If you’re an active real estate investor, you’ve likely seen thousands of deals cross your desk over the last few years. But in what was recently a frothy market, cap rates were compressed, and deals were few and far between. There were probably a handful of properties — let’s call it 10% — that you really liked, but you just couldn’t make the numbers work. Now, you might have a second chance.

In times of market dislocation, deals have a way of coming back around, as some investors find themselves in a position of distress. They might be overleveraged or on the cusp of a significant reduction in property income. Now is the time when well-capitalized investors can snap up assets at much more attractive terms.

As described in a recent Wall Street Journal article, investors are taking the opportunity to purchase distressed debt backed by commercial properties that have lost value because of COVID-19. In April, a record 939 commercial real estate funds around the world were raising money, targeting $297 billion. Kayne Anderson Real Estate, a Florida-based investment firm and one of our key clients, was one of the first to jump on this strategy. In just two weeks, Kayne Anderson raised a $1.3 billion fund targeting debt being sold by distressed sellers.

If there were ever a good time to revisit “the ones that got away,” it’s now. But, how quickly can you find and reevaluate that old deal information? That data — as well as the ability to retrieve it — is immensely valuable. Ideally, you would have all of it at your fingertips, ready to prioritize, so you could begin contacting investors and brokers for follow-up conversations.

However, if you don’t have an organized system for gathering, tagging, and archiving your deal flow through a commercial real estate CRM designed for investors, it’s going to be a lot more difficult now to revisit those deals. Maybe that information exists, but it’s not particularly well organized and is spread among shared drives, spreadsheets, and inboxes. Unfortunately, tracking down that information is going to be a major time suck, and time is already of the essence in capitalizing on market change.

If you’re digging through your inbox for deal information, it’s time to implement software that enables better deal and relationship management. By getting a solid process in place now, you can make your deal data more valuable, both now and in the future. Here are five ways for real estate investment managers to leverage CRM tools that allow your firm to be more responsive to market conditions and more successful in the long term:

1. Map out your information

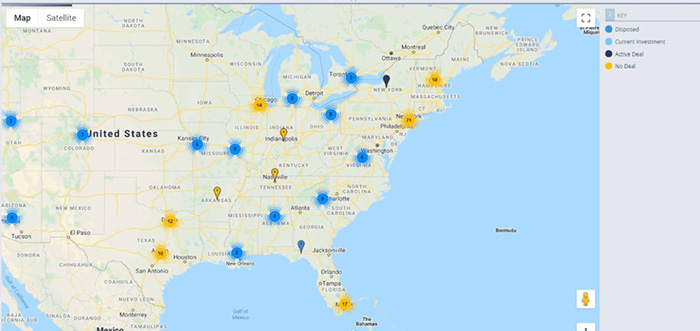

Data is useless if it’s not well organized. Organize your data in such a way that you can drill down into any particular deal and pull out not only a copy of the offering memorandum (OM), but also operating statements, rent rolls, and proforma models. On DealCloud’s commercial real estate CRM platform, for example, you can retrieve a map of any market with pins marking all the deals you reviewed in the past. From there, you can take a deep dive into all asset details.

2. Keep track of old deal notes

It’s easy to tell yourself you could find your old deal notes if you needed them. Let’s be real, though – when was the last time you searched an inbox or shared drive for deal notes and thought it to be time well spent? As an alternative, we suggest that every firm take the time to sync clean and important notes while conversations about deals are happening, that way they can be housed and accessed from a central system. Then, when market conditions like these arise, you can easily sort and filter through your old notes in order to make important decisions.

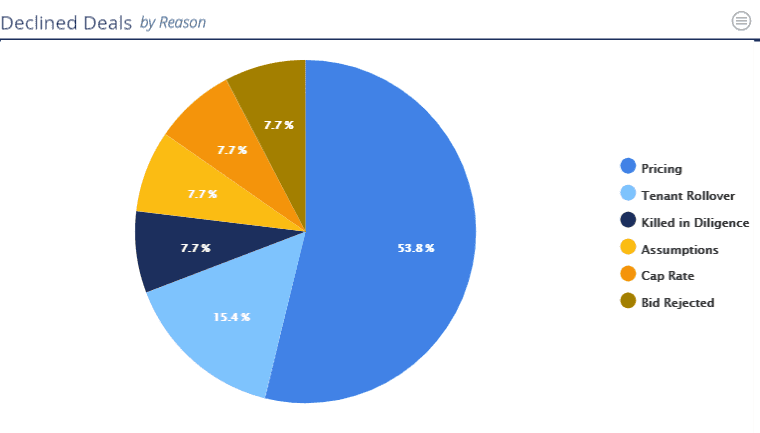

3. Leverage old notes to inform your re-engagement approach

You should be able to quickly locate old deal notes, but also to draw insights from them to inform your follow-up approach. Review offer and counter-offer terms, as well as any notes you have on deal dynamics that would help you determine how to reprice the asset. This will help you decide which approach to take with the seller or intermediary/advisors in light of new market conditions.

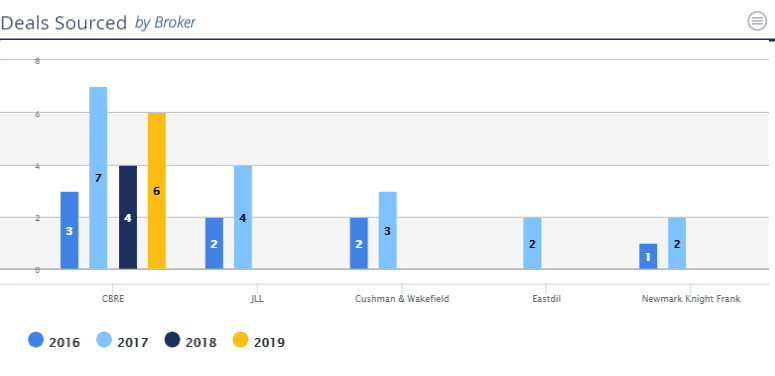

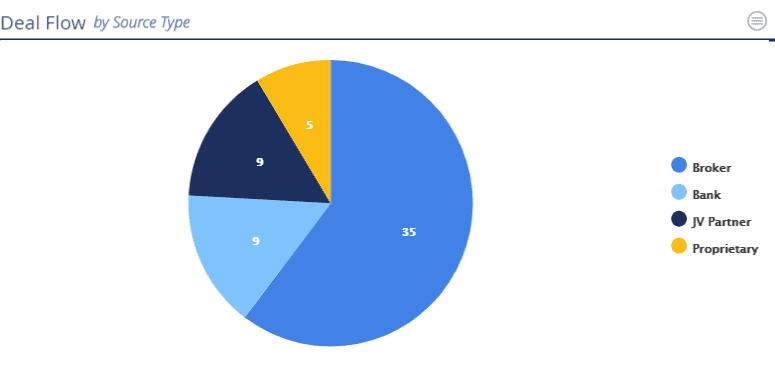

4. Track broker relationships

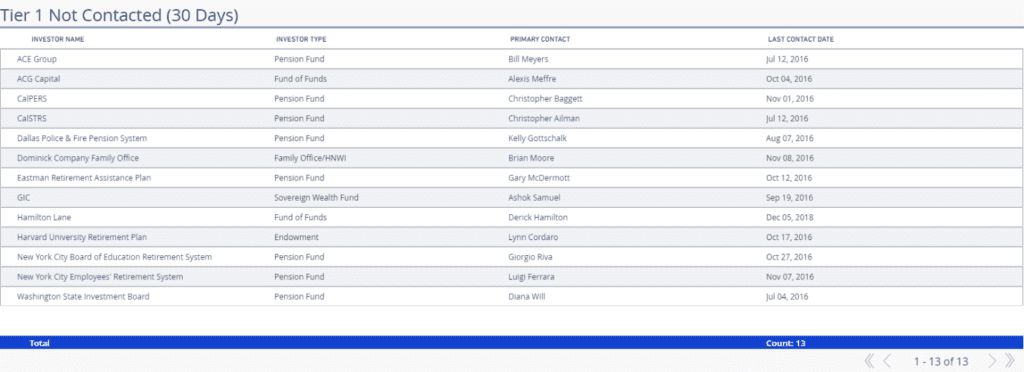

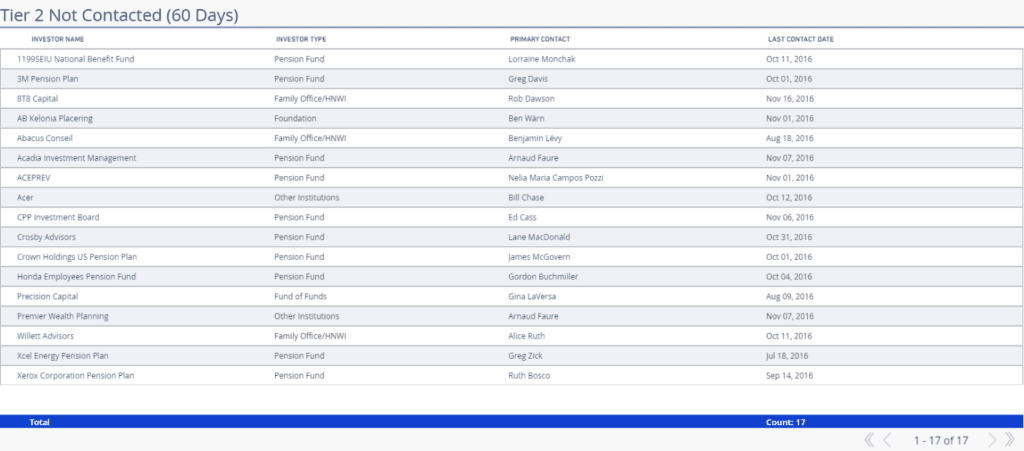

In addition to the deals themselves, it’s imperative that you track broker relationships and keep detailed notes on your engagements. Then, when opportunities come up, a purpose-built real estate CRM can provide insights around which brokers to reach out to, or which ones have the best relationships with your target sellers.

5. Centralize your data

Centralization — the ability to capture all of that knowledge and have it in one place — is key. Not only does it keep you from piecing it together from disparate sources (or worse, your memory!), it allows you to quickly and easily pull the relevant data you need. DealCloud, for example, centralizes all data related to brokers, sellers, third-party advisors, attorneys, and lenders. When you have that entire ecosystem of people in one place, re-engagement efforts become much more streamlined and process-driven.

Now is the time

Despite what many may believe, COVID-19’s market disruption is providing many firms with the opportunity to re-evaluate their technology stack while people are remote. That way, they’ll be ready to hit the ground running when business picks up again and everyone returns to the busy days of endless business development travel.

The more centralized and collaborative an environment your company maintains, the more competitive you’ll be under normal circumstances — and, in market down cycles, it’s the make or break difference to compete on the deals that “got away.” Please feel free to reach out if you’d like to discuss further or schedule a demo of the DealCloud platform.

Writing/research support provided by BlueWave ventures.