For corporate development teams, an optimized pipeline is the backbone of strategic growth. But optimizing your pipeline requires efficient sourcing, precise evaluations, quick approvals, and clear visibility into deal progress — all of which can be difficult to achieve without the right technology.

Intapp DealCloud is an AI-powered, unified platform that lets corporate development teams take a structured approach to optimizing their pipeline. Follow our step-by-step guide to learn how your team can use DealCloud to enhance its workflows, make data-driven decisions, and focus on high-value activities.

Step 1: Identify high-value opportunities with a unified strategic sourcing platform

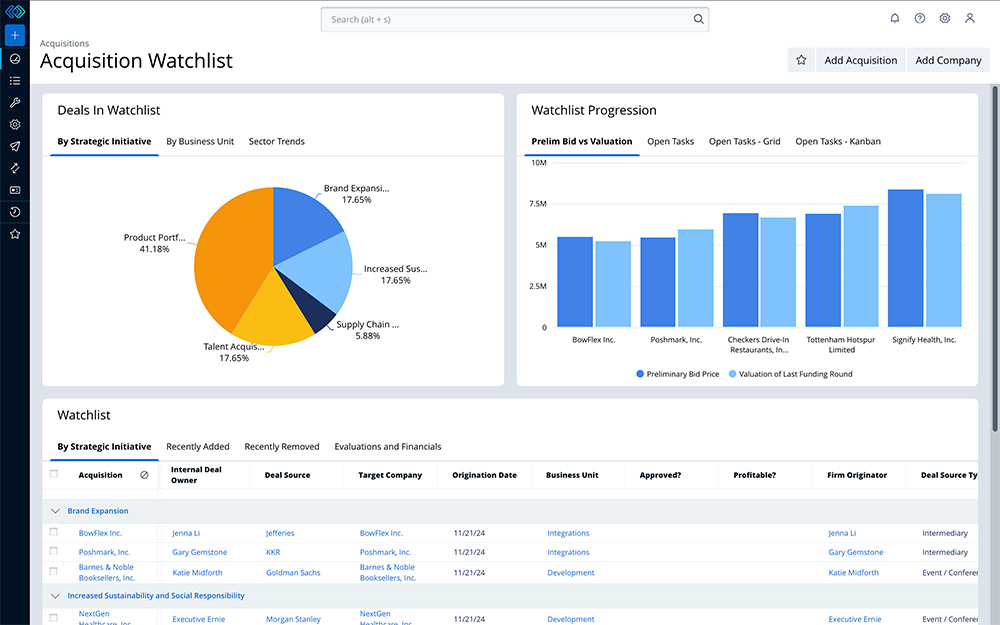

Sourcing the right opportunities starts with a targeted and efficient process. Rather than toggling between platforms to find the best targets, your corporate development professionals can simplify and centralize their sourcing efforts via DealCloud.

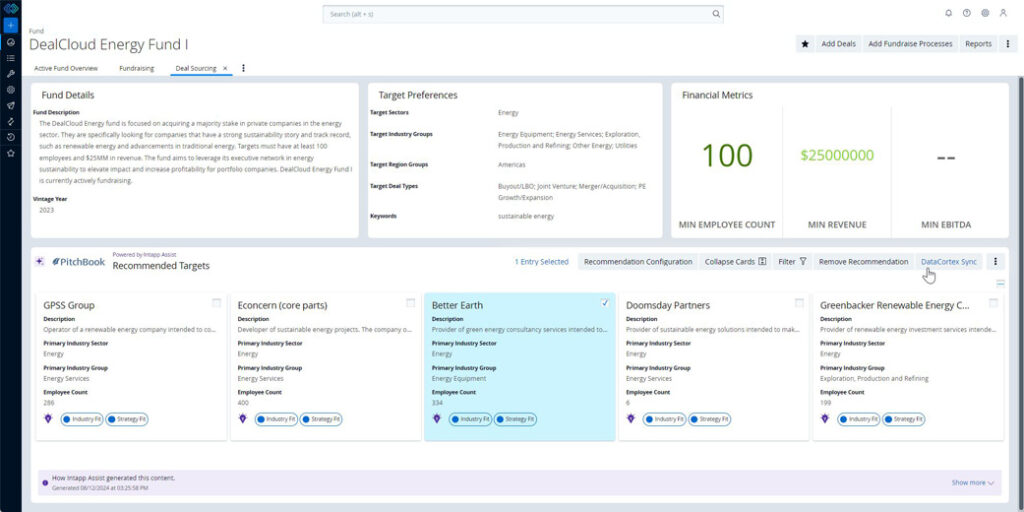

DealCloud provides expansive datasets and market coverage by integrating with Intapp Data and third-party providers such as Pitchbook, SourceScrub, and S&P Global. Users can filter by industry, revenue, ownership structure, and other factors to quickly identify potential targets that align with the firm’s strategic goals.

Once users identify potential opportunities, they can create target watchlists with a click of a button, combining proprietary data with external insights. These watchlists include critical details — including high-quality private and public firmographic data and financials — so your corporate development professionals can easily determine which targets to prioritize.

DealCloud also provides AI-powered company recommendations that surface high-potential opportunities and targets based on your firm’s predefined strategic initiatives and business goals. Users can easily track pipeline progress and access reports on the impact of strategic initiatives — all from a centralized dashboard.

Step 2: Evaluate new opportunities with data-driven insights

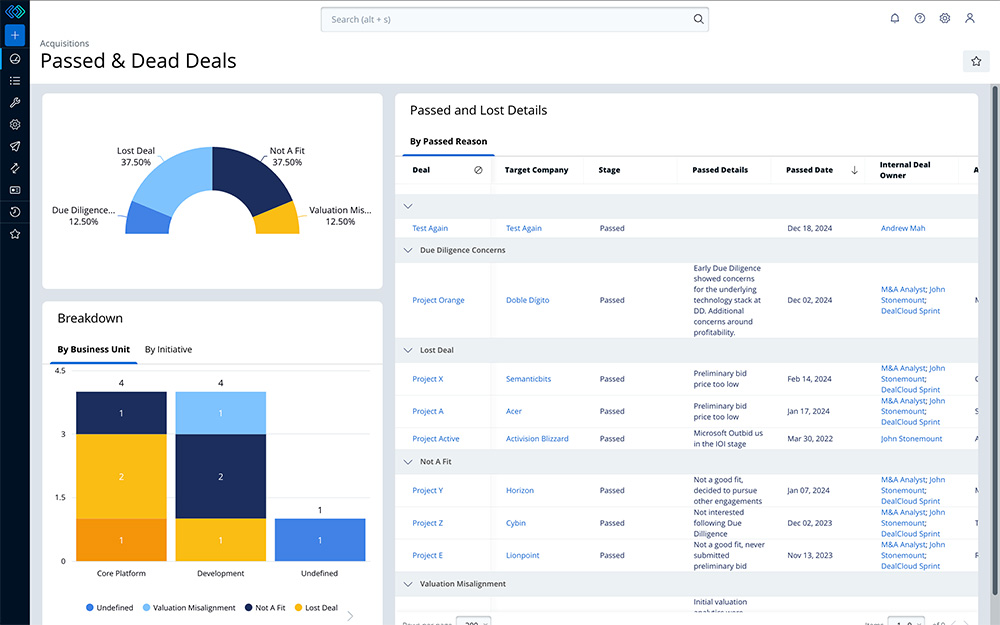

Data is critical for evaluating opportunities and making informed decisions. By tracking deal-related data — such as the reasons behind deal statuses and key decision points — corporate development teams can refine their approach and apply lessons learned to future evaluations.

DealCloud draws on historical data and provides advanced analytics to help corporate development teams assess deals more effectively. The software analyzes passed and dead deals, providing insights into why certain opportunities didn’t move forward. Users can also access third-party and proprietary data through DealCloud to assess market conditions, compare potential targets, and evaluate whether a deal reflects the firm’s strategic goals.

With all this data readily available, your team can easily make better-informed decisions around which opportunities to pursue, which ones to pass, and how to best execute current deals.

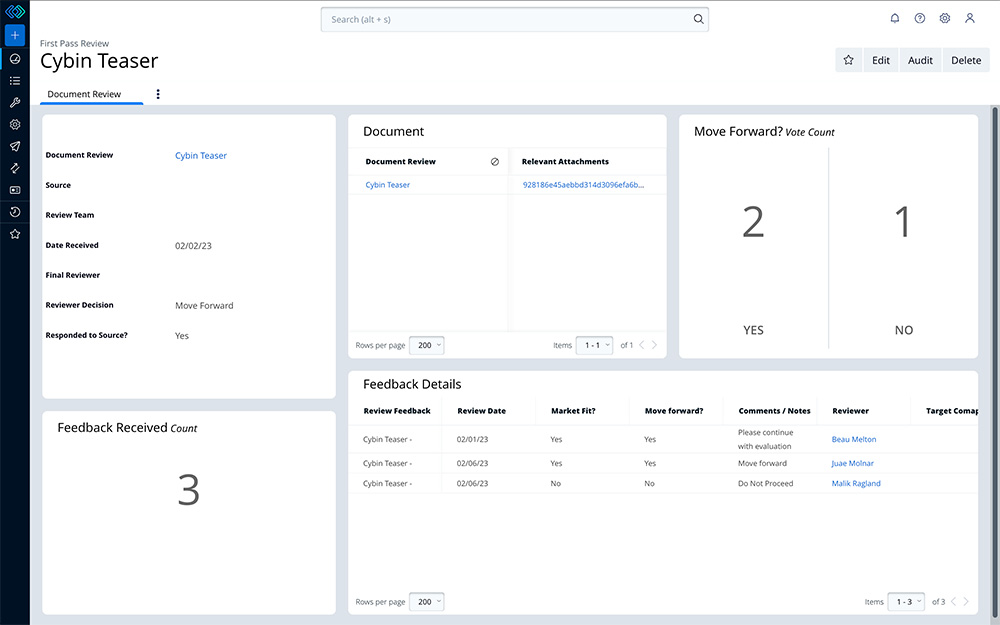

Step 3: Automate the deal review and approval process

The deal review and approval process is one of the most time-consuming aspects of dealmaking, often slowed by administrative tasks and communication delays. DealCloud simplifies this process by automating workflows, centralizing collaboration, and capturing essential details for future reference.

With DealCloud, teams can document first-pass reviews and deal approvals, and record who reviewed an opportunity, when the review occurred, and any comments provided. Initiative sponsors can then provide feedback via forms that automatically compile responses in real-time on the deal page. DealCloud’s event-triggered notifications also alert team members when their input or action is needed, ensuring the process moves forward without delays.

By automating the deal and approval process, firms eliminate the need for manual follow-ups, allowing dealmakers to maintain momentum and focus more on high-value activities. This lets your firm provide better and faster client service, giving it a competitive advantage in the fast-paced corporate market.

Step 4: Visualize your pipeline for better updates and reporting

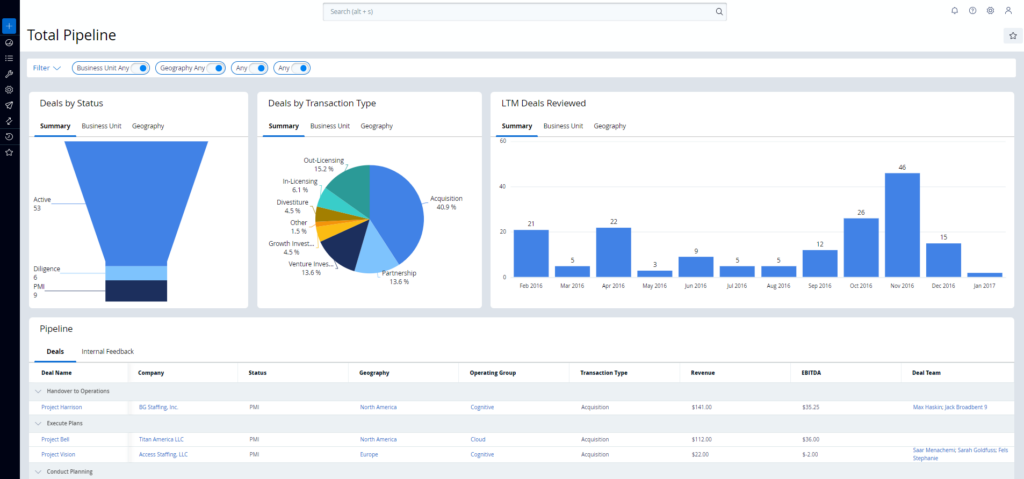

Visibility is essential for aligning stakeholders and ensuring smooth deal execution. That’s why DealCloud offers powerful visualization and reporting tools that make it easy to track pipeline performance and share updates across your organization.

DealCloud’s customizable, pre-filtered dashboards let corporate development professionals quickly consume and analyze data. With a comprehensive view of the pipeline, teams can see every deal by status, geography, business unit, deal type, and key performance metrics. They can also click on a specific deal to access detailed information, such as past communications, upcoming deadlines, executive contacts, and public financial records.

Plus, DealCloud offers automated reporting capabilities that deliver real-time updates, ensuring that everyone — from corporate development team members to leadership and even board members — can access the latest information without relying on emails or other manual updates.

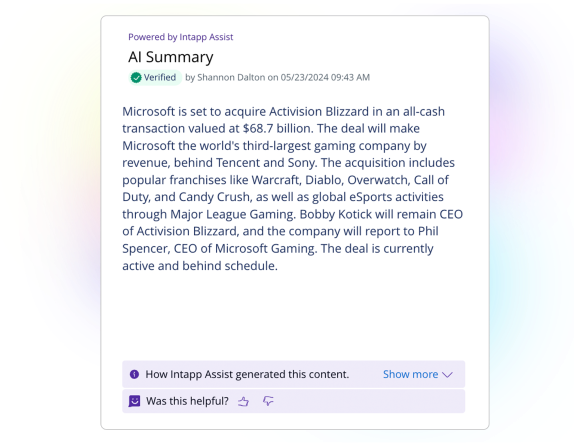

Users can further simplify reporting with DealCloud’s AI summarization feature, which condenses key updates and recent activity into concise summaries. Teams can then easily share insights and drive informed discussions based on these data-driven summaries.

By enhancing transparency and simplifying data sharing, DealCloud empowers corporate development teams to stay organized, aligned, and focused on driving results.

Help your business optimize their corporate strategy

Optimizing your corporate development pipeline is about more than just efficiency — it’s about driving better outcomes for both your firm and your clients. By following these four steps and leveraging the advanced capabilities of DealCloud, your team can take a data-driven, simplified approach to sourcing, evaluating, approving, and reporting on deals.

Ready to get started with DealCloud?