As we near the end of 2022, deal volume, transaction sizes, and fundraising are all trending downward. That said, dry powder is still up, and private companies still want to trade ownership for capital. In this unique environment, how can private equity (PE) firms emerge as leaders, secure successful deals, and improve their private equity marketing strategies?

The success of a PE firm depends on the way fund managers market themselves to their limited partners (LPs), intermediaries, and private companies. One common myth is that fund managers must either market themselves in high volume or not at all, but this “go big or go home” extremism misses the mark. Instead, leaders should tailor their group’s marketing message and channels to their ideal LPs, intermediaries, and private companies.

Without proper marketing, you’ll lose mind share with intermediaries, and private companies won’t trust your group enough to consider your bid. Check out three ways PE firms can better market themselves to LPs, intermediaries, and private companies, and learn how digital technology can help support optimized marketing processes.

Upgrade your private equity marketing to LPs

According to the PwC Private equity Trend Report 2022, 99% of surveyed PE firms said they planned to invest in digitalization this year. Without advanced digital technology, firms can’t successfully adapt to changing client needs or stand out against the competition. In fact, a recent Private equity Law Report post warned that LPs are growing frustrated by their general partners’ outdated technology and unreliable, non-standardized reporting.

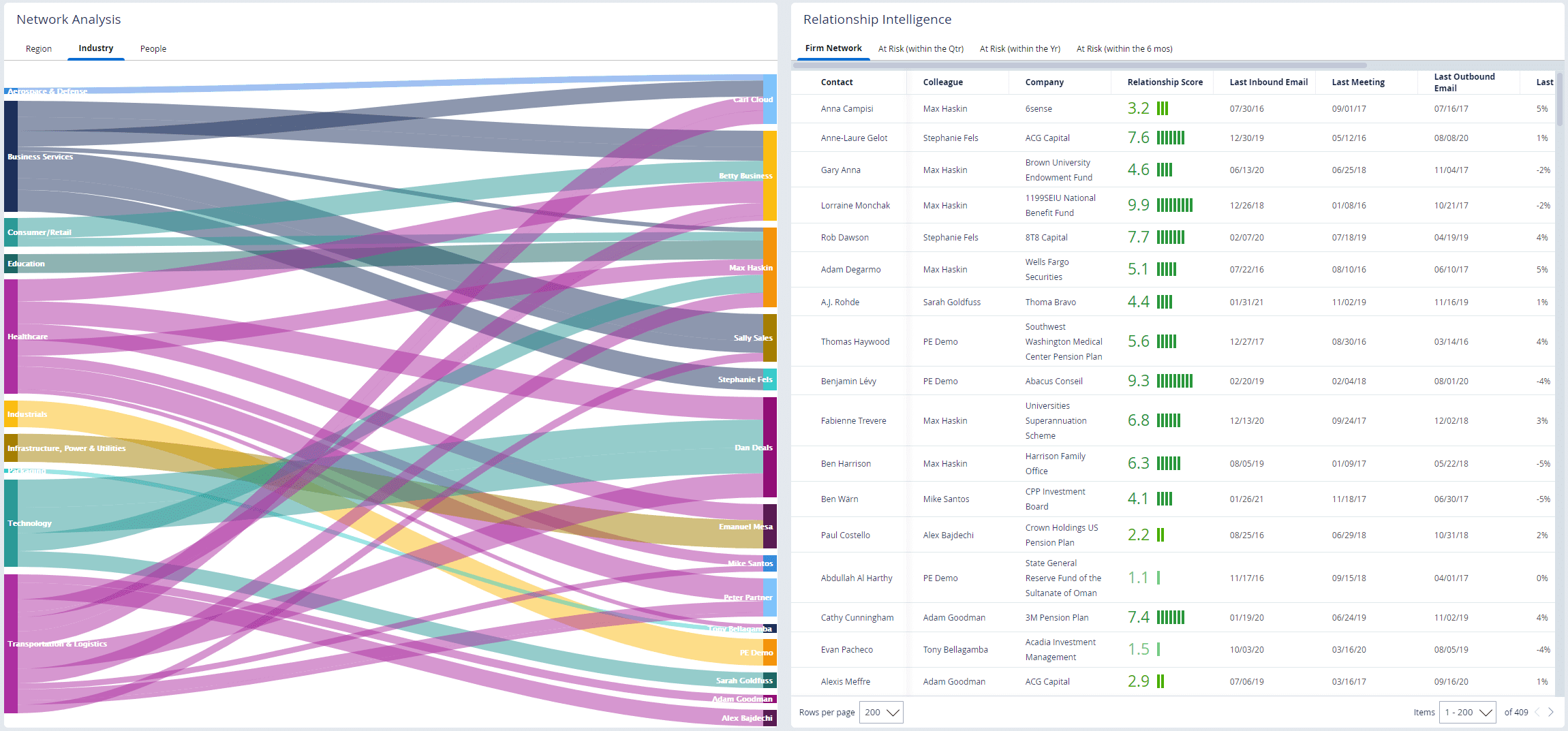

Without modern, back-end technology to support an influx of LPs and capital, even the best marketing efforts are likely to be fruitless. That’s why so many firms are investing in cloud-based platforms like Intapp DealCloud, a data, pipeline, and relationship management system built specifically for teams in capital markets. As an industry-minded technology platform, DealCloud also offers Dispatch, an email marketing tool for financial services firms that enables dealmakers to communicate with target LPs while capturing engagement data directly in their existing pipeline.

Once your firm implements a single source of truth to support pipeline and marketing efforts, you can begin creating and deploying more relevant and targeted marketing tactics:

- Improve and clarify your investment thesis. Revisit your firm’s investment thesis and make any necessary adjustments. This will let you better identify target companies and ideal LPs, and dismiss any pension plans, foundations, endowments, or high net worth individuals (HNWIs) who don’t align.

- Attend private equity trade shows and conferences. Mark your calendar for this year’s industry gatherings, and research ahead of time who will likely attend. Seek out the folks you’d like to work with, introduce yourself, swap contact information, and use your CRM mobile app to instantly import your new contacts’

- Create and send an email campaign. Once you’ve familiarized yourself with your new contacts, their industry, and their past work, it’s time to share your story and plans with them. Use DealCloud’s customizable templates to send a drip campaign or email newsletter.

- Show upgraded pitch books. Leverage relevant and verified information from data providers such as PitchBook, Preqin, Sutton Place Strategies, SourceScrub, Dun & Bradstreet, FactSet, S&P Global Market Intelligence, PrivCo, and Esri. Use your LP’s logo and past investments to customize your presentations.

- Host hybrid roadshows. Use technology to evolve fundraising efficiency by replacing a portion of your in-person meetings with virtual presentations. For example, you could show all the executed and current deals you’ve won in New York City to an endowment fund by using DealCloud’s Esri integration, which lets you — and remote meeting attendees — overlay a satellite map with real-time demographic, geographic, and deal data.

Evolve your private equity marketing to intermediaries

GPs have traditionally cast a wide net when approaching intermediaries, hoping to grab the attention of many advisors, placement agents, and investment bankers. They would then move these intermediaries through a funnel to eventually find, engage, and retain the best ones possible.

However, today’s environment requires PE firms to take a more nuanced approach to relationship-building. Modernizing your marketing to intermediaries puts your group at the top of mind when finding fruitful deals, and lets you source and structure the most profitable deals.

To reach the best intermediaries most effectively, focus on building a web of relationships rather than funnelling them, and approach them in a more thoughtful and intentional manner:

- Improve your research. Rather than communicating with misaligned or unqualified intermediaries, upgrade your research to determine which relationships will best serve you. Use DataCortex to tap the details that involve the intermediaries in your sector or ideal target’s growth stage, and filter those people by past deals, geography, or other defining data.

- Batch email introductions. Before connecting with potential intermediaries via email, scale your work by batching a few introductions within Dispatch. Personalize your emails with attachments or provide links that let recipients schedule a meeting, reserve a spot at an event, or learn more about your firm. Then, track how your contacts engage with your message. Rather than funneling and dismissing contacts who don’t engage, you can use Dispatch to triage them for future needs.

- Analyze your data to guide future marketing efforts. Gain useful performance insights, such as which placement agent professionals with a given job title engage the most with your emails. These insights can guide your next marketing campaign.

- Deploy a niche content marketing strategy. Offer your intermediaries unique content and insights based on your firm’s observations and goals via a blog, podcast, or newsletter. This will help intermediaries send deals that best align with your firm’s objectives. Be sure to collect email addresses to follow up.

- Give and ask for referrals. A personal introduction is still the most valuable outbound PE marketing activity. However, today’s leading GPs are increasingly leaning on their intermediaries, networks, and contacts to source and transact new deals. If a banker can’t help you, ask if they can refer you to someone who can, and return the favor by providing your own referrals.

Retrofit your private equity marketing to acquisition targets

Today’s founders and operators know that their choice of investors can decide the fate of their companies. To appeal to acquisition targets’ owners, retrofit your marketing activities to ensure that your targets feel known, appreciated, and safe. Doing so can make private company operators feel valued and can streamline deal flow and deal velocity.

- Ask your LPs and intermediaries for referrals. A personal introduction increases the likelihood that founders will feel less like an “opportunity” and more like a valued connection.

- Publish content in channels that founders prefer. Help private companies get the best deal, whether or not you end up being the buyer. Search online discussion boards and hashtags for entrepreneurs and business owners in your industry. Ask brokers which channels these leaders utilize and assure your intermediaries that you only want to provide useful content, not contact them. By posting this content in these channels, you can help leaders find the best investor and grow or exit well.

- Use third-party data sources to collect contact information. Tap SourceScrub or PrivCo via DealCloud to access contact information for the leaders and owners of private targets.

- Showcase your track record. Private company leaders don’t want to hand over the business to a successor who doesn’t agree with the company’s direction, or to a competitor who won’t value the company the way you do. Remind leaders of their current pain points and showcase your track record to explain how you can help resolve these issues better than any other firm.

- Form a bond by doing creative activities together. After meeting and discussing business with your new targets’ executives, offer to do something with them that’s more creative than drinks or a meal. Today’s dealmakers are getting to know target owners over a round of virtual golf or kombucha taste tests.

- Build institutional knowledge to share insights across your team. Modernize your marketing to private companies by monitoring the strength and relevance of every relationship, no matter who on your team made those connections. Track your team’s collective relationship-building efforts and activity details to extract insights like:

- Who knows whom?

- How do they know one another, and who made the introduction?

- How do they tend to connect?

- How recent were those connection events?

- How fruitful are the relationships? Determine the rate of deals opened and closed, the size of profitable deals, reasons for terminated deals, etc.

In the private capital market — unlike other industries — the buyer must be the one to build trust. Thankfully, modern marketing can help.

The better you are at private equity marketing, the less you need do it

There’s one clear way that PE marketing diverges from the marketing done by typical sales- or service-provider businesses: After a campaign, momentum builds instead of wanes. When you market well and work diligently on engagements, your relationships solidify and grow, generating more interest from curious LPs, intermediaries, and private companies.

Take the first step toward modernizing today by scheduling a demo of Intapp DealCloud.