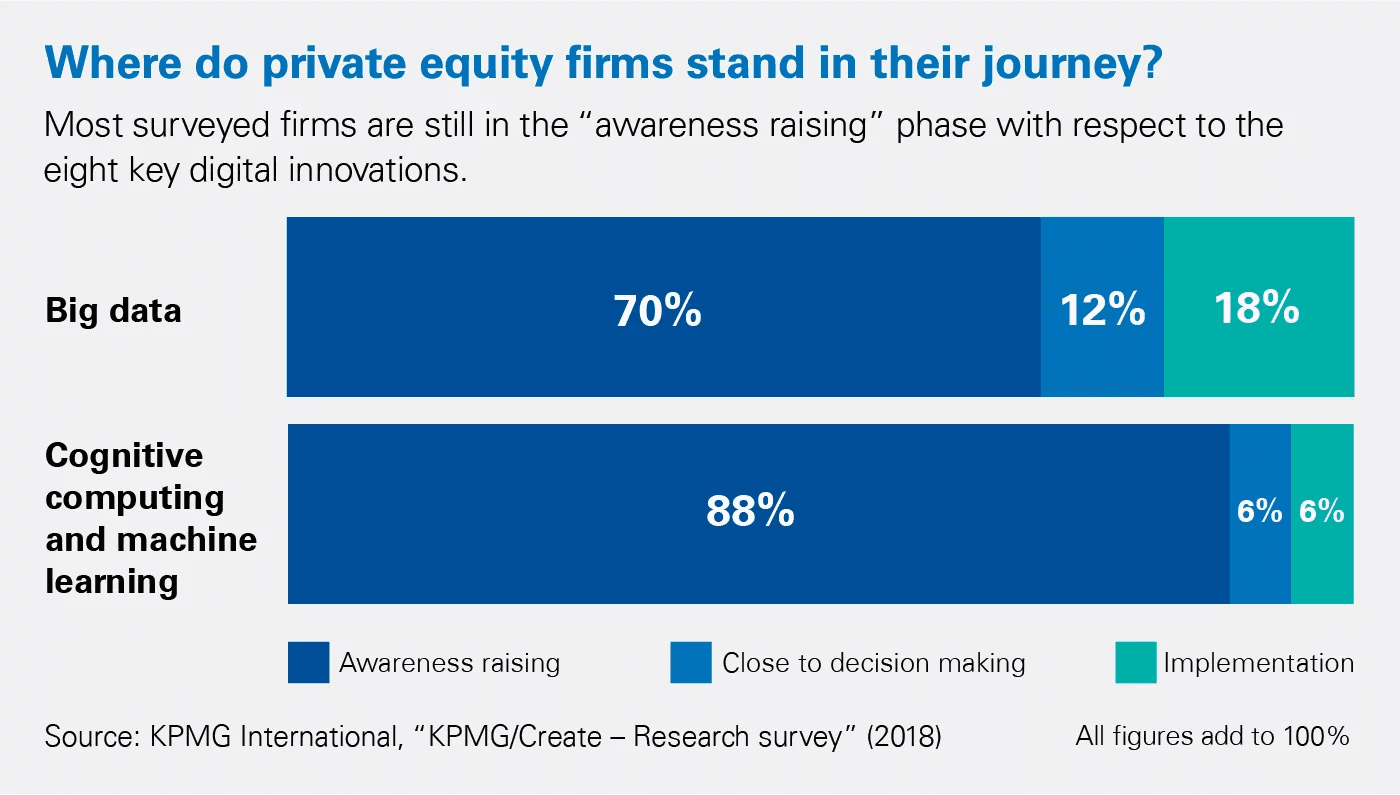

Predictive data and machine learning are transforming nearly every industry, prompting private equity and venture capital firms to follow suit. In 2018, a KPMG survey found that 79% of private equity firms were aware of predictive data and machine learning technology, 9% were considering implementing private equity machine learning technologies, and 12% were already using a form of related software, such as a private equity deal sourcing platform. Deal-makers have since grown more tech-savvy over the years, especially in the wake of the COVID-19 pandemic and the consequential lack of in-person networking and business development opportunities. But how are predictive data, private equity machine learning technologies, and deal origination software being implemented at firms?

In this article, we’ll highlight the expectations and goals firms have for these technologies as well as the advantages of thoughtful implementation. We’ll also examine the areas of business where predictive data and private equity machine learning technologies have the most positive impact.

Predictive data gives firms a competitive edge

In today’s hypercompetitive world of deal-making, buyers and sellers alike need every available advantage. Most firms have amassed mountains of deal and relationship data, but few have found meaningful ways to search, report on, and otherwise leverage their data without advanced technologies such as private equity deal sourcing platforms and machine learning programs.

According to KPMG, “Artificial intelligence (AI) and machine learning programs can be used to build predictive models that learn through cycles of data, continually improving accuracy. This can be done during the pre-deal diligence phase to test and refine hypotheses, or post-close to support ongoing business decision-making.”

Firms may initially find it challenging to decipher their glut of data; however, predictive data and other advanced technologies can help firms make sense of the data by categorizing, cleaning, and filtering it — which, in turn, allows firms to perform time-based trend monitoring and other valuable analyses. Analysts and other deal-makers can consequentially save a significant amount of precious time when competing against firms with similar buying power. Implementing advanced technologies — like private equity machine learning — also increases the likelihood of value creation post-closing, as the firm gains a better understanding of operational excellence and shortcomings across the portfolio.

Technology transforms the value creation lifecycle

The benefits of implementing predictive data models, deal origination software, and capital markets and private equity machine learning tools are clear; despite this, few firms have been quick to implement these tools. As of 2018, just 6% of private equity firms were implementing cognitive computing technologies like predictive data and machine learning at their firms or within their portfolio companies.

Although most firms have not yet crossed the chasm, many see the implementation of private equity machine learning and similar technologies as the next major value creation tool to penetrate the market.

In a recent piece by Boston Consulting Group (BCG), BCG consultants argued, “PE funds are uniquely positioned to provide digital expertise and scale to subscale portfolio companies in what are often fragmented industries. Just as they did with core IT and ERP expertise in the late 1990s and 2000s, such firms can marshal specialized analytics teams to create strategic weapons that unlock the power of data for their portfolio companies.”

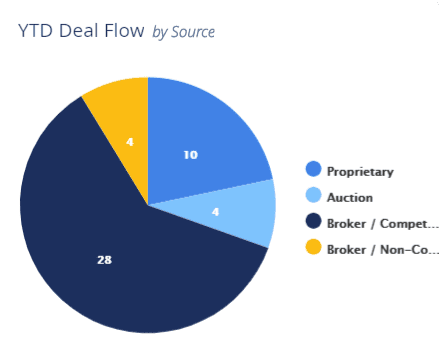

Advanced cloud-based deal origination software moves new deals faster and more efficiently

One of the major challenges facing private equity, investment banks, and other capital markets firms is that every deal is unique and complex, making it difficult to build repeatable processes and approaches. Before purchasing any private equity machine learning technology, predictive data tools, or deal origination software, firms should seek out advanced solutions that are available within their existing technology stack. Since most firms leverage CRM technology to manage relationships and transactions, we’ve highlighted several key use cases for infusing predictive data and private equity machine learning into your firm’s existing workflows using the Intapp DealCloud private equity deal sourcing platform:

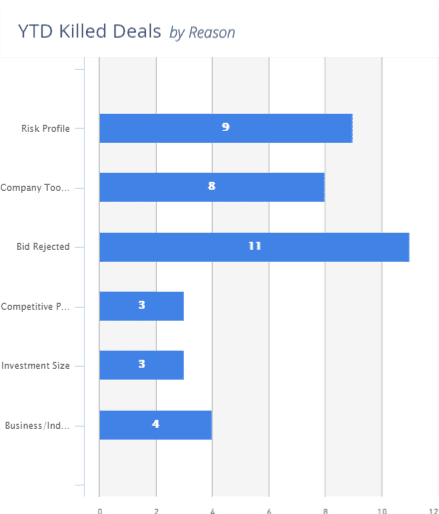

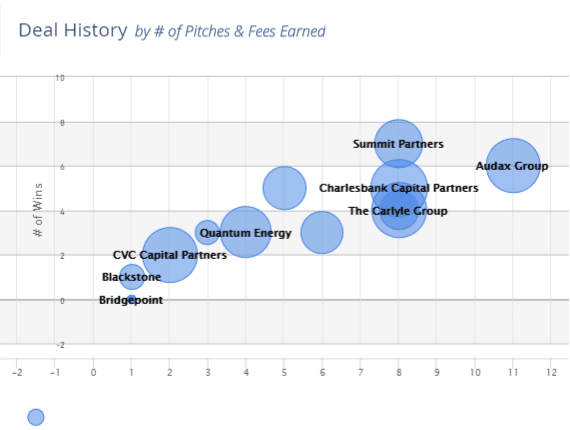

- Review passed or dead deals, or target companies based on how they match past transaction criteria such as industry, sector, revenue, revenue growth, EBITDA, EBITDA growth, employee count, and deal type.

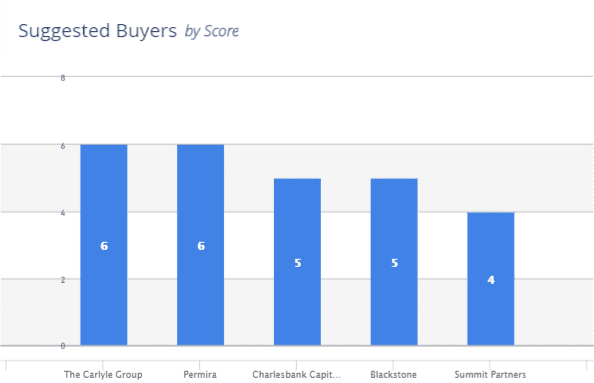

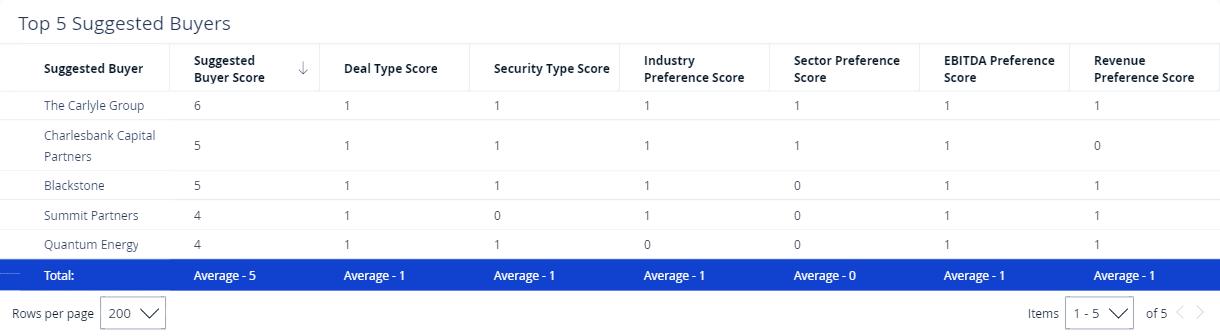

- Receive suggestions on which buyers to send OMs based on the sponsors’ recent market transactions, add-on and platform acquisition breakdowns, industry specialization, deal size preferences, latest fundraising stage, and other variables.

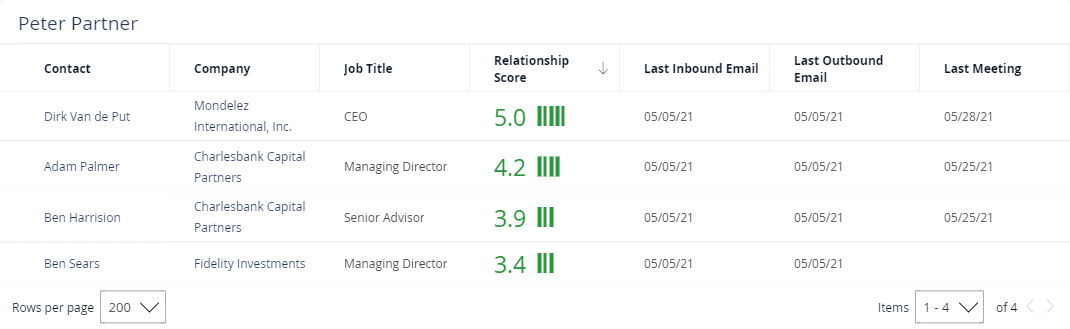

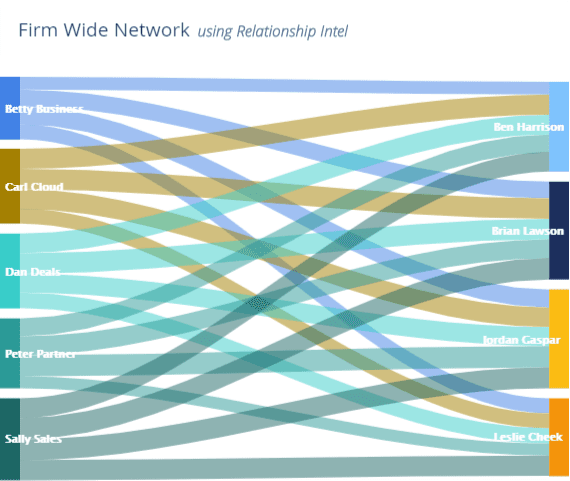

- Deepen relationships with individuals at other firms based on the frequency, type, and quality of engagements they may (or may not) have with peers within your firm.

When firms choose to implement next-generation technologies, they typically set high expectations for the way those tools will influence operational efficiency and the ability to compete against peer organizations. Although it’s important for firms to seek out new advantages, they must also thoughtfully implement those technologies to ensure the tools will make a lasting impact both on the firm and the clients it serves.

Schedule a demo of the Intapp DealCloud private equity deal sourcing platform