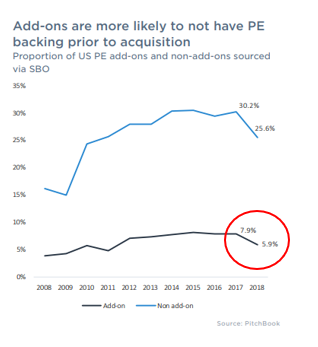

2018 was a monster year for deals. According to Pitchbook’s 2018 US PE Breakdown report, deal activity surpassed $800 billion for the second-highest annual figure ever. An interesting trend that the report uncovered is that, in 2018, “the proportion of deals sourced from other financial sponsors fell steadily for nearly a decade.” Even more specifically, it found that add-ons are more likely to not have private equity-backing prior to acquisition.

With the buy-and-build trend continuing to show its validity, many dealmakers are preparing to execute a more sophisticated and purpose-driven add-on strategy in 2019. With any new strategy, though, comes challenges. In this article, we explore three ways for private equity professionals and corporate buyers to more strategically source add-ons in 2019, given the trends we observed in 2018.

Know the relationship history

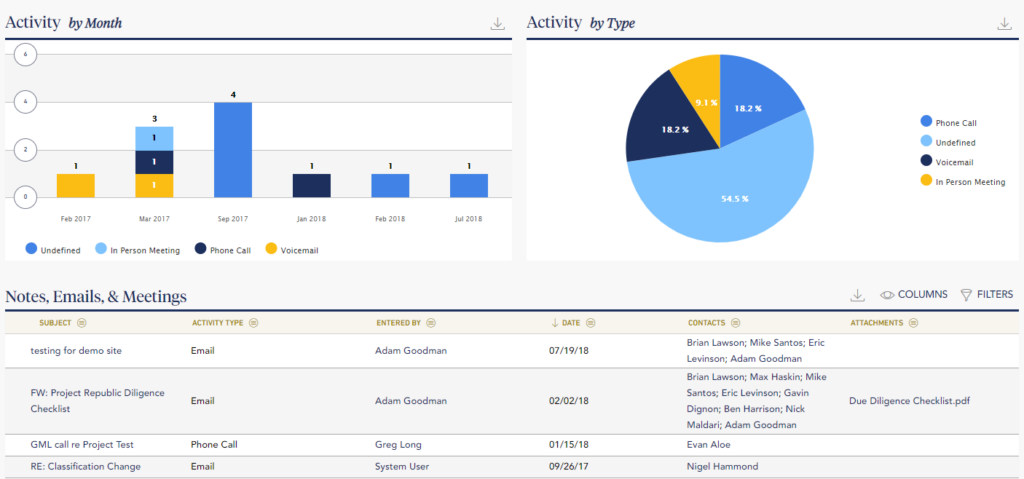

While the inability to identify private companies in the U.S. is not a new challenge, many private equity firms and corporate development professionals still seem to struggle with their private company relationship management. More often than not, details of the relationship and past conversations are housed in several disparate locations across the firm, or not tracked at all.

A best practice, however, is that all of the details about your firm’s correspondences with a private company be held in one central platform and be easily accessible to everyone at your firm. That way, it is clear where the relationship stands, what the next steps are, and which team member is running point.

Analyze the industry

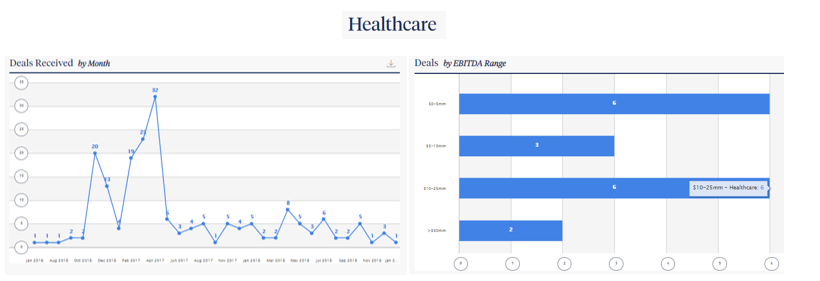

“The growth in add-on size may cause problems with the buy-and-build strategy because these higher-priced add-ons likely make blending down the purchase-price multiple more difficult,” says Pitchbook in its report. In order to avoid over-paying for add-on deals, private equity firms and corporate development teams should keep a keen eye on the market forces at play in any given industry.

With a mix of both proprietary and third-party data, these teams can closely watch the number of deals received in a given industry, the EBITDA range for each, and which intermediaries are bringing deals to market.

Establish a healthy blend of proprietary and third-party data

No matter if you’re a search fund just getting started, a corporate development team establishing a new growth strategy, or a private equity fund with a tried-and-true process, it’s critical that you gather a full understanding of a private company before picking up the phone or hosting a management meeting. These days, private company data is plentiful and can be fully integrated into your deal and relationship management platforms.

While proprietary data (such as logged conversations with private company owners and CFOs) is ideal, firms need to be prepared to start the relationship at ground zero. Leveraging third-party data sets like DataFox and SourceScrub will help arm sourcing and origination teams with the data it needs to have a productive conversation directly with business owners.

Interested in learning more about DealCloud’s deal management platform? Talk to our team today!