector, geography, etc.

If you’re working in investment banking sponsor coverage and are lacking the data and analytics tools you need to drive efficient business development, reach out to our team. We help hundreds of firms streamline their processes and close more deals.