Private equity dealmakers are constantly thinking about the best way to manage both their deals and relationships with limited partners. According to a recent report by Deloitte, “General partners (GP) have worked closely with limited partners (LP) to develop a cadence in reporting that is both useful to LPs and not disruptive to GP operations.”

How are limited partners using technology to improve their operations?

When utilizing technology purpose-built for deal and relationship management, LPs are better able to streamline their relationships with GPs. In this article, we discuss the ways that LPs can eliminate excess steps and distractions during their deal journey and simplify their everyday workflows.

Limited partners use technology to organize activity, fund, and relationship data

When LPs need to get in touch with GPs, it’s typically a time-sensitive request. Given the need to maintain a harmonious relationship, it’s important that LPs have access to a technology platform that tracks their deal and conversation activity with GPs. This platform should allow LPs to manage relationships in a concise and streamlined dashboard view.

Technology platforms like DealCloud are built for the unique needs of LPs, and provide a user-friendly experience that allows them to fully customize their reports and dashboards that track fund and capital allocation as well as performance.

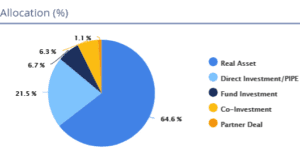

Using a dashboard, such as the pipeline summary (shown below), LP professionals can see a full breakdown of the deals shared by their GPs. LPs can then categorize these transactions by strategy, stage, fund allocation, region, and other criteria.

When using a fundraising dashboard (shown below), LPs can quickly and easily understand fund allocation and strategy breakdown. This can be helpful to determine industry exposure over time as well as future strategy investments.

Limited partners use technology to create a unified view for all GP data

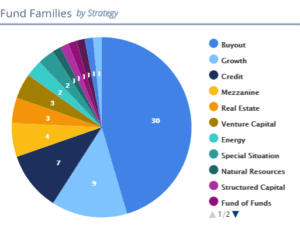

One of the best ways LPs can simplify and improve everyday workflows is by creating bespoke dashboards that highlight key data about their general partners. LPs can use DealCloud to simplify and improve everyday dealmaking by creating a unified view for all of their working investment teams. By using intelligent tagging technology, LPs can use technology to quickly review their primary investments, co-investments, credit exposure, real asset investments, and other critical deal attributes.

Because each GP investment team focuses on a unique strategy, keeping track of deal details and returns can be challenging. Using the right technology, they can create reports and dashboards aligned to those unique strategies – such as tracking deals, pipeline analytics, and other factors.

Limited partners use technology to unlock private market intelligence with Preqin

For those LPs looking to allocate capital to new funds or to track what other LPs’ interests, they often lean on data from Preqin. Modern dealmaking software like DealCloud automatically imports Preqin data and intelligence into an LP’s CRM. Through this partnership, dealmakers can populate their technology platform with Preqin’s curated investor and co-investor profiles, investment criteria and allocations, GP firm information, and up-to-date GP contact details.

Incorporating Preqin data into technology platforms like DealCloud allows LPs to access real-time, private capital market intelligence, capture more accurate contact and company records, and supercharge their relationship-management initiatives.

Limited partners use technology tools built for investors

To function as a best-in-class limited partnership, dealmakers need a solution created by investors, for investors. Dozens of firms across the globe have deployed DealCloud’s purpose-built limited partner software, and trust DealCloud security and accessibility.

The DealCloud platform comes equipped with all of the must-have features and functions dealmakers need, and is fully configurable to meet the unique needs of complex LP investors and firms.

Learn more about DealCloud, and schedule a product demo.