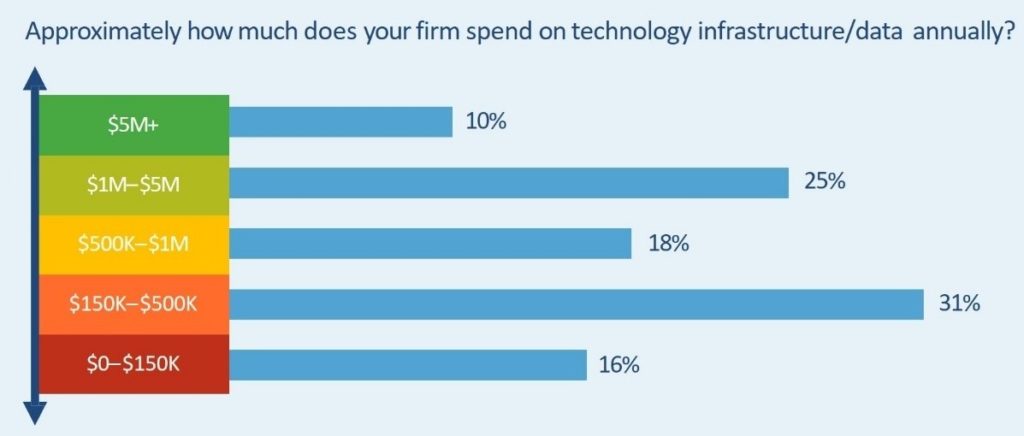

“What does it say about an industry [private equity] in which the majority of participants are spending fewer than one million dollars per year on technology infrastructure?”

This question was recently posed by Hamilton Lane in their 2019/2020 Market Overview. Their answer is pointed as well as illuminating, as they say GP’s “are going to get passed by as others invest more in their infrastructure and as technology upends traditional patterns of investing and providing transparency.” They really drive the nail home as they conclude, “The industry needs to wake up.” And if that wasn’t clear enough, they posted a nice picture of a hole in some sand with the words “Bury Head Here” next to it.

The world of private investing has never been more competitive. Every day it becomes more and more difficult to differentiate and stand out amongst the crowd. The need to find more proprietary deals, build better relationships, and be more efficient in your execution is more intensive than it’s ever been. But don’t take it from us, the technology provider, take it from Hamilton Lane, the innovative investment manager with more than $66 billion in AUM that takes pride in the fact that much of their success is derived from a data driven approach to investing.

So, the question becomes, are you one of the GPs that is at risk of being passed by? Is your head in the sand?

The leaders are already passing you by

While it’s true that many firms are not spending adequately on technology, the market leaders and those that aspire to be the market leaders are making the necessary investments. They don’t view technology as a “nice to have,” but instead view it as a driver of their business and a major differentiator. They view technology as a tool to find more proprietary deals, connect the dots and build better relationships, and execute deals more efficiently.

And this isn’t about becoming the next Carlyle or Apollo. Certainly not everyone aspires to be the next mega fund. This is about differentiating yourself in your segment of the market, finding the right deals in your segment of the market, and building the best relationships in your segment of the market – all so that you can generate the necessary returns to be considered one of the top players in your segment of the market.

The competition is fierce

The competition in the private investing space has never been more fierce or intensive. We all know this. You feel it every day. You feel it every time you get involved in an auction process or get beat to the proprietary deal. You feel it every time that you struggle to stay on top of your relationships.

According to Private equity Insights the average fund size grew 35% in 2019. Think about that, 35%!

In addition, there are more than 18,000 fund managers currently offering a private equity product, up more than 10% from 16,400 in 2018. Facts like these led Private equity Insights to say, “Market conditions are becoming increasingly more challenging, with the influx of investable capital and intensifying competition driving up asset prices.”

Further exemplifying the heightened competition, a Preqin survey recently found that 45% of fund managers experienced more competition in private equity transactions. This led Preqin to conclude “This will test the mettle of the best performers. Investors will be watching closely to determine which firms are able to flourish in bad times as well as good”.

What are you doing to stay ahead of the competition?

Private equity firms investing in technology to improve their daily operations are off to a good start, but then there are those who are holding themselves back by deciding to stick with old plans as opposed to finding new solutions. These companies think they’re successful enough and will continue to be successful without investing in new internal infrastructures. Well, the question isn’t whether you’ve been successful.

The question is: will you be successful? Do you risk getting passed by as the market becomes even more competitive and when/if the market turns? What made you successful in 2015 or 2017 won’t make you successful in 2020 and beyond. It’s time to catch up with the competition.

With leaders already passing you by and such fierce competition for private equity deal sourcing in place, take a tip from Hamilton Lane and invest in yourself, in technology, and in your future.